The junior tranche refers to the lowest priority layer in a structured finance deal, typically bearing the highest risk but offering the highest potential returns. It absorbs initial losses, providing protection to senior tranches and making it an attractive option for investors willing to take on more risk. Discover how understanding junior tranches can enhance your investment strategy in the rest of this article.

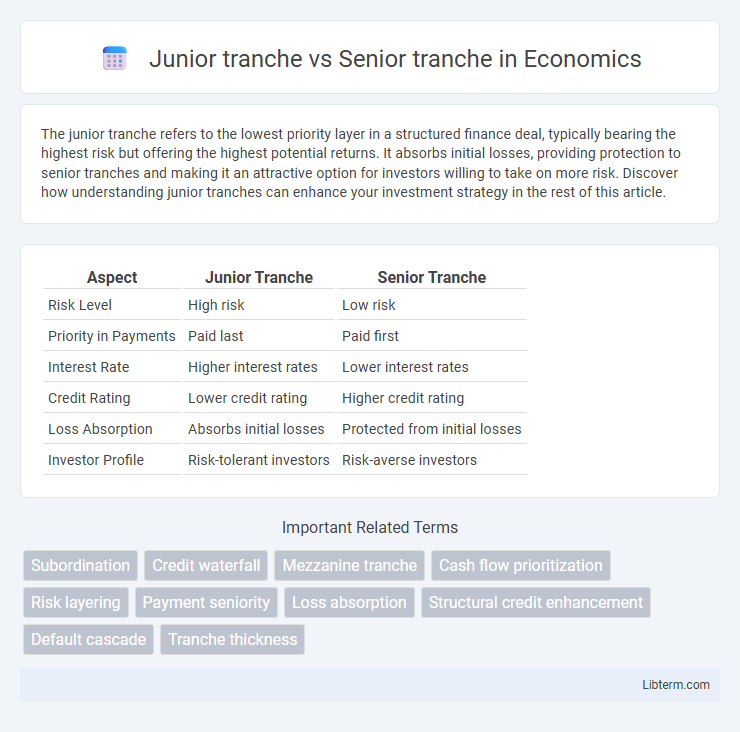

Table of Comparison

| Aspect | Junior Tranche | Senior Tranche |

|---|---|---|

| Risk Level | High risk | Low risk |

| Priority in Payments | Paid last | Paid first |

| Interest Rate | Higher interest rates | Lower interest rates |

| Credit Rating | Lower credit rating | Higher credit rating |

| Loss Absorption | Absorbs initial losses | Protected from initial losses |

| Investor Profile | Risk-tolerant investors | Risk-averse investors |

Understanding Tranches: An Overview

Junior tranche refers to the portion of a structured finance product that absorbs losses first and offers higher yields due to increased risk, while senior tranche holds priority in payments and lower risk exposure. Understanding tranches involves recognizing their hierarchical structure within securitized assets, where each tranche has distinct risk, return, and claim rights during cash flow distributions. This segmentation helps investors tailor portfolios according to risk appetite and enhances capital market efficiency by distributing credit risk across different investor classes.

What is a Junior Tranche?

A Junior Tranche refers to the lower-priority segment of a structured finance product, such as a mortgage-backed security or collateralized loan obligation, which absorbs losses before Senior Tranches during defaults. Investors in Junior Tranches face higher risk but receive higher yields compared to Senior Tranches, which have priority claim on assets and payments. The repayment hierarchy makes Junior Tranches more suitable for those seeking higher returns and willing to accept increased credit risk.

What is a Senior Tranche?

A Senior tranche is a segment of a structured financial product, such as a collateralized debt obligation (CDO) or mortgage-backed security (MBS), that holds the highest claim on assets and receives priority for interest and principal payments. This tranche carries lower risk and typically offers lower yields compared to Junior tranches, which absorb losses first and have subordinate payment priority. Investors in Senior tranches benefit from enhanced credit protection due to the subordinate positions of Junior tranches, making them more suitable for risk-averse investors.

Key Differences Between Junior and Senior Tranches

Senior tranches have higher credit ratings and receive priority in interest and principal payments, reducing default risk for investors, while junior tranches carry lower credit ratings and absorb losses first, increasing their risk but offering higher potential returns. Senior tranches typically have lower yields due to their lower risk profile, whereas junior tranches provide higher yields to compensate for elevated credit risk. The structural subordination in senior and junior tranches plays a crucial role in debt repayment waterfalls, influencing investor decisions based on risk tolerance and investment strategy.

Risk Profiles: Junior vs Senior Tranches

Junior tranches carry higher risk due to their subordinate position in the capital structure, absorbing losses before senior tranches, which makes them more volatile but potentially offers higher returns. Senior tranches have lower risk as they have priority in receiving principal and interest payments, providing greater protection against default and more stable cash flows. Investors in junior tranches should expect increased exposure to credit risk and potential for loss, while senior tranche investors benefit from enhanced security and lower default risk.

Returns and Yield Comparison

The junior tranche typically offers higher returns and yield compared to the senior tranche due to its increased risk exposure as it absorbs losses first in credit events. Senior tranches provide lower yields but benefit from priority in receiving payments and principal repayments, resulting in reduced default risk. Investors seeking greater income potential often opt for junior tranches, while conservative investors prefer senior tranches for capital preservation and stable returns.

Role in Structured Finance

Senior tranches hold priority in receiving principal and interest payments, reducing their credit risk and making them attractive to conservative investors in structured finance deals like mortgage-backed securities. Junior tranches absorb initial losses, bearing higher risk but offering greater potential returns, thereby providing a credit enhancement layer that protects senior tranches. The distinct roles of these tranches facilitate risk distribution and capital structuring, enabling efficient financing and risk management within asset-backed securities.

Importance in Credit Risk Allocation

Senior tranches hold priority in repayment and face lower credit risk due to their first claim on assets, making them critical for conservative investors seeking stability. Junior tranches absorb initial losses, which increases their credit risk but provides a vital buffer that protects senior tranches and enhances overall credit risk allocation. This tiered structure allows financial institutions to distribute risk efficiently, attracting diverse investors by aligning risk tolerance with tranche positioning.

Common Applications and Examples

Junior tranches, often first-loss positions, are commonly used in mortgage-backed securities (MBS) and collateralized debt obligations (CDOs) to absorb initial defaults, offering higher yields to compensate for increased risk. Senior tranches have priority claim on cash flows from underlying assets, making them favorable for conservative investors seeking stable returns in structured finance products like asset-backed securities (ABS). Common applications include residential mortgage-backed securities (RMBS) where senior tranches provide investment-grade credit ratings, while junior tranches serve as equity or mezzanine layers to enhance capital structure resilience.

Investor Considerations: Junior vs Senior Tranches

Investors in senior tranches benefit from higher credit ratings and priority in cash flow distribution, reducing default risk but offering lower yields compared to junior tranches. Junior tranche investors assume greater risk as they absorb initial losses, yet they gain potential for higher returns due to elevated interest rates. Understanding the risk-return tradeoff and the capital structure hierarchy is crucial for aligning investment strategies with risk tolerance and income goals.

Junior tranche Infographic

libterm.com

libterm.com