Dutch disease occurs when a country's natural resource boom leads to currency appreciation, harming its manufacturing sector by making exports more expensive. This phenomenon can cause economic imbalances, including reduced industrial competitiveness and increased dependency on resource revenues. Discover how Dutch disease might impact Your economy and what strategies can mitigate its effects in the rest of the article.

Table of Comparison

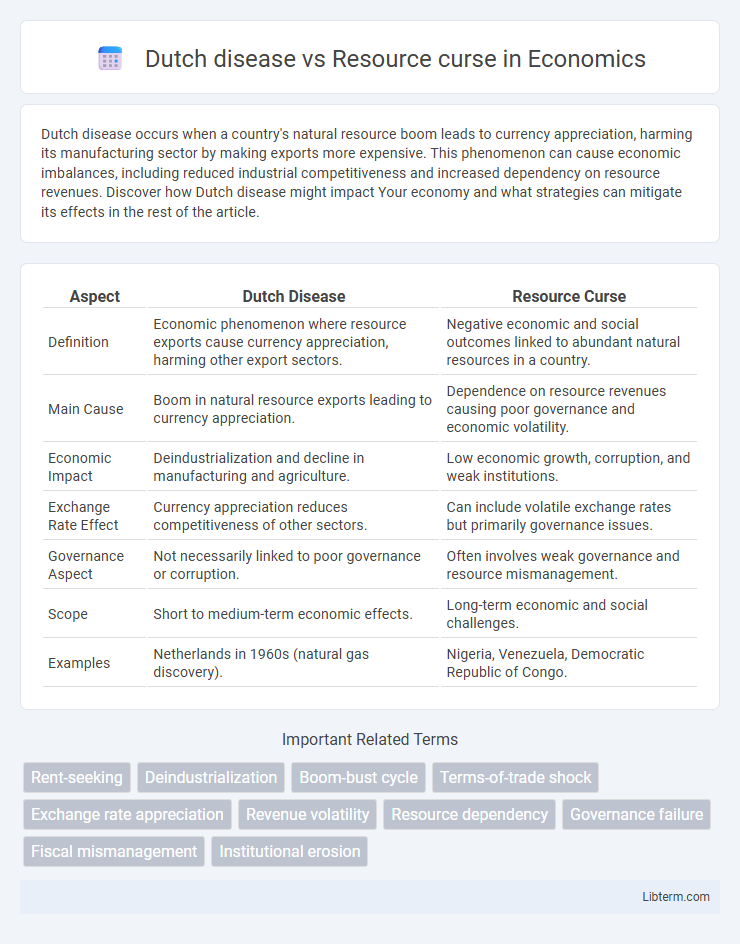

| Aspect | Dutch Disease | Resource Curse |

|---|---|---|

| Definition | Economic phenomenon where resource exports cause currency appreciation, harming other export sectors. | Negative economic and social outcomes linked to abundant natural resources in a country. |

| Main Cause | Boom in natural resource exports leading to currency appreciation. | Dependence on resource revenues causing poor governance and economic volatility. |

| Economic Impact | Deindustrialization and decline in manufacturing and agriculture. | Low economic growth, corruption, and weak institutions. |

| Exchange Rate Effect | Currency appreciation reduces competitiveness of other sectors. | Can include volatile exchange rates but primarily governance issues. |

| Governance Aspect | Not necessarily linked to poor governance or corruption. | Often involves weak governance and resource mismanagement. |

| Scope | Short to medium-term economic effects. | Long-term economic and social challenges. |

| Examples | Netherlands in 1960s (natural gas discovery). | Nigeria, Venezuela, Democratic Republic of Congo. |

Understanding Dutch Disease: Definition and Origins

Dutch Disease refers to the economic phenomenon where a resource boom, such as natural gas discoveries, causes a currency appreciation that harms the manufacturing sector by making exports less competitive. Originating from the Netherlands' experience in the 1960s after discovering large natural gas fields, it highlights how resource wealth can lead to structural imbalances in an economy. This effect contrasts with the broader Resource Curse, which encompasses various economic and political challenges linked to resource dependence.

The Resource Curse: An Overview

The resource curse refers to the paradox where countries rich in natural resources often experience slower economic growth, weaker governance, and increased conflict compared to resource-poor nations. This phenomenon is linked to factors such as overreliance on commodity exports, volatility in resource prices, and neglect of other economic sectors, particularly manufacturing. Empirical studies highlight that nations like Nigeria and Venezuela exemplify resource curse symptoms, displaying corruption, economic mismanagement, and political instability despite vast hydrocarbon wealth.

Key Differences Between Dutch Disease and Resource Curse

Dutch Disease primarily refers to the economic effects of a natural resource discovery leading to currency appreciation, which harms the manufacturing sector. The Resource Curse encompasses broader governance and institutional challenges that result in poor economic growth despite resource wealth. Key differences lie in Dutch Disease's focus on macroeconomic symptoms like exchange rate shifts, while Resource Curse emphasizes political instability and corruption linked to resource dependence.

Economic Mechanisms Behind Dutch Disease

Dutch disease arises when a resource boom causes currency appreciation, making non-resource exports less competitive and leading to deindustrialization. The economic mechanism involves a shift of labor and capital toward the booming resource sector and a rise in income that increases demand for tradable and non-tradable goods, pushing up prices in the non-tradable sector. This reallocation of resources undermines long-term economic diversification, contrasting the broader resource curse which includes governance issues, volatility, and conflict risks associated with resource wealth.

Social and Political Dimensions of the Resource Curse

The resource curse often leads to weakened political institutions and increased corruption, as governments rely heavily on resource revenues instead of taxation, reducing accountability and citizen engagement. Socially, this dependence can exacerbate income inequality and fuel social unrest due to uneven distribution of wealth and limited investment in public services. Dutch disease contributes by causing economic distortions that undermine other sectors, intensifying social tensions and political instability linked to resource dependency.

Case Studies: Countries Affected by Dutch Disease

Nigeria and Venezuela exemplify countries affected by Dutch disease, where rapid resource wealth expansion caused currency appreciation that harmed manufacturing sectors. The Netherlands in the 1960s faced this phenomenon after natural gas discoveries led to a decline in competitiveness in other export industries. These case studies reveal how resource booms can disrupt economic diversification and create long-term challenges despite immediate wealth gains.

Resource Curse in Practice: Global Examples

Resource curse manifests when countries rich in natural resources, such as oil or minerals, experience slower economic growth and governance challenges. Nigeria and Venezuela exemplify this phenomenon, facing corruption, economic volatility, and underinvestment in other sectors despite abundant resources. These cases highlight how resource wealth can undermine institutional quality and sustainable development.

Policy Responses to Mitigate Dutch Disease

Effective policy responses to mitigate Dutch Disease emphasize economic diversification by investing resource revenues in sectors beyond natural resources, such as manufacturing and technology. Implementing sovereign wealth funds helps stabilize the economy by managing resource income volatility and preventing inflationary pressures that appreciate the currency. Exchange rate policies and labor market reforms also play key roles in maintaining competitiveness and supporting sustainable long-term growth.

Strategies for Overcoming the Resource Curse

Effective strategies for overcoming the resource curse involve diversifying the economy beyond natural resource dependence, investing in human capital, and establishing transparent governance frameworks to manage revenues responsibly. Countries like Norway have successfully implemented sovereign wealth funds to stabilize income and promote long-term economic growth. Promoting institutional quality and reducing corruption are critical to ensuring resource wealth translates into sustainable development rather than economic volatility or social inequality.

Lessons Learned: Balancing Resource Wealth and Sustainable Growth

Effective management of resource wealth requires avoiding overreliance on volatile commodity exports, as seen in Dutch disease, where currency appreciation harms manufacturing. The resource curse warns of governance pitfalls, such as corruption and rent-seeking, that hinder sustainable development. Lessons emphasize diversification of the economy, strong institutions, and transparent fiscal policies to balance resource wealth with long-term economic stability.

Dutch disease Infographic

libterm.com

libterm.com