A monetary anchor serves as a key tool used by central banks to stabilize a country's currency by tying it to a stable value such as gold, foreign currency, or inflation rate targets. This strategy helps control inflation expectations and maintain economic stability by providing a clear commitment to a predetermined value or target. Explore the rest of the article to understand how a monetary anchor impacts your financial decisions and the broader economy.

Table of Comparison

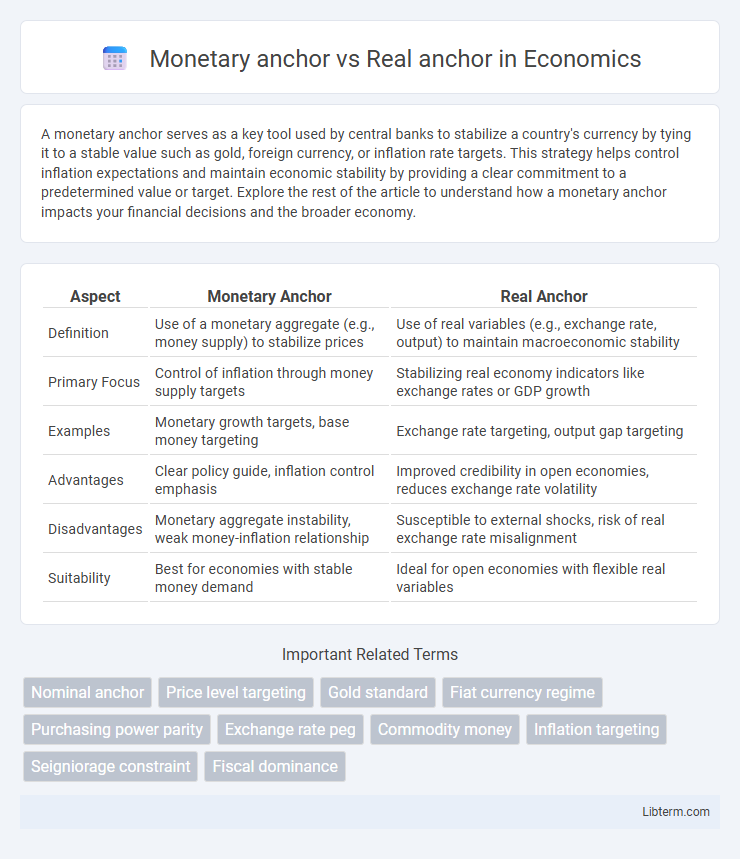

| Aspect | Monetary Anchor | Real Anchor |

|---|---|---|

| Definition | Use of a monetary aggregate (e.g., money supply) to stabilize prices | Use of real variables (e.g., exchange rate, output) to maintain macroeconomic stability |

| Primary Focus | Control of inflation through money supply targets | Stabilizing real economy indicators like exchange rates or GDP growth |

| Examples | Monetary growth targets, base money targeting | Exchange rate targeting, output gap targeting |

| Advantages | Clear policy guide, inflation control emphasis | Improved credibility in open economies, reduces exchange rate volatility |

| Disadvantages | Monetary aggregate instability, weak money-inflation relationship | Susceptible to external shocks, risk of real exchange rate misalignment |

| Suitability | Best for economies with stable money demand | Ideal for open economies with flexible real variables |

Introduction to Monetary and Real Anchors

Monetary anchors stabilize inflation expectations through targets like exchange rates or money supply growth, guiding central bank policies. Real anchors focus on long-term economic fundamentals such as output or employment levels to maintain economic stability and credibility. Both anchors serve as reference points that help policymakers control inflation and support sustainable growth.

Defining Monetary Anchor: Concepts and Examples

A monetary anchor is a policy tool used by central banks to maintain price stability by targeting a specific monetary aggregate such as money supply or exchange rate. Examples include pegging the national currency to a stable foreign currency or setting strict money supply growth rates to control inflation. Unlike real anchors, which rely on real economic variables like output or employment, monetary anchors focus on nominal variables to guide inflation expectations and monetary policy credibility.

Understanding Real Anchor in Economic Policy

Real anchors in economic policy refer to tangible, non-monetary targets such as exchange rates, inflation rates, or output levels used to stabilize an economy and guide expectations. Unlike monetary anchors that rely on controlling money supply or interest rates, real anchors focus on observable economic indicators which anchor policy credibility and reduce inflationary uncertainty. Understanding real anchors involves recognizing their role in enhancing policy transparency, anchoring inflation expectations, and facilitating sustainable economic growth by directly targeting real variables within the economy.

Key Differences Between Monetary and Real Anchors

Monetary anchors primarily rely on specific monetary aggregates, such as money supply or inflation targeting, to maintain price stability, while real anchors focus on real variables like exchange rates or output levels to achieve economic stability. Monetary anchors provide a clear, quantifiable target for central banks, facilitating expectations management, whereas real anchors depend on external benchmarks that can be influenced by external shocks or structural changes. The key difference lies in their impact on policy flexibility and credibility, with monetary anchors offering more direct control over inflation, while real anchors help stabilize broader macroeconomic variables.

Role of Monetary Anchors in Stabilizing Currency

Monetary anchors, such as fixed exchange rates or inflation targets, play a crucial role in stabilizing currency by providing clear, credible benchmarks for monetary policy and anchoring inflation expectations. Real anchors focus on underlying economic fundamentals like productivity or output levels to guide currency stability, emphasizing long-term equilibrium rather than short-term price signals. Effective use of monetary anchors enhances market confidence, reduces exchange rate volatility, and helps maintain price stability.

The Importance of Real Anchors for Price Stability

Real anchors, such as fiscal discipline and structural economic reforms, play a crucial role in achieving and maintaining price stability by grounding inflation expectations in actual economic fundamentals rather than solely on monetary aggregates. Unlike monetary anchors that rely on targeting variables like money supply or exchange rates, real anchors address the underlying economic forces, reducing volatility and enhancing the credibility of inflation control policies. Empirical evidence shows that countries with strong real anchors experience lower inflation variability and more sustainable growth compared to those relying primarily on monetary anchors.

Case Studies: Countries Using Monetary vs Real Anchors

Countries like Argentina and Brazil have historically used monetary anchors such as fixed exchange rates or inflation targeting to stabilize their economies, with mixed results due to external shocks and fiscal imbalances. Alternatively, Hong Kong and Botswana exemplify effective use of real anchors, relying on commodity prices and wage controls respectively, which anchored expectations more sustainably during volatility. Empirical analyses show that real anchors often provide greater consistency in inflation control, especially in economies susceptible to currency fluctuations and external economic pressures.

Advantages and Limitations of Monetary Anchors

Monetary anchors stabilize inflation by targeting money supply growth or exchange rate levels, providing clear policy signals and transparency. Advantages include simplicity in communication and enhanced credibility, which can help manage inflation expectations effectively. Limitations involve vulnerability to shocks in velocity of money, difficulty in controlling the exact monetary aggregate, and potential conflicts with output stabilization goals.

Advantages and Limitations of Real Anchors

Real anchors, such as exchange rates or commodity prices, provide a tangible reference for stabilizing inflation expectations, enhancing credibility in monetary policy by directly linking the domestic economy to external benchmarks. Their advantages include simplicity in communication and predictability, which can help reduce inflation volatility and guide market behavior effectively. Limitations arise from vulnerability to external shocks, loss of monetary policy autonomy, and potential misalignment with domestic economic conditions, which can lead to inappropriate policy responses during asymmetric or supply-side disturbances.

Implications for Financial Policy and Economic Growth

A monetary anchor, typically involving strict control of inflation through targets like exchange rates or money supply, stabilizes price expectations and curbs inflationary pressures, supporting predictable financial policy. A real anchor, emphasizing long-term equilibrium values such as output or employment levels, fosters sustainable economic growth by aligning policy with fundamental economic conditions. Balancing these anchors enhances policy credibility, reduces macroeconomic volatility, and promotes investor confidence essential for long-term investment and growth.

Monetary anchor Infographic

libterm.com

libterm.com