The inflation rate measures the percentage increase in the general price level of goods and services over a specific period, affecting your purchasing power and cost of living. Understanding how inflation impacts wages, savings, and interest rates is essential for effective financial planning. Explore the article to learn how inflation influences the economy and strategies to protect your finances.

Table of Comparison

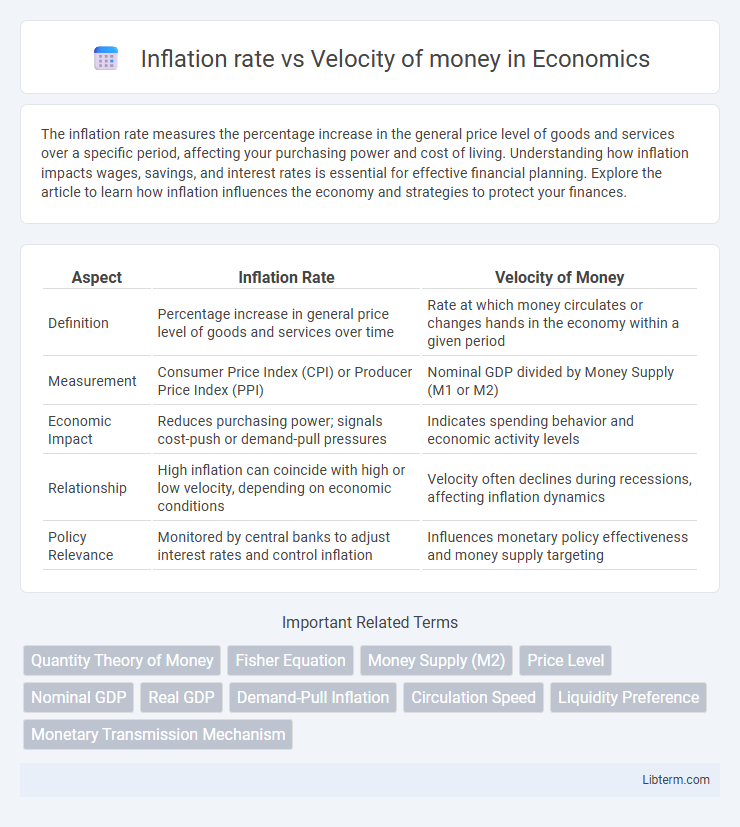

| Aspect | Inflation Rate | Velocity of Money |

|---|---|---|

| Definition | Percentage increase in general price level of goods and services over time | Rate at which money circulates or changes hands in the economy within a given period |

| Measurement | Consumer Price Index (CPI) or Producer Price Index (PPI) | Nominal GDP divided by Money Supply (M1 or M2) |

| Economic Impact | Reduces purchasing power; signals cost-push or demand-pull pressures | Indicates spending behavior and economic activity levels |

| Relationship | High inflation can coincide with high or low velocity, depending on economic conditions | Velocity often declines during recessions, affecting inflation dynamics |

| Policy Relevance | Monitored by central banks to adjust interest rates and control inflation | Influences monetary policy effectiveness and money supply targeting |

Understanding Inflation Rate: A Brief Overview

Inflation rate measures the percentage increase in the general price level of goods and services over a specific period, reflecting the decrease in purchasing power of money. The velocity of money represents the frequency at which one unit of currency is used for transactions within the economy during a given time frame, influencing overall demand and price levels. Understanding the relationship between inflation rate and velocity of money is essential, as a higher velocity can accelerate inflation if the money supply grows too quickly relative to economic output.

Defining the Velocity of Money

The velocity of money measures how frequently a unit of currency circulates within an economy over a specific period, reflecting the rate at which money changes hands for final goods and services. It is calculated by dividing the nominal GDP by the money supply, indicating the efficiency of money usage in driving economic activity. Understanding the velocity of money helps explain inflationary pressures, as a higher velocity can amplify inflation if the money supply remains constant or grows.

How Inflation Rate and Velocity of Money are Connected

The inflation rate and velocity of money are interconnected through the equation of exchange, where the velocity of money represents how quickly money circulates in the economy, affecting price levels. When the velocity of money increases while money supply remains constant, higher demand can lead to rising inflation rates. Conversely, a decrease in velocity can mitigate inflationary pressures despite an expanding money supply.

Factors Influencing the Velocity of Money

The velocity of money is influenced by factors such as consumer spending habits, technological advancements in payment systems, and overall economic confidence. High velocity indicates frequent transactions, which can amplify inflation when the money supply increases. Conversely, slower velocity suggests money is hoarded or saved, reducing inflationary pressure even with a growing money supply.

The Quantity Theory of Money Explained

The Quantity Theory of Money explains that inflation rate is directly proportional to the money supply and velocity of money, assuming constant output. Velocity of money measures how quickly money circulates in the economy, influencing inflation when money supply grows faster than real GDP. Empirical analysis shows stable velocity leads inflation rates to reflect changes in money supply, supporting monetarist policy frameworks.

Real-World Examples: Inflation vs Money Velocity

Rising inflation in Venezuela coincided with a sharp decline in the velocity of money, highlighting how hyperinflation erodes spending confidence despite increased cash circulation. In contrast, the U.S. experienced low inflation but rising velocity during the 2021 economic recovery, showing enhanced consumer activity driving demand-pull inflation. These cases demonstrate that inflation rates often reflect complex interactions with money velocity, influenced by consumer behavior and economic conditions.

Central Bank Policies: Impact on Inflation and Money Velocity

Central bank policies significantly influence inflation rates and the velocity of money by adjusting interest rates and controlling money supply. Expansionary policies, such as lowering interest rates or quantitative easing, typically increase money velocity by encouraging spending and borrowing, which can drive inflation upward. Conversely, contractionary measures reduce money velocity by discouraging expenditure, aiming to curb inflation and stabilize the economy.

Inflation Control Strategies and Money Flow

Inflation control strategies often target the velocity of money to stabilize price levels by influencing how quickly money circulates within the economy. Central banks may implement monetary policies such as adjusting interest rates or reserve requirements to reduce money velocity, thereby curbing excessive inflation. Effective money flow regulation helps maintain purchasing power and supports sustainable economic growth by balancing liquidity and demand.

Economic Growth, Inflation, and Money Circulation

The inflation rate and velocity of money are closely linked indicators that influence economic growth, where a higher velocity of money often signals increased money circulation and economic activity, potentially driving inflation. Rapid money circulation can fuel demand-pull inflation if it outpaces the economy's productive capacity, while controlled velocity supports stable growth by balancing spending and price levels. Understanding the dynamic between inflation and money velocity is essential for policymakers aiming to stimulate sustainable economic expansion without triggering excessive inflation.

Future Trends: Predicting Inflation and Velocity of Money

Future trends indicate a complex relationship between inflation rate and velocity of money, influenced by technological advancements and monetary policy shifts. Economic models predict that rising digital transactions may boost velocity, potentially accelerating inflation if money supply growth is not controlled. Central banks' adaptive strategies, including real-time data analysis and targeted interventions, will be crucial in managing these dynamics effectively.

Inflation rate Infographic

libterm.com

libterm.com