Market failures occur when the allocation of goods and services by a free market is not efficient, leading to negative outcomes such as externalities, public goods, and information asymmetries. These inefficiencies can result in overproduction or underproduction, harming overall economic welfare. Explore the rest of the article to understand how market failures impact Your economy and possible solutions.

Table of Comparison

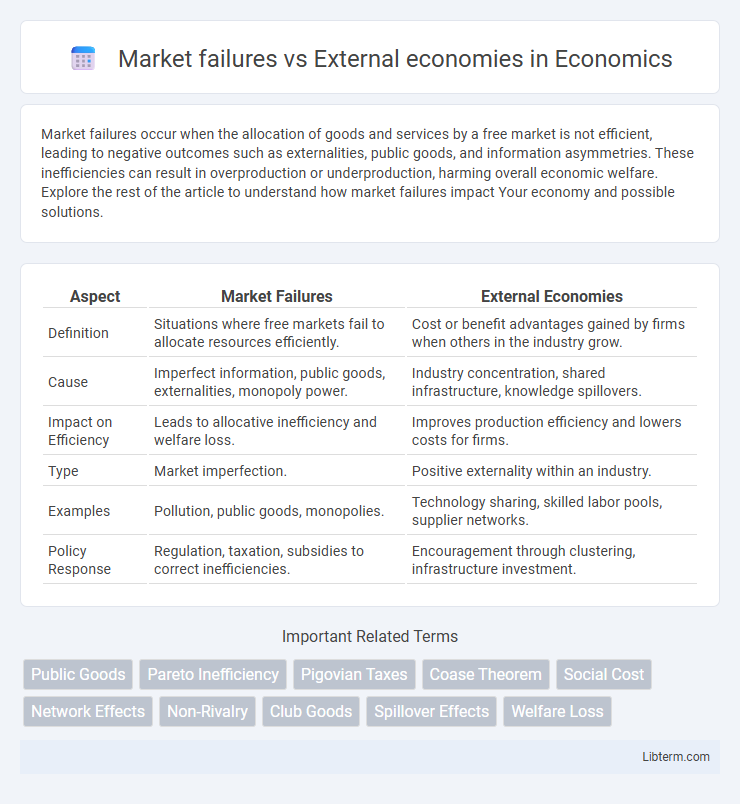

| Aspect | Market Failures | External Economies |

|---|---|---|

| Definition | Situations where free markets fail to allocate resources efficiently. | Cost or benefit advantages gained by firms when others in the industry grow. |

| Cause | Imperfect information, public goods, externalities, monopoly power. | Industry concentration, shared infrastructure, knowledge spillovers. |

| Impact on Efficiency | Leads to allocative inefficiency and welfare loss. | Improves production efficiency and lowers costs for firms. |

| Type | Market imperfection. | Positive externality within an industry. |

| Examples | Pollution, public goods, monopolies. | Technology sharing, skilled labor pools, supplier networks. |

| Policy Response | Regulation, taxation, subsidies to correct inefficiencies. | Encouragement through clustering, infrastructure investment. |

Introduction to Market Failures and External Economies

Market failures occur when the allocation of goods and services by a free market is not efficient, leading to a loss of economic and social welfare. External economies refer to the benefits that accrue to third parties or society at large when a firm or individual undertakes certain activities, without these benefits being reflected in market prices. Understanding the distinction between market failures and external economies is crucial for designing policies that correct inefficiencies and promote positive externalities in the economy.

Defining Market Failures: Key Concepts

Market failures occur when resources are allocated inefficiently, leading to outcomes where individual incentives do not result in optimal social welfare. Key concepts include public goods, information asymmetry, and externalities, which distort market equilibrium by causing either overproduction or underproduction compared to a socially optimal level. External economies, a subset of externalities, arise when an individual's or firm's actions confer unpriced benefits on others, influencing demand and supply without direct compensation.

Understanding External Economies: Basic Overview

External economies occur when the actions of a firm or industry result in cost advantages that benefit other firms or the broader economy without direct compensation. Unlike market failures, which arise from inefficient allocation of resources due to externalities, public goods, or information asymmetries, external economies specifically refer to positive spillovers that enhance productivity or reduce costs outside the initiating firm. Recognizing these external economies is vital for policymaking, as fostering environments that encourage knowledge sharing, infrastructure improvements, and skilled labor pools can stimulate industrial growth and regional economic development.

Causes of Market Failures in Modern Economies

Market failures in modern economies often arise from information asymmetry, public goods, externalities, and market power imbalances. External economies, a form of positive externality, occur when a firm's production benefits other firms or consumers without direct compensation, leading to underinvestment or underproduction in competitive markets. These causes create inefficiencies that prevent optimal resource allocation, necessitating government intervention or regulation to correct market outcomes.

Types of External Economies in Industry

Market failures occur when resource allocation by free markets is inefficient, often leading to suboptimal outcomes in industries. External economies in industry include types such as localization economies, where firms benefit from proximity to similar businesses; urbanization economies, derived from the overall growth of a city enhancing infrastructure and labor markets; and technological spillovers, where innovation by one firm generates benefits for others in the same industry. These external economies reduce production costs and increase productivity, yet they may cause market failures if individual firms do not internalize these positive externalities.

Differences Between Market Failures and External Economies

Market failures occur when the allocation of goods and services by a free market is not efficient, often due to information asymmetry, public goods, or monopoly power, leading to welfare losses. External economies, a subset of externalities, refer to cost savings or benefits experienced by third parties resulting from the production or consumption activities of others, without these effects being reflected in market prices. Unlike broader market failures, external economies specifically emphasize positive spillover effects that can enhance productivity or reduce costs but are not captured in market transactions.

Real-World Examples of Market Failures

Market failures arise when resources are allocated inefficiently, often due to externalities like pollution from factories contaminating local water supplies, which impose costs on communities without compensation. Public goods such as national defense showcase market failures since private markets underprovide them due to free-rider problems. Congestion in urban transportation systems exemplifies negative externalities where individual choices lead to excessive traffic, reducing overall welfare and signaling the need for regulatory intervention.

External Economies and Their Impact on Market Efficiency

External economies arise when a firm's actions create benefits for others without compensation, leading to positive externalities that enhance overall productivity. These external benefits can improve market efficiency by lowering costs or increasing innovation, but they often remain underproduced due to the absence of direct incentives. Addressing external economies through targeted policies like subsidies or support for knowledge spillovers can correct market failures and optimize resource allocation.

Policy Responses to Market Failures vs External Economies

Policy responses to market failures often include government interventions such as taxes, subsidies, regulations, and provision of public goods to correct inefficiencies and promote social welfare. In contrast, addressing external economies involves enhancing positive externalities through targeted subsidies, infrastructure investments, or support for innovation clusters that foster productivity spillovers. Both strategies aim to realign private incentives with social benefits, but policies for market failures typically correct market distortions, while those for external economies focus on amplifying beneficial external effects.

Conclusion: Implications for Economic Development

Market failures occur when markets inefficiently allocate resources, often leading to suboptimal economic outcomes and hindering sustainable development. External economies, as positive spillovers from production or consumption, can enhance productivity and innovation, thereby fostering economic growth. Understanding the interplay between market failures and external economies is crucial for designing effective policies that stimulate investment, improve infrastructure, and promote equitable economic development.

Market failures Infographic

libterm.com

libterm.com