Hedonic pricing is a method used to estimate the value of a good or service by breaking down its attributes and analyzing how each characteristic contributes to the overall price. This approach is commonly applied in real estate markets, where factors such as location, size, and amenities directly influence property values. Discover how hedonic pricing can help you understand market dynamics by reading the full article.

Table of Comparison

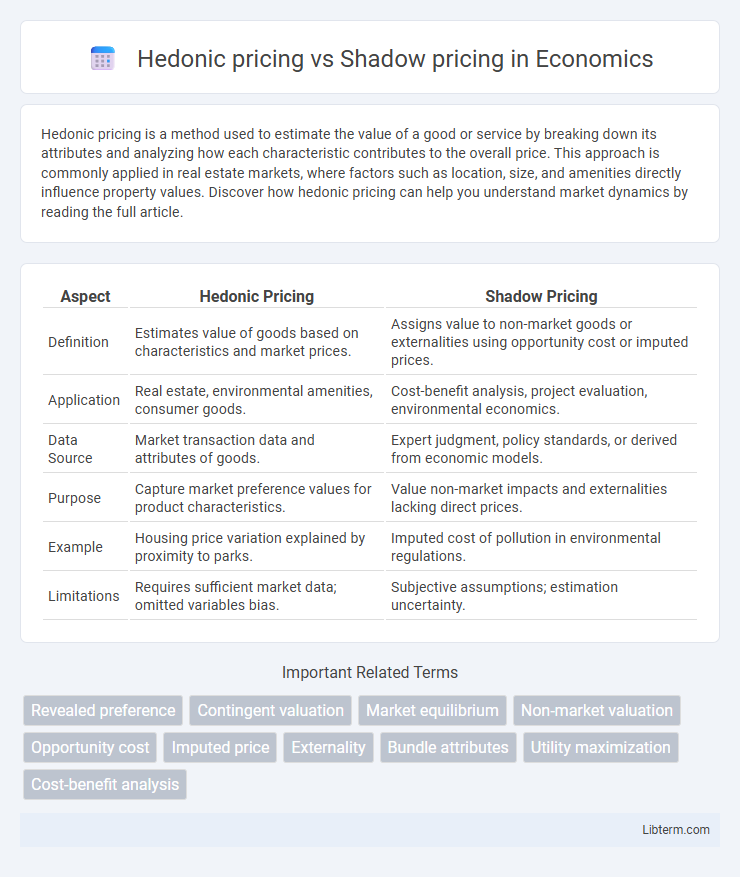

| Aspect | Hedonic Pricing | Shadow Pricing |

|---|---|---|

| Definition | Estimates value of goods based on characteristics and market prices. | Assigns value to non-market goods or externalities using opportunity cost or imputed prices. |

| Application | Real estate, environmental amenities, consumer goods. | Cost-benefit analysis, project evaluation, environmental economics. |

| Data Source | Market transaction data and attributes of goods. | Expert judgment, policy standards, or derived from economic models. |

| Purpose | Capture market preference values for product characteristics. | Value non-market impacts and externalities lacking direct prices. |

| Example | Housing price variation explained by proximity to parks. | Imputed cost of pollution in environmental regulations. |

| Limitations | Requires sufficient market data; omitted variables bias. | Subjective assumptions; estimation uncertainty. |

Introduction to Hedonic Pricing and Shadow Pricing

Hedonic pricing is a method used to estimate the economic value of specific attributes that influence market prices, such as environmental quality or property features, by analyzing variations in product prices. Shadow pricing assigns a monetary value to goods or services not traded in markets, often used in cost-benefit analysis to evaluate externalities or non-market impacts. Both approaches are essential in environmental economics and policy-making for quantifying values that are not directly observable in market transactions.

Defining Hedonic Pricing: Key Concepts

Hedonic pricing estimates the value of a good or service by analyzing how its characteristics affect market prices, commonly applied in real estate to assess factors like location, size, and amenities. This method decomposes prices into constituent attributes, enabling precise valuation of non-market features such as environmental quality or neighborhood safety. Shadow pricing differs by assigning monetary values to goods or services not traded in markets, often used in cost-benefit analysis for public projects or environmental resources.

Understanding Shadow Pricing: An Overview

Shadow pricing assigns a monetary value to goods or services not typically traded in markets, reflecting their true economic worth in decision-making processes. It is essential for evaluating externalities, public goods, and resource allocations where market prices are absent or distorted. Unlike hedonic pricing, which derives values from market data based on product attributes, shadow pricing relies on economic models and opportunity costs to guide policy and investment decisions.

Methodological Differences Between Hedonic and Shadow Pricing

Hedonic pricing estimates the value of goods or services by analyzing market prices and isolating the contribution of specific attributes through regression models, typically used in real estate and environmental economics. Shadow pricing assigns implicit values to non-market goods or externalities by estimating the opportunity cost or social cost, often derived from optimization models or governmental policies. The methodological difference lies in hedonic pricing relying on observed market data to infer value, while shadow pricing uses theoretical or policy-based frameworks to assign prices to intangible or external factors.

Data Requirements for Hedonic and Shadow Pricing Models

Hedonic pricing models require detailed data on product attributes and market transactions to isolate the value of individual characteristics, such as property features or environmental factors. Shadow pricing models rely on estimating implicit prices for non-market goods, demanding comprehensive data on related market behaviors or policy impacts to infer worth accurately. Both approaches depend on high-quality, context-specific datasets to produce reliable valuations for decision-making in economics and policy analysis.

Applications of Hedonic Pricing in Market Valuation

Hedonic pricing is widely applied in real estate and environmental economics to estimate market values based on the characteristics of goods or properties, such as location, size, and amenities. This method captures how different attributes contribute to price variations, providing accurate valuations for housing markets, urban planning, and pollution impact assessments. In contrast, shadow pricing assigns value to non-market goods or externalities, often used in cost-benefit analysis where market prices are unavailable.

Use Cases of Shadow Pricing in Environmental Economics

Shadow pricing in environmental economics assigns monetary values to non-market goods like clean air, biodiversity, and water resources, enabling policymakers to evaluate trade-offs in natural resource management. It is crucial in cost-benefit analyses for projects affecting ecosystems, such as estimating the social cost of pollution or valuing carbon emissions reductions. These applications guide sustainable decision-making by incorporating environmental externalities into economic assessments where market prices do not exist.

Strengths and Limitations of Hedonic Pricing

Hedonic pricing captures the value of individual attributes by analyzing market prices, making it effective for estimating benefits related to housing, environmental quality, and consumer goods. Its strength lies in reflecting real-world preferences through observable behavior, but it is limited by data availability, potential multicollinearity among attributes, and challenges in isolating external influences. Despite these limitations, hedonic pricing provides detailed insights into implicit market values that are difficult to measure directly.

Pros and Cons of Shadow Pricing

Shadow pricing reflects the estimated economic value of goods or services not traded in formal markets, providing critical insights in cost-benefit analysis and public policy decisions. Pros include enabling valuation of externalities and intangible assets, fostering informed decision-making in environmental economics, and capturing social costs or benefits absent from market prices. Cons involve challenges in accurately estimating shadow prices due to subjective assumptions, potential bias in valuation methods, and variability across contexts limiting comparability and reliability.

Choosing Between Hedonic and Shadow Pricing: Key Considerations

Choosing between hedonic pricing and shadow pricing depends on the availability and nature of market data, with hedonic pricing relying on observable market transactions to estimate value based on product attributes, while shadow pricing assigns value to goods or services without explicit market prices, often in policy or environmental contexts. Consider the specific application's context, such as environmental valuation or real estate, where hedonic pricing excels through market-based attribute analysis, whereas shadow pricing is necessary for non-market goods like public goods or externalities. The decision hinges on data availability, market completeness, and the purpose of valuation, guiding whether to leverage actual market prices or infer values from theoretical or opportunity cost estimates.

Hedonic pricing Infographic

libterm.com

libterm.com