Inflation targeting is a monetary policy strategy where central banks set a specific inflation rate as their goal to maintain price stability and guide economic expectations. By focusing on this target, policymakers aim to control inflation's impact on purchasing power, interest rates, and overall economic growth. Explore the following sections to understand how inflation targeting shapes financial markets and influences your economic decisions.

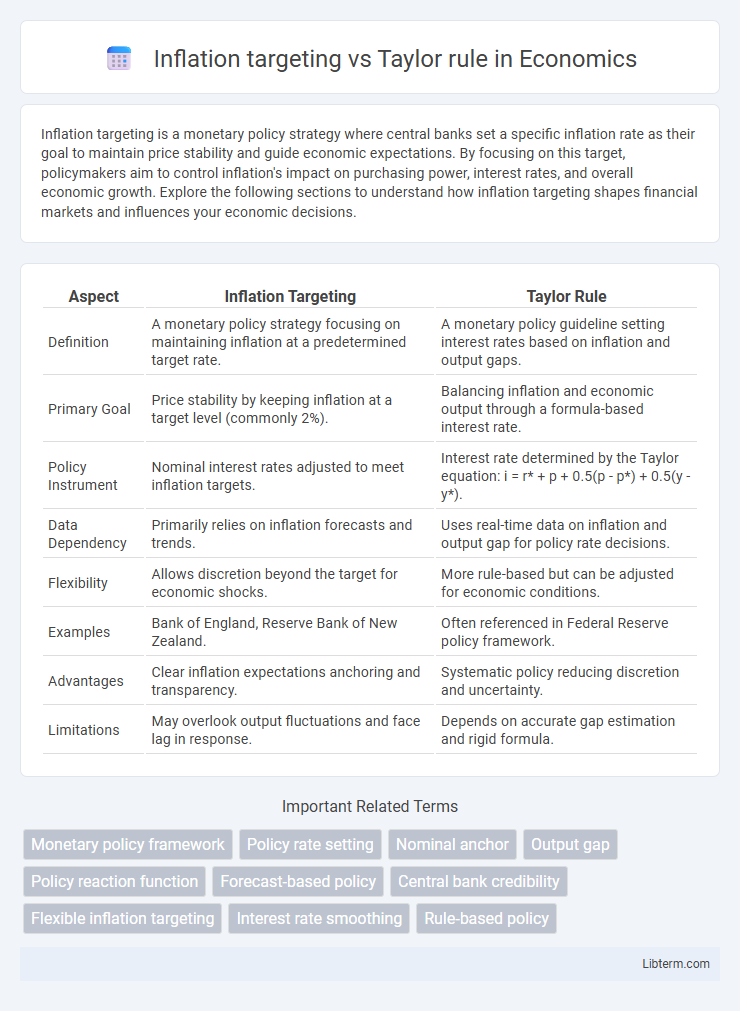

Table of Comparison

| Aspect | Inflation Targeting | Taylor Rule |

|---|---|---|

| Definition | A monetary policy strategy focusing on maintaining inflation at a predetermined target rate. | A monetary policy guideline setting interest rates based on inflation and output gaps. |

| Primary Goal | Price stability by keeping inflation at a target level (commonly 2%). | Balancing inflation and economic output through a formula-based interest rate. |

| Policy Instrument | Nominal interest rates adjusted to meet inflation targets. | Interest rate determined by the Taylor equation: i = r* + p + 0.5(p - p*) + 0.5(y - y*). |

| Data Dependency | Primarily relies on inflation forecasts and trends. | Uses real-time data on inflation and output gap for policy rate decisions. |

| Flexibility | Allows discretion beyond the target for economic shocks. | More rule-based but can be adjusted for economic conditions. |

| Examples | Bank of England, Reserve Bank of New Zealand. | Often referenced in Federal Reserve policy framework. |

| Advantages | Clear inflation expectations anchoring and transparency. | Systematic policy reducing discretion and uncertainty. |

| Limitations | May overlook output fluctuations and face lag in response. | Depends on accurate gap estimation and rigid formula. |

Introduction to Monetary Policy Frameworks

Inflation targeting is a monetary policy framework where central banks set explicit inflation goals, usually around 2%, to stabilize prices and guide expectations. The Taylor rule provides a systematic approach for setting interest rates based on deviations of actual inflation from target inflation and output gap, offering a formulaic response to economic conditions. Both frameworks aim to promote economic stability, but inflation targeting emphasizes transparency and communication, while the Taylor rule focuses on mechanical policy adjustments.

Understanding Inflation Targeting

Inflation targeting is a monetary policy strategy where central banks set explicit inflation rate goals, typically around 2%, to anchor expectations and maintain price stability. It involves transparent communication and systematic adjustments of interest rates to achieve the inflation target, fostering economic predictability. Compared to the Taylor rule, which prescribes interest rate changes based on inflation and output gaps, inflation targeting emphasizes a clear inflation goal as the primary policy focus.

Basics of the Taylor Rule

The Taylor Rule is a monetary policy guideline that prescribes how central banks should adjust interest rates based on deviations of inflation from the target and output from its potential. It uses a formula: nominal interest rate equals the neutral rate plus weighted gaps of inflation and output, emphasizing systematic responses to economic conditions. This rule contrasts with inflation targeting by providing a structured framework that automatically reacts to both inflation and economic output fluctuations.

Key Differences Between Inflation Targeting and the Taylor Rule

Inflation targeting is a monetary policy strategy where central banks set explicit inflation rate goals, typically around 2%, to anchor expectations and guide interest rate decisions. The Taylor Rule provides a formulaic approach to setting interest rates based on deviations of actual inflation from the target and output from potential GDP, emphasizing systematic adjustments. Key differences include inflation targeting's emphasis on a clear inflation goal versus the Taylor Rule's dual consideration of inflation and economic output gaps in policy determinations.

Advantages of Inflation Targeting

Inflation targeting provides a clear and transparent framework that anchors inflation expectations, enhancing central bank credibility and economic stability. It allows for flexible monetary policy adjustments based on a specific inflation goal, improving predictability for businesses and consumers. The approach simplifies communication, helping to manage market expectations and reduce volatility in inflation outcomes.

Strengths of the Taylor Rule Approach

The Taylor Rule offers a systematic framework for setting interest rates based on deviations of actual inflation and output from their targets, enhancing policy transparency and predictability. Its strength lies in its formulaic structure, which allows central banks to respond flexibly to economic changes while maintaining inflation control. Empirical research shows the Taylor Rule's effectiveness in stabilizing inflation and output, supporting its use as a reliable guideline for monetary policy decisions.

Challenges and Limitations of Each Framework

Inflation targeting faces challenges such as delayed policy effects and difficulty in responding to supply shocks, which can lead to suboptimal outcomes during economic volatility. The Taylor rule, while providing a systematic approach by linking interest rates to inflation and output gaps, often struggles with accurately estimating the output gap and adapting to structural changes in the economy. Both frameworks encounter limitations in managing unexpected shocks and require robust data and judgment to implement effectively.

Empirical Evidence and Case Studies

Empirical evidence shows inflation targeting often leads to more stable inflation rates and improved public expectations, as observed in New Zealand and Canada. Case studies of the Taylor rule highlight its effectiveness in guiding monetary policy adjustments based on output gaps and inflation deviations, with notable success in the U.S. Federal Reserve's historical interest rate decisions. Comparative analyses suggest that combining inflation targeting with Taylor rule frameworks can enhance policy transparency and economic stability.

Policy Implications and Central Bank Strategies

Inflation targeting necessitates that central banks prioritize maintaining price stability by setting explicit inflation goals, which guides interest rate adjustments to anchor inflation expectations. The Taylor rule provides a systematic framework for policy by linking interest rate decisions to deviations in inflation and output gaps, promoting transparency and predictability in monetary policy. Central banks using inflation targeting may adopt flexible strategies, while those employing the Taylor rule often emphasize rule-based adjustments, impacting communication, credibility, and the responsiveness of policy to economic fluctuations.

Conclusion: Choosing the Right Framework

Selecting between inflation targeting and the Taylor rule depends on the central bank's priority for stability and responsiveness. Inflation targeting offers clear, transparent goals that anchor public expectations, fostering stable long-term inflation outcomes. The Taylor rule provides a systematic, data-driven approach that adjusts policy based on real-time economic conditions, supporting flexible responses to output and inflation deviations.

Inflation targeting Infographic

libterm.com

libterm.com