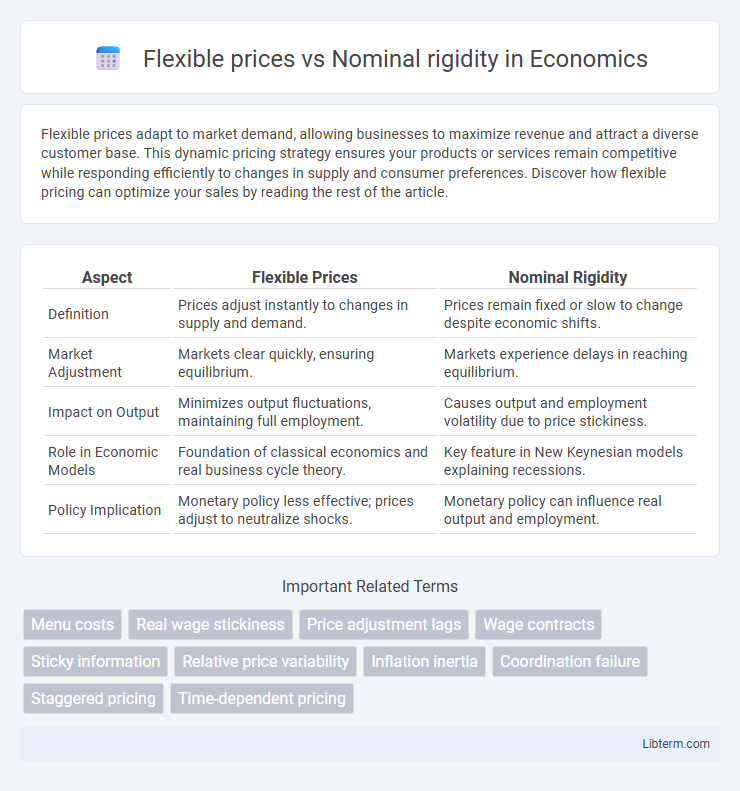

Flexible prices adapt to market demand, allowing businesses to maximize revenue and attract a diverse customer base. This dynamic pricing strategy ensures your products or services remain competitive while responding efficiently to changes in supply and consumer preferences. Discover how flexible pricing can optimize your sales by reading the rest of the article.

Table of Comparison

| Aspect | Flexible Prices | Nominal Rigidity |

|---|---|---|

| Definition | Prices adjust instantly to changes in supply and demand. | Prices remain fixed or slow to change despite economic shifts. |

| Market Adjustment | Markets clear quickly, ensuring equilibrium. | Markets experience delays in reaching equilibrium. |

| Impact on Output | Minimizes output fluctuations, maintaining full employment. | Causes output and employment volatility due to price stickiness. |

| Role in Economic Models | Foundation of classical economics and real business cycle theory. | Key feature in New Keynesian models explaining recessions. |

| Policy Implication | Monetary policy less effective; prices adjust to neutralize shocks. | Monetary policy can influence real output and employment. |

Introduction to Flexible Prices and Nominal Rigidity

Flexible prices adjust rapidly to changes in supply and demand, allowing markets to clear efficiently and maintain equilibrium. Nominal rigidity refers to the slow adjustment of nominal prices and wages, causing short-term imbalances like unemployment and output fluctuations. Understanding the contrast between flexible prices and nominal rigidity is crucial for analyzing economic responses to shocks and designing effective monetary policies.

Defining Flexible Prices

Flexible prices rapidly adjust to changes in supply and demand conditions, allowing markets to reach equilibrium without delays or distortions. In contrast, nominal rigidity refers to the slow or sticky adjustment of prices, wages, or contracts due to menu costs, long-term agreements, or informational frictions. Understanding flexible prices is crucial for analyzing efficient market outcomes where price signals accurately reflect economic fundamentals.

Understanding Nominal Rigidity

Nominal rigidity refers to the resistance of prices and wages to adjust immediately in response to changes in economic conditions, causing short-term imbalances in supply and demand. Unlike flexible prices that quickly reflect market shifts, nominal rigidity can lead to inefficiencies such as unemployment or excess inventory because prices and wages remain fixed. Understanding nominal rigidity is crucial for policymakers when designing interventions aimed at stabilizing economic fluctuations without causing unintended distortions.

Key Differences Between Flexible Prices and Nominal Rigidity

Flexible prices adjust quickly in response to changes in supply and demand, allowing markets to reach equilibrium efficiently. Nominal rigidity refers to the resistance of prices and wages to change, often due to contracts, menu costs, or wage agreements, leading to slower adjustments. This key difference impacts monetary policy effectiveness, as nominal rigidity can cause price stickiness and unemployment, whereas flexible prices promote rapid market clearing.

Causes of Nominal Price Rigidity

Nominal price rigidity arises from menu costs, where firms face expenses to change prices frequently, leading to sticky prices despite market fluctuations. Customer relationships and long-term contracts also cause firms to maintain stable prices to avoid consumer dissatisfaction and uncertainty. Moreover, information asymmetry and coordination failures among firms contribute to delayed price adjustments, reinforcing nominal rigidity in various industries.

The Economic Impact of Flexible Prices

Flexible prices allow markets to adjust quickly to changes in supply and demand, enhancing economic efficiency by preventing prolonged mismatches and reducing unemployment rates. In contrast, nominal rigidity, such as sticky wages and prices, often leads to delayed market adjustments, causing inefficiencies including persistent inflation or output gaps. The economic impact of flexible prices results in more stable economic cycles and improved resource allocation, promoting higher growth and price stability.

How Nominal Rigidity Affects Market Equilibrium

Nominal rigidity, characterized by slow adjustment of prices and wages, prevents markets from instantly reaching equilibrium despite changes in supply or demand. This price stickiness causes persistent unemployment and output fluctuations by hindering the clearing of labor and goods markets. Flexible prices, in contrast, allow rapid realignment of equilibrium by adjusting to economic shocks, minimizing inefficiencies caused by delays in price responses.

Real-World Examples of Price Flexibility and Rigidity

Flexible prices are evident in commodity markets where oil prices fluctuate daily based on supply and demand, reflecting real-time economic conditions. In contrast, nominal rigidity is apparent in labor markets, where wages tend to remain sticky downward due to contracts, minimum wage laws, and employee morale considerations, despite economic downturns. Retail prices also exhibit rigidity, often changing only during sales or major inventory shifts, illustrating partial price flexibility in consumer goods sectors.

Policy Implications: Addressing Nominal Rigidity

Addressing nominal rigidity requires targeted monetary and fiscal policies to enhance price flexibility and improve economic responsiveness to shocks. Central banks may implement forward guidance and adjust interest rates strategically to mitigate the effects of sticky prices on inflation and output. Structural reforms aimed at increasing competition and reducing menu costs can also alleviate nominal rigidity, promoting efficient resource allocation and stabilizing economic fluctuations.

Conclusion: Balancing Flexibility and Stability in Pricing

Balancing flexible prices and nominal rigidity is crucial for maintaining both market efficiency and economic stability. Flexible prices allow quick adjustments to supply and demand shifts, enhancing resource allocation, while nominal rigidity prevents excessive volatility that can destabilize markets and discourage long-term investment. Optimal pricing strategies incorporate measured rigidity to smooth short-term fluctuations without sacrificing the responsiveness needed for economic growth.

Flexible prices Infographic

libterm.com

libterm.com