A double-dip recession occurs when an economy experiences a short period of recovery followed by another downturn, causing two consecutive recessions. This phenomenon often results from lingering structural weaknesses and inadequate fiscal policies that fail to sustain growth. To understand how a double-dip recession impacts Your financial stability and what measures can mitigate its effects, keep reading the rest of the article.

Table of Comparison

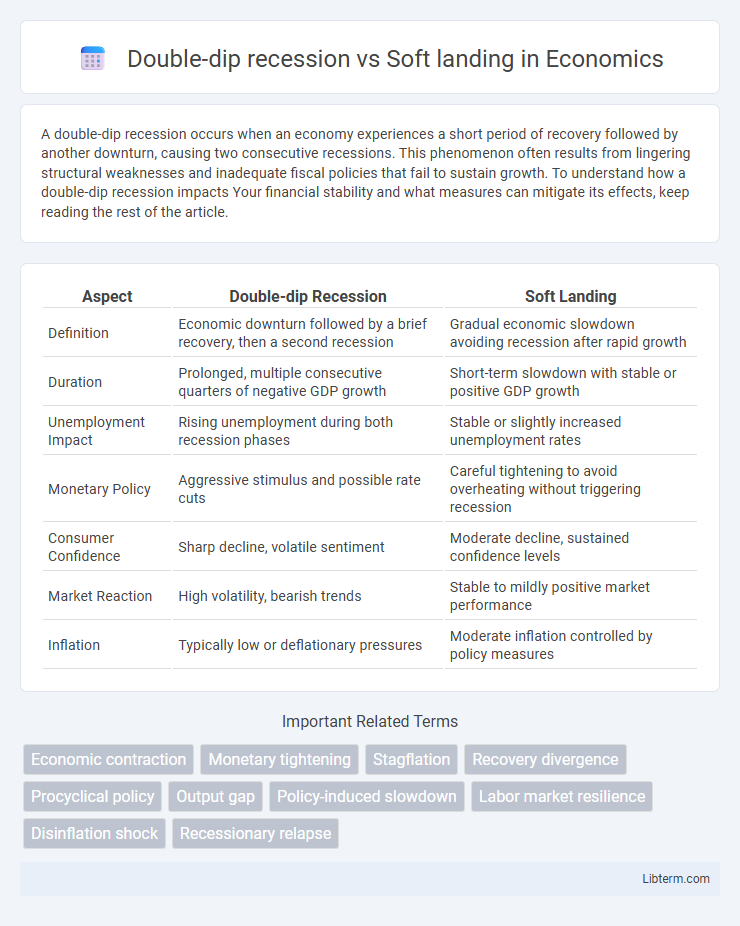

| Aspect | Double-dip Recession | Soft Landing |

|---|---|---|

| Definition | Economic downturn followed by a brief recovery, then a second recession | Gradual economic slowdown avoiding recession after rapid growth |

| Duration | Prolonged, multiple consecutive quarters of negative GDP growth | Short-term slowdown with stable or positive GDP growth |

| Unemployment Impact | Rising unemployment during both recession phases | Stable or slightly increased unemployment rates |

| Monetary Policy | Aggressive stimulus and possible rate cuts | Careful tightening to avoid overheating without triggering recession |

| Consumer Confidence | Sharp decline, volatile sentiment | Moderate decline, sustained confidence levels |

| Market Reaction | High volatility, bearish trends | Stable to mildly positive market performance |

| Inflation | Typically low or deflationary pressures | Moderate inflation controlled by policy measures |

Understanding Economic Cycles: Double-Dip Recession vs Soft Landing

A double-dip recession occurs when an economy experiences a shallow recovery followed by a subsequent decline, leading to two distinct periods of negative GDP growth within a short timeframe. In contrast, a soft landing describes a scenario where economic growth slows down just enough to curb inflation and avoid recession, maintaining steady employment and stable markets. Understanding these economic cycles helps policymakers implement measures that aim to stabilize growth without triggering prolonged downturns or excessive overheating.

Defining Double-Dip Recession: Meaning and Indicators

A double-dip recession occurs when an economy experiences a short-term recovery followed by a second decline in economic activity, typically measured by consecutive quarters of negative GDP growth. Key indicators include a rebound in employment and consumer spending that falters, rising unemployment rates after initial improvement, and renewed declines in industrial production and business investment. This contrasts with a soft landing, where economic growth slows gradually without falling back into recession, maintaining stable inflation and avoiding significant job losses.

What is a Soft Landing? Key Concepts Explained

A soft landing occurs when an economy slows down enough to reduce inflation and avoid overheating, but continues to grow without entering a recession. Key concepts include controlled monetary policies and steady employment levels that prevent sharp declines in consumer spending or investment. Unlike a double-dip recession, which features a brief recovery followed by another downturn, a soft landing maintains economic stability and gradual expansion.

Historical Examples: Double-Dip Recessions in the Past

Historical examples of double-dip recessions include the early 1980s in the United States, where the economy experienced two consecutive downturns driven by tight monetary policy to combat inflation. Another notable case is Japan's Lost Decade in the 1990s, characterized by a prolonged economic slump with multiple contractions and weak recovery attempts. These episodes contrast sharply with soft landings, where central banks successfully slow growth to sustainable levels without triggering another recession.

Notable Soft Landings: Lessons from Economic History

Notable soft landings in economic history, such as the U.S. Federal Reserve's monetary policy adjustments in the mid-1990s, demonstrate how controlled interest rate hikes can curb inflation without triggering a recession. The 1994-1995 period is often cited as a textbook example where GDP growth remained positive, employment levels were stable, and inflation was tamed, contrasting sharply with double-dip recessions characterized by a second, unexpected downturn after initial recovery. These historical lessons emphasize the importance of calibrated fiscal and monetary interventions to avoid the cyclical pitfalls commonly observed in double-dip recessions.

Causes and Triggers: What Leads to Each Outcome?

A double-dip recession occurs when an economy experiences a short-lived recovery followed by a renewed decline, often triggered by persistent high unemployment, inadequate fiscal stimulus, or external shocks like a sudden drop in consumer demand. A soft landing is achieved when central banks successfully curb inflation without causing a recession, typically through gradual interest rate hikes and targeted monetary policies that maintain consumer confidence and spending. The key difference lies in the effectiveness of policy responses and the resilience of underlying economic fundamentals, which determine whether recovery sustains or falters.

Key Differences: Double-Dip Recession vs Soft Landing

A double-dip recession is characterized by two consecutive periods of economic decline separated by a brief recovery, reflecting a fragile economy unable to sustain growth. In contrast, a soft landing describes a controlled slowdown of economic growth aimed at avoiding recession while preventing inflation from rising unchecked. Key differences include the severity of impact, with double-dip recessions causing prolonged unemployment and business failures, whereas soft landings maintain labor market stability and moderate inflation rates.

Economic Impacts: Growth, Employment, and Inflation

A double-dip recession leads to prolonged economic contraction, heightened unemployment rates, and suppressed consumer demand that further depresses inflation. In contrast, a soft landing achieves controlled slowing of growth, stabilizing employment levels while keeping inflation near target rates. Policymakers aim for a soft landing to avoid the severe job losses and deflationary pressures characteristic of a double-dip recession.

Policy Responses: How Central Banks and Governments React

Central banks implement aggressive monetary easing, such as slashing interest rates and quantitative easing, during a double-dip recession to stimulate demand and avoid contraction, while governments increase fiscal spending with stimulus packages targeting job preservation and business support. In contrast, a soft landing strategy involves gradual tightening of monetary policy, including cautious rate hikes and reduced asset purchases, to control inflation without triggering a recession, alongside calibrated fiscal measures ensuring economic stability. Effective communication and coordinated policy responses between central banks and governments are crucial in both scenarios to manage market expectations and sustain investor confidence.

Navigating Future Risks: Preparing for Economic Uncertainty

Navigating future risks amid economic uncertainty involves understanding the differences between a double-dip recession and a soft landing. A double-dip recession occurs when the economy briefly recovers then slips back into another downturn, requiring robust fiscal policies and contingency plans to mitigate prolonged financial instability. In contrast, a soft landing aims for a controlled slowdown without triggering recession, emphasizing balanced monetary measures and proactive risk management to sustain growth while addressing inflation pressures.

Double-dip recession Infographic

libterm.com

libterm.com