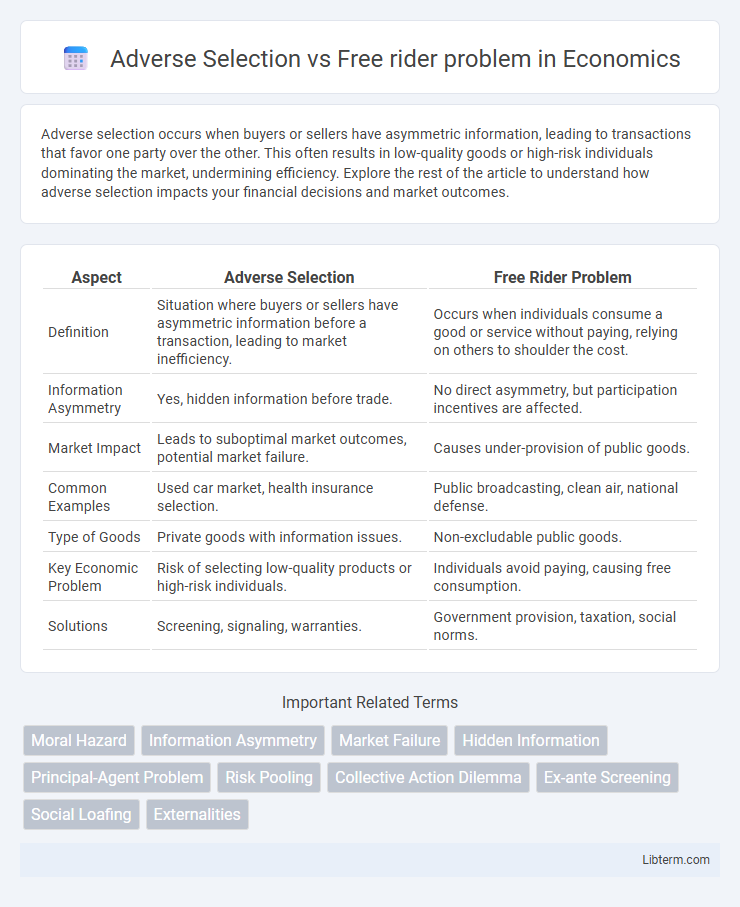

Adverse selection occurs when buyers or sellers have asymmetric information, leading to transactions that favor one party over the other. This often results in low-quality goods or high-risk individuals dominating the market, undermining efficiency. Explore the rest of the article to understand how adverse selection impacts your financial decisions and market outcomes.

Table of Comparison

| Aspect | Adverse Selection | Free Rider Problem |

|---|---|---|

| Definition | Situation where buyers or sellers have asymmetric information before a transaction, leading to market inefficiency. | Occurs when individuals consume a good or service without paying, relying on others to shoulder the cost. |

| Information Asymmetry | Yes, hidden information before trade. | No direct asymmetry, but participation incentives are affected. |

| Market Impact | Leads to suboptimal market outcomes, potential market failure. | Causes under-provision of public goods. |

| Common Examples | Used car market, health insurance selection. | Public broadcasting, clean air, national defense. |

| Type of Goods | Private goods with information issues. | Non-excludable public goods. |

| Key Economic Problem | Risk of selecting low-quality products or high-risk individuals. | Individuals avoid paying, causing free consumption. |

| Solutions | Screening, signaling, warranties. | Government provision, taxation, social norms. |

Introduction to Adverse Selection and Free Rider Problem

Adverse selection occurs when asymmetric information leads one party to engage in riskier behavior, common in insurance markets where high-risk individuals are more likely to purchase coverage. The free rider problem arises when individuals benefit from resources or services without paying, often seen in public goods and collective action scenarios. Both concepts highlight challenges in economic transactions and resource allocation due to information gaps and incentive misalignments.

Defining Adverse Selection

Adverse selection occurs when asymmetric information leads one party in a transaction to exploit the other by withholding critical knowledge, often causing market inefficiencies. It manifests prominently in insurance markets where high-risk individuals are more likely to purchase coverage, skewing risk pools and driving up premiums. This problem contrasts with the free rider dilemma, where individuals benefit from resources or services without contributing to their cost.

Defining the Free Rider Problem

The free rider problem occurs when individuals benefit from resources, goods, or services without paying for their cost, leading to under-provision or depletion of those resources. This issue is prominent in public goods and common-pool resources, where exclusion is difficult and consumption is non-excludable. Unlike adverse selection, which involves asymmetric information before a transaction, the free rider problem emerges from incentives to exploit shared benefits after resources are made available.

Key Differences Between Adverse Selection and Free Rider Problem

Adverse selection occurs when asymmetric information leads one party to selectively participate in a market, often resulting in lower-quality goods or higher-risk individuals dominating, while the free rider problem arises when individuals benefit from resources without paying for their cost, causing under-provision of public goods. The key difference lies in adverse selection being rooted in hidden information before a transaction, whereas the free rider problem is related to non-excludability and non-rivalry in the consumption of goods after they are provided. Adverse selection primarily affects market efficiency through quality distortion, while the free rider problem challenges collective action and resource allocation in public economics.

Causes of Adverse Selection in Markets

Adverse selection in markets arises primarily from information asymmetry, where sellers or buyers possess more knowledge about product quality or risk than the other party. This imbalance leads to high-risk individuals or low-quality goods dominating the market because the uninformed side cannot accurately assess value or risk. The result is market inefficiencies, including reduced trust and potential market failure, as seen in insurance and used car markets.

Causes of the Free Rider Problem in Public Goods

The free rider problem in public goods arises primarily because these goods are non-excludable and non-rivalrous, allowing individuals to benefit without directly contributing to their provision. This lack of exclusion mechanisms creates an incentive to avoid payment, leading to underfunding or depletion of resources. Furthermore, information asymmetry about others' contributions exacerbates the issue, as individuals rely on others to bear costs while enjoying the benefits freely.

Real-World Examples of Adverse Selection

Adverse selection occurs when asymmetric information leads buyers or sellers to make suboptimal decisions, commonly seen in the health insurance market where individuals with higher health risks are more likely to purchase coverage, raising costs for insurers. In the used car market, sellers often possess more information about vehicle defects than buyers, resulting in a "market for lemons" where low-quality cars dominate. These real-world examples illustrate how adverse selection distorts market efficiency and increases transaction costs.

Real-World Examples of the Free Rider Problem

The free rider problem occurs when individuals benefit from resources, goods, or services without paying for their cost, often leading to under-provision. Real-world examples include public goods like clean air, national defense, and public broadcasting where people consume benefits without contributing financially. This issue is evident in large-scale projects such as infrastructure maintenance or vaccination programs, where some individuals rely on others' contributions to sustain communal advantages.

Solutions and Policy Interventions

Addressing adverse selection involves implementing mandatory insurance schemes, enhancing information transparency through standardized disclosures, and using risk-based pricing to align premiums with individual risk profiles. Solutions to the free rider problem include establishing compulsory contribution systems, enforcing regulations that require participation in public goods funding, and designing incentive structures such as benefits tied to contributions. Policy interventions often combine regulatory frameworks with economic incentives to reduce information asymmetry and ensure equitable participation in collective resource financing.

Summary: Impact on Economics and Market Efficiency

Adverse selection leads to market inefficiencies by causing information asymmetry, where buyers or sellers possess private knowledge that distorts fair pricing and reduces transaction quality, particularly in insurance and financial markets. The free rider problem results in under-provision of public goods because individuals consume resources without paying, diminishing overall market efficiency and leading to resource allocation failure. Both issues impair economic efficiency by disrupting optimal market functioning and reducing welfare through distorted incentives and information gaps.

Adverse Selection Infographic

libterm.com

libterm.com