A liquidity trap occurs when interest rates are low and savings rates are high, rendering monetary policy ineffective in stimulating the economy. In this scenario, people prefer holding cash over investments, causing demand to stagnate despite central bank efforts. Explore the rest of the article to understand how a liquidity trap can impact your financial decisions and economic outlook.

Table of Comparison

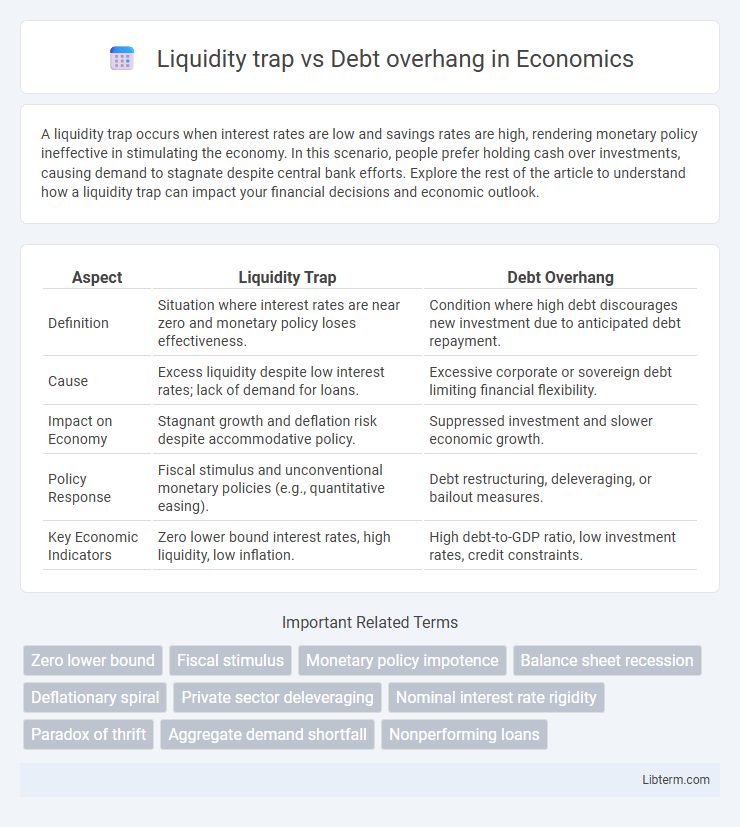

| Aspect | Liquidity Trap | Debt Overhang |

|---|---|---|

| Definition | Situation where interest rates are near zero and monetary policy loses effectiveness. | Condition where high debt discourages new investment due to anticipated debt repayment. |

| Cause | Excess liquidity despite low interest rates; lack of demand for loans. | Excessive corporate or sovereign debt limiting financial flexibility. |

| Impact on Economy | Stagnant growth and deflation risk despite accommodative policy. | Suppressed investment and slower economic growth. |

| Policy Response | Fiscal stimulus and unconventional monetary policies (e.g., quantitative easing). | Debt restructuring, deleveraging, or bailout measures. |

| Key Economic Indicators | Zero lower bound interest rates, high liquidity, low inflation. | High debt-to-GDP ratio, low investment rates, credit constraints. |

Understanding Liquidity Trap: Key Concepts

Understanding liquidity trap involves recognizing a situation where nominal interest rates approach zero, rendering monetary policy ineffective in stimulating economic demand. This occurs when individuals prefer holding cash over investing, despite low borrowing costs, leading to stagnant spending and economic slowdown. Contrastingly, debt overhang refers to excessive debt burden hindering new investments, while liquidity trap specifically highlights the failure of monetary policy to lower interest rates further to boost liquidity and economic activity.

Defining Debt Overhang in Modern Economies

Debt overhang in modern economies occurs when a country's or corporation's existing debt is so large that it discourages new borrowing and investment, impairing economic growth. This situation creates a financial burden where future earnings are largely committed to servicing old debt, reducing incentives to undertake profitable projects. Unlike a liquidity trap, which involves low interest rates failing to stimulate demand, debt overhang specifically relates to excessive debt levels that hinder fiscal and investment activities.

Causes and Triggers of Liquidity Traps

Liquidity traps occur when interest rates approach zero, causing monetary policy to lose effectiveness as consumers and businesses hoard cash instead of spending or investing. This situation is often triggered by deflationary expectations, financial crises, or severe recessions that undermine confidence in economic recovery. In contrast, debt overhang arises when excessive debt burdens discourage new investments because future profits will primarily repay existing creditors rather than fund growth.

How Debt Overhang Develops: Core Mechanisms

Debt overhang develops when high existing debt levels inhibit new investment because future earnings primarily serve to repay old creditors, reducing incentives for both borrowers and lenders. The core mechanisms involve a firm's or economy's inability to generate sufficient cash flow to cover debt service, leading to underinvestment despite profitable opportunities. This contrasts with a liquidity trap, where monetary policy becomes ineffective due to near-zero interest rates and preference for liquidity over spending.

Distinguishing Features: Liquidity Trap vs Debt Overhang

A liquidity trap occurs when interest rates are near zero, rendering monetary policy ineffective as consumers and businesses hoard cash instead of spending or investing. Debt overhang refers to a situation where excessive existing debt discourages new borrowing and investment because anticipated returns primarily service old debts rather than generate profit. The key distinction lies in liquidity trap's emphasis on monetary policy paralysis due to near-zero rates, whereas debt overhang centers on the burden of substantial debt stifling economic activity despite available credit.

Economic Impacts: Comparing Both Phenomena

Liquidity traps restrict monetary policy effectiveness by rendering interest rate cuts unable to stimulate demand, leading to prolonged economic stagnation and deflationary pressures. Debt overhang discourages new investment as borrowers prioritize debt repayment over spending, slowing growth and weakening credit markets. Both phenomena undermine economic recovery by limiting consumption and investment, though liquidity traps primarily affect monetary policy transmission while debt overhang impacts balance sheet strength and financial stability.

Policy Challenges in Addressing Liquidity Traps

Liquidity traps arise when nominal interest rates approach zero, rendering conventional monetary policy ineffective as consumers and investors hoard cash instead of spending or investing, complicating economic stimulus efforts. Debt overhang occurs when excessive debt burdens discourage new borrowing and investment, limiting the effectiveness of fiscal measures aimed at economic recovery. Policymakers face challenges in liquidity traps by needing to implement unconventional monetary tools like quantitative easing and forward guidance, while addressing debt overhang requires restructuring debt and strengthening balance sheets to restore credit flow and promote growth.

Solutions for Managing Debt Overhang

Addressing debt overhang effectively requires restructuring existing debt to restore firm solvency and incentivize new investments. Implementing debt-for-equity swaps allows creditors to convert debt into ownership, reducing the burden while aligning interests for growth. Government-backed guarantees and targeted fiscal stimulus can further alleviate credit constraints and stimulate economic activity.

Case Studies: Real-World Examples and Lessons

The Japanese economy's prolonged deflation during the 1990s exemplifies a liquidity trap, where low interest rates failed to stimulate borrowing or spending despite ample monetary supply. Greece's sovereign debt crisis highlighted debt overhang, as massive public debt discouraged investment and growth due to fears of default and austerity measures. These cases demonstrate that liquidity traps require unconventional monetary policies like quantitative easing, while debt overhang necessitates fiscal restructuring and debt relief to restore economic confidence.

Future Risks and Strategies for Resilient Economies

Liquidity traps hinder central banks' ability to stimulate economies through traditional monetary policy, increasing the risk of prolonged stagnation and deflationary pressures. Debt overhang constrains investment as high existing debt deters new borrowing, amplifying financial fragility and limiting growth potential. Strategies for resilient economies include enhancing fiscal policy flexibility, promoting private sector deleveraging, and implementing counter-cyclical regulatory frameworks to mitigate future systemic risks.

Liquidity trap Infographic

libterm.com

libterm.com