Reserve requirement refers to the minimum amount of funds that a bank must hold in reserve against deposits made by its customers, typically mandated by central banks to ensure liquidity and financial stability. This regulation helps control the money supply, influencing interest rates and inflation within the economy. Discover how understanding reserve requirements can impact your financial strategies by exploring the full article.

Table of Comparison

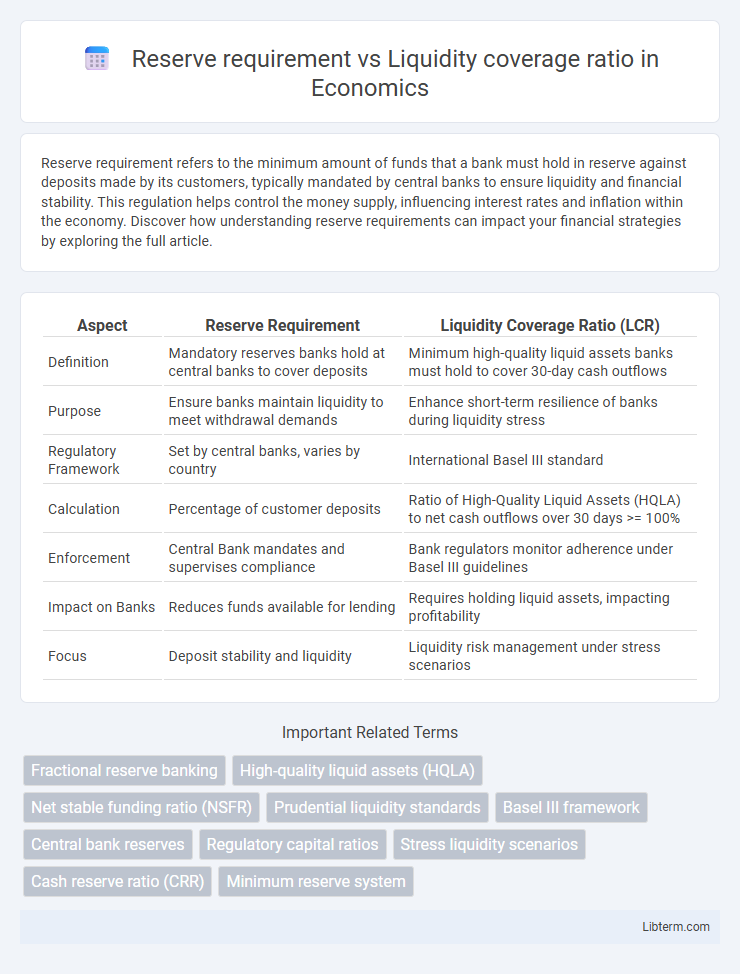

| Aspect | Reserve Requirement | Liquidity Coverage Ratio (LCR) |

|---|---|---|

| Definition | Mandatory reserves banks hold at central banks to cover deposits | Minimum high-quality liquid assets banks must hold to cover 30-day cash outflows |

| Purpose | Ensure banks maintain liquidity to meet withdrawal demands | Enhance short-term resilience of banks during liquidity stress |

| Regulatory Framework | Set by central banks, varies by country | International Basel III standard |

| Calculation | Percentage of customer deposits | Ratio of High-Quality Liquid Assets (HQLA) to net cash outflows over 30 days >= 100% |

| Enforcement | Central Bank mandates and supervises compliance | Bank regulators monitor adherence under Basel III guidelines |

| Impact on Banks | Reduces funds available for lending | Requires holding liquid assets, impacting profitability |

| Focus | Deposit stability and liquidity | Liquidity risk management under stress scenarios |

Introduction to Reserve Requirement and Liquidity Coverage Ratio

Reserve requirement is a regulatory mandate compelling banks to hold a minimum fraction of customer deposits as reserves, ensuring liquidity and stability in the banking system. Liquidity Coverage Ratio (LCR) requires banks to maintain an adequate level of high-quality liquid assets (HQLA) to cover net cash outflows over a 30-day stress period, promoting short-term resilience during financial stress. Both metrics serve as critical tools for risk management, with reserve requirements focusing on deposit liabilities and LCR emphasizing liquidity buffers.

Definition of Reserve Requirement

Reserve requirement is a regulatory mandate that compels banks to hold a specific percentage of their deposit liabilities as reserves, either in cash or as deposits with the central bank, to ensure liquidity and financial stability. It serves as a tool for controlling money supply and mitigating risks related to bank runs and insolvency. In contrast, the Liquidity Coverage Ratio (LCR) measures the ability of financial institutions to withstand short-term liquidity disruptions by maintaining an adequate stock of high-quality liquid assets covering net cash outflows over a 30-day stress period.

Definition of Liquidity Coverage Ratio

Liquidity Coverage Ratio (LCR) is a regulatory standard established by the Basel III framework that mandates banks to hold sufficient high-quality liquid assets (HQLA) to cover net cash outflows for 30 days under stress scenarios. The LCR ensures short-term resilience by requiring financial institutions to maintain a liquidity buffer that can absorb liquidity shocks, minimizing the risk of insolvency. Unlike the Reserve Requirement, which dictates the minimum reserves held against deposits, the Liquidity Coverage Ratio focuses specifically on liquidity risk management over a defined stress period.

Key Differences Between Reserve Requirement and Liquidity Coverage Ratio

The Reserve Requirement mandates banks to hold a specified percentage of customer deposits as reserves, ensuring stability in the banking system by limiting excessive lending. The Liquidity Coverage Ratio (LCR) requires banks to maintain high-quality liquid assets sufficient to cover net cash outflows for 30 days, enhancing short-term resilience during financial stress. While the Reserve Requirement focuses on deposit stability, the LCR emphasizes immediate liquidity readiness in adverse market conditions.

Historical Evolution of Reserve Requirement Policies

The historical evolution of reserve requirement policies traces back to early central banking practices where fixed reserves aimed to ensure banks held a minimum portion of deposits as cash or equivalent assets, primarily to prevent bank runs and maintain financial stability. Over time, reserve requirements adapted to changes in monetary policy, reflecting shifting economic conditions and regulatory frameworks, transitioning from rigid fixed ratios to more flexible tools supplemented by new measures like the Liquidity Coverage Ratio (LCR). The LCR, introduced under Basel III, emphasizes high-quality liquid assets to withstand 30-day stressed funding scenarios, marking a paradigm shift from quantity-based reserves to liquidity quality and risk management.

Implementation and Calculation of LCR

The Liquidity Coverage Ratio (LCR) is implemented to ensure banks maintain an adequate level of high-quality liquid assets (HQLA) to cover net cash outflows over a 30-day stress period, focusing on short-term liquidity risk. LCR calculation involves dividing the stock of HQLA by total net cash outflows, with Basel III standards requiring an LCR of at least 100%. Unlike the reserve requirement, which mandates holding a fixed percentage of deposits as reserves primarily for monetary policy, LCR emphasizes maintaining liquidity buffers to enhance bank resilience during financial stress.

Impact on Bank Liquidity Management

Reserve requirements mandate banks to hold a specific percentage of depositors' balances as cash reserves, directly reducing available funds for lending or investment, thus limiting liquidity but ensuring stability. The Liquidity Coverage Ratio (LCR) requires banks to maintain a buffer of high-quality liquid assets sufficient to cover net cash outflows for 30 days, enhancing short-term resilience against liquidity shocks. Both metrics influence liquidity management by balancing the trade-off between profitability and risk mitigation, with reserve requirements imposing a static constraint and LCR providing a dynamic measure tied to stress scenarios.

Regulatory Objectives and Compliance

Reserve requirements mandate banks to hold a minimum percentage of customer deposits as cash reserves, ensuring stability and mitigating liquidity risks by providing a cushion against sudden withdrawals. The Liquidity Coverage Ratio (LCR) is designed to guarantee that financial institutions maintain an adequate stock of high-quality liquid assets to survive a 30-day stress scenario, enhancing short-term resilience. Both regulatory measures promote financial system stability, with reserve requirements focusing on deposit protection and LCR emphasizing comprehensive liquidity risk management under Basel III compliance.

Global Practices and Standards Comparison

Reserve requirements mandate banks to hold a specific portion of deposits as a buffer against withdrawals, varying widely across countries, with emerging economies often enforcing higher ratios to ensure stability. The Liquidity Coverage Ratio (LCR), introduced under Basel III standards, requires banks globally to maintain high-quality liquid assets sufficient to cover net cash outflows for 30 days, promoting short-term resilience. While reserve requirements focus on depositor protection and monetary policy implementation, the LCR emphasizes systemic liquidity risk management, with developed economies leading in LCR adoption and harmonization under international regulatory frameworks.

Conclusion: Future Trends in Reserve and Liquidity Regulations

Future trends in reserve requirements and liquidity coverage ratios indicate a shift towards more dynamic, risk-sensitive frameworks that better address real-time market conditions and financial institution-specific profiles. Regulatory bodies are increasingly emphasizing stress testing, enhanced transparency, and integration of advanced analytics to strengthen overall financial stability. These evolving standards aim to balance systemic safety with operational efficiency, fostering resilient banking sectors amid growing economic uncertainties.

Reserve requirement Infographic

libterm.com

libterm.com