Consumption tax is a value-added tax imposed on the purchase of goods and services, playing a crucial role in government revenue generation. It directly affects consumer spending habits and pricing structures across various industries. Discover how consumption tax impacts Your daily purchases and the broader economy by reading further.

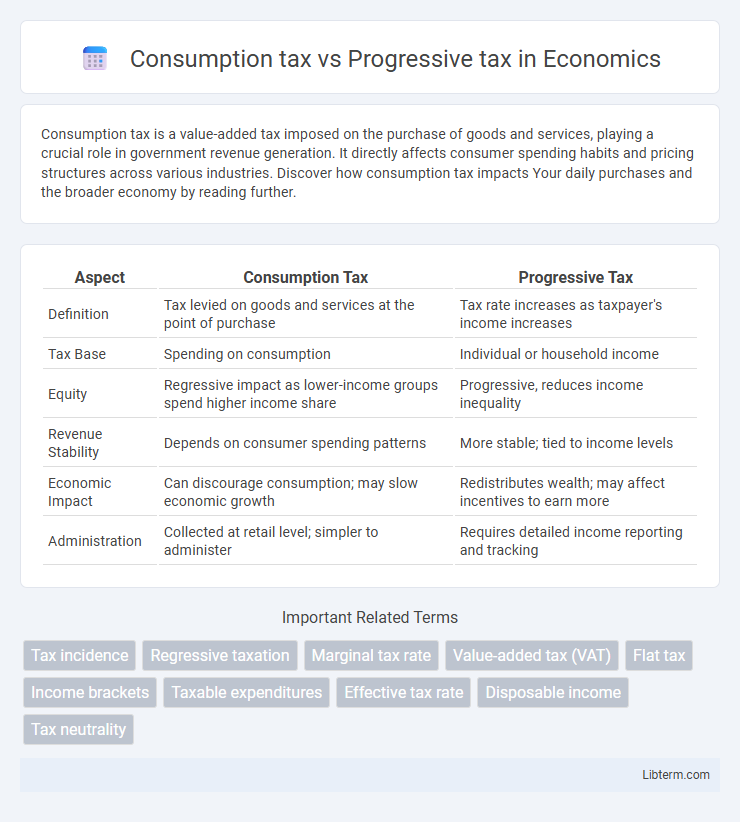

Table of Comparison

| Aspect | Consumption Tax | Progressive Tax |

|---|---|---|

| Definition | Tax levied on goods and services at the point of purchase | Tax rate increases as taxpayer's income increases |

| Tax Base | Spending on consumption | Individual or household income |

| Equity | Regressive impact as lower-income groups spend higher income share | Progressive, reduces income inequality |

| Revenue Stability | Depends on consumer spending patterns | More stable; tied to income levels |

| Economic Impact | Can discourage consumption; may slow economic growth | Redistributes wealth; may affect incentives to earn more |

| Administration | Collected at retail level; simpler to administer | Requires detailed income reporting and tracking |

Introduction to Consumption Tax and Progressive Tax

Consumption tax, levied on goods and services at the point of sale, directly impacts consumer spending behavior and is often implemented as a flat rate such as a value-added tax (VAT). Progressive tax, on the other hand, is an income-based tax system where the tax rate increases as the taxpayer's income rises, aiming to reduce income inequality by placing a higher burden on those with greater financial resources. Understanding these tax structures is crucial for evaluating their effects on economic equity and government revenue generation.

Definition and Key Features of Consumption Tax

Consumption tax is a levy imposed on goods and services at the point of purchase, primarily designed to tax spending rather than income. Key features include its broad base, often encompassing value-added tax (VAT) or sales tax, making it a regressive form of taxation as it affects all consumers regardless of income level. Unlike progressive taxes, which increase rates with higher income brackets, consumption taxes maintain a flat rate applied uniformly to all eligible transactions.

Definition and Key Features of Progressive Tax

Progressive tax is a tax system where the tax rate increases as the taxable income or value increases, resulting in higher earners paying a larger percentage of their income compared to lower earners. Key features include graduated tax brackets, income-based rates, and redistribution goals aimed at reducing income inequality. Unlike consumption tax, which is levied on goods and services regardless of income, progressive tax focuses on the taxpayer's ability to pay.

How Consumption Taxes Are Implemented

Consumption taxes are implemented primarily through sales taxes, value-added taxes (VAT), or excise taxes applied to goods and services at the point of sale. These taxes are typically a fixed percentage added to the price, affecting all consumers regardless of their income level. Unlike progressive taxes, which increase with income, consumption taxes generate government revenue based on spending behavior, often requiring mechanisms for tax collection from retailers or service providers.

How Progressive Taxes Are Implemented

Progressive taxes are implemented through tax brackets where rates increase as taxable income rises, ensuring higher earners pay a larger percentage. This structure is designed to reduce income inequality by imposing heavier tax burdens on the wealthiest individuals while offering lower rates or exemptions for lower-income groups. Governments often use detailed income assessments and withholding systems to enforce accurate filing and collection of progressive taxes.

Economic Impacts of Consumption vs Progressive Taxation

Consumption taxes, such as sales tax or value-added tax (VAT), typically impose a uniform rate on goods and services, often resulting in a regressive burden that disproportionately affects lower-income households and can reduce overall consumer spending. Progressive taxes, including graduated income taxes, have increasing rates for higher income brackets, promoting income redistribution and potentially reducing economic inequality while also influencing labor supply and investment decisions. Economic impacts of consumption versus progressive taxation highlight trade-offs between simplicity and fairness, with consumption taxes driving consumption patterns and savings behavior, and progressive taxes affecting income distribution and long-term economic growth.

Equity and Fairness: Who Bears the Tax Burden?

Consumption tax, such as sales tax or value-added tax (VAT), tends to be regressive, disproportionately impacting low-income households that spend a higher percentage of their income on taxed goods and services. Progressive tax systems impose higher rates on higher income brackets, enhancing equity by ensuring wealthier individuals contribute a larger share relative to their income. The burden of consumption taxes falls more heavily on lower-income earners, while progressive taxes promote fairness by aligning tax liability with taxpayers' ability to pay.

Revenue Stability and Efficiency Comparisons

Consumption tax provides more stable revenue streams due to consistent consumer spending patterns, making it less sensitive to economic fluctuations compared to progressive tax systems. Progressive taxes, which increase rates with higher income levels, can cause revenue volatility during economic downturns when high earners' incomes decline. Efficiency-wise, consumption taxes encourage savings and investment by taxing spending rather than income, while progressive taxes may discourage income generation through higher marginal rates.

Real-World Examples of Consumption and Progressive Taxes

Consumption taxes, such as the Value-Added Tax (VAT) in the European Union and the Goods and Services Tax (GST) in Canada, are levied at the point of purchase, disproportionately affecting lower-income households due to their higher spending ratios. Progressive taxes, exemplified by the United States federal income tax system and Sweden's personal income tax, impose higher rates on higher income brackets to promote income redistribution and reduce economic inequality. Real-world data from OECD countries indicate that consumption taxes generate stable revenue but may increase regressive effects, whereas progressive tax systems are more effective at wealth redistribution but can impact incentives for high earners.

Choosing the Best Tax System: Considerations and Conclusions

Choosing the best tax system involves evaluating the economic impact, fairness, and administrative efficiency of consumption tax and progressive tax models. Consumption taxes, such as VAT, provide a consistent revenue stream with lower compliance costs but tend to be regressive, disproportionately affecting lower-income households. Progressive taxes, structured around income brackets, promote equity by taxing higher earners at increased rates, yet may discourage income generation and require complex enforcement mechanisms.

Consumption tax Infographic

libterm.com

libterm.com