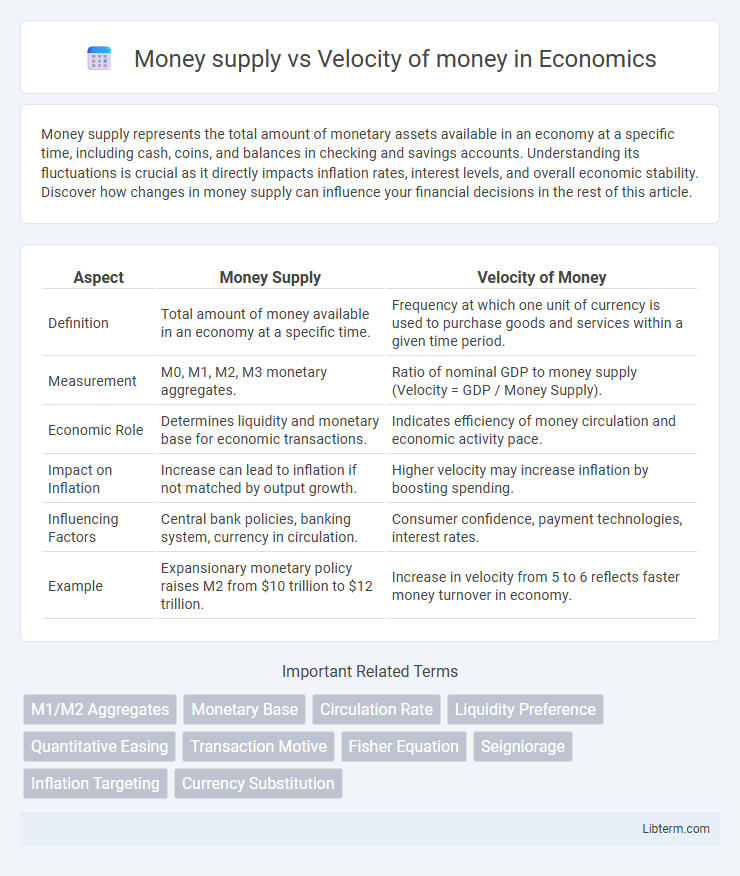

Money supply represents the total amount of monetary assets available in an economy at a specific time, including cash, coins, and balances in checking and savings accounts. Understanding its fluctuations is crucial as it directly impacts inflation rates, interest levels, and overall economic stability. Discover how changes in money supply can influence your financial decisions in the rest of this article.

Table of Comparison

| Aspect | Money Supply | Velocity of Money |

|---|---|---|

| Definition | Total amount of money available in an economy at a specific time. | Frequency at which one unit of currency is used to purchase goods and services within a given time period. |

| Measurement | M0, M1, M2, M3 monetary aggregates. | Ratio of nominal GDP to money supply (Velocity = GDP / Money Supply). |

| Economic Role | Determines liquidity and monetary base for economic transactions. | Indicates efficiency of money circulation and economic activity pace. |

| Impact on Inflation | Increase can lead to inflation if not matched by output growth. | Higher velocity may increase inflation by boosting spending. |

| Influencing Factors | Central bank policies, banking system, currency in circulation. | Consumer confidence, payment technologies, interest rates. |

| Example | Expansionary monetary policy raises M2 from $10 trillion to $12 trillion. | Increase in velocity from 5 to 6 reflects faster money turnover in economy. |

Understanding Money Supply: Definition and Components

Money supply represents the total amount of monetary assets available in an economy at a specific time, typically categorized into components such as M1, M2, and M3. M1 includes physical currency and checkable deposits, while M2 adds savings deposits, money market securities, and other time deposits, reflecting more liquid financial assets. Understanding these components helps analyze how changes in money supply influence the velocity of money, which measures the frequency at which one unit of currency is used for transactions within a given period.

What is Velocity of Money? Key Concepts Explained

Velocity of money refers to the frequency at which a unit of currency circulates and is used for purchasing goods and services within a specific time period. It measures how quickly money changes hands and is a key indicator of economic activity, reflecting the efficiency of money usage in an economy. Understanding velocity helps analyze the relationship between money supply and inflation, showing how changes in money supply impact overall demand.

The Relationship Between Money Supply and Velocity

The relationship between money supply and the velocity of money is fundamental in understanding economic activity and inflation dynamics. When the money supply increases, velocity often decreases as more money chases the same amount of goods, reducing the frequency each unit of currency is spent. Conversely, a higher velocity typically indicates a robust economy where money changes hands quickly, amplifying the impact of the existing money supply on aggregate demand and GDP growth.

Measuring Money Supply: M1, M2, and Beyond

Measuring money supply involves categorizing currency into aggregates such as M1 and M2, where M1 includes physical currency, demand deposits, and checkable deposits, representing the most liquid forms of money. M2 expands on M1 by adding savings accounts, small time deposits, and retail money market mutual funds, reflecting broader access to near-money assets. Understanding the relationship between money supply aggregates and the velocity of money helps economists assess how often money circulates in the economy, influencing inflation and economic growth projections.

Factors Influencing the Velocity of Money

The velocity of money is chiefly influenced by factors such as interest rates, inflation expectations, and the overall confidence in the economy, which affect how quickly money changes hands in transactions. Technological advancements in payment systems and financial innovations can accelerate money circulation by reducing transaction costs and delays. Changes in consumer behavior, such as preferences for holding cash versus spending immediately, also play a critical role in determining the velocity of money.

Economic Impacts of Changing Money Supply

Changes in money supply directly influence inflation rates and aggregate demand by altering the amount of money available for transactions. An increase in money supply typically leads to higher spending and can boost economic growth but risks overheating the economy and causing inflation if velocity remains constant. Conversely, a decrease in money supply can reduce inflationary pressures but may slow down economic activity and increase unemployment if it leads to lower velocity of money.

How Velocity Shapes Inflation and Economic Growth

Velocity of money measures how quickly money circulates within the economy, directly impacting inflation and economic growth by influencing demand levels. A higher velocity signals increased spending and consumption, often driving inflation upward as businesses raise prices amid robust economic activity. Conversely, low velocity indicates sluggish spending, which can suppress inflation but hinder economic growth due to reduced demand for goods and services.

Case Studies: Money Supply and Velocity in Action

Case studies reveal that during Japan's Lost Decade, despite aggressive monetary expansion, the velocity of money plummeted, limiting inflation and economic growth. In contrast, the U.S. experienced a rebound in velocity post-2009 quantitative easing, which amplified the effect of increased money supply on GDP recovery. These examples highlight how fluctuations in money velocity can significantly influence the real impact of changes in the money supply on economic activity.

Policy Implications: Managing Money Supply and Velocity

Effective monetary policy requires careful regulation of the money supply and monitoring the velocity of money to control inflation and stimulate economic growth. Central banks use tools such as open market operations, interest rate adjustments, and reserve requirements to influence liquidity and spending behavior. Understanding the interplay between a stable money supply and velocity helps policymakers target inflation rates, stabilize currency value, and promote sustainable economic expansion.

Future Trends: Digital Currencies and the Evolving Velocity of Money

The integration of digital currencies is reshaping the future trends of money supply and velocity, as blockchain technology enables faster and more transparent transactions, potentially increasing velocity. Central bank digital currencies (CBDCs) offer enhanced control over money supply while enabling instantaneous settlement, which may accelerate economic activity. As digital payment systems evolve, the velocity of money could rise significantly, influencing inflation dynamics and monetary policy effectiveness.

Money supply Infographic

libterm.com

libterm.com