A staple trap is a common hazard in offices and workshops, often causing minor injuries or damage to materials. Proper handling and securing of staples can prevent accidental pricks or rips, ensuring safety and efficiency in your workspace. Explore the full article to learn effective strategies for avoiding and managing staple traps.

Table of Comparison

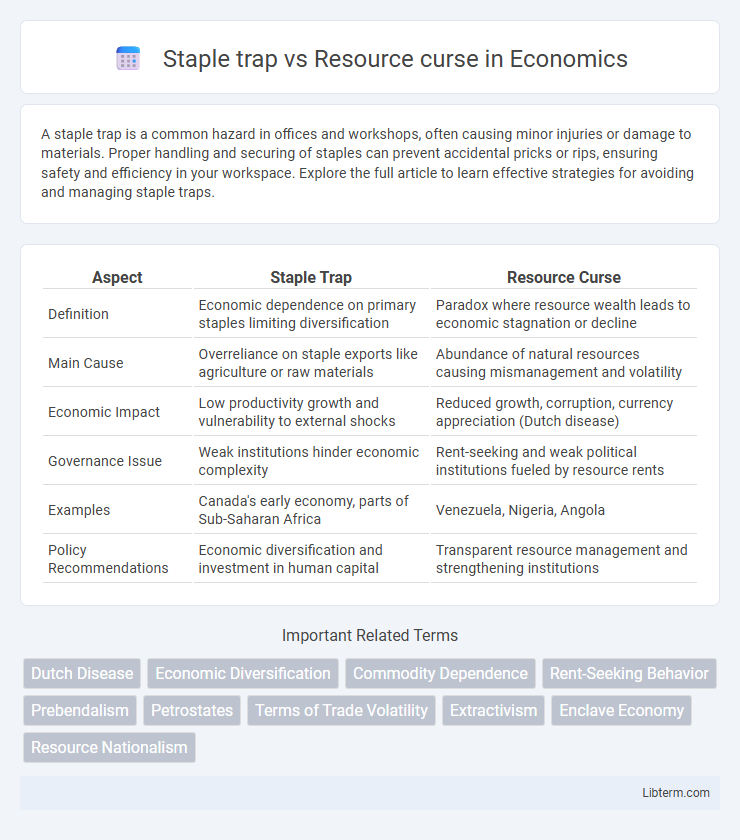

| Aspect | Staple Trap | Resource Curse |

|---|---|---|

| Definition | Economic dependence on primary staples limiting diversification | Paradox where resource wealth leads to economic stagnation or decline |

| Main Cause | Overreliance on staple exports like agriculture or raw materials | Abundance of natural resources causing mismanagement and volatility |

| Economic Impact | Low productivity growth and vulnerability to external shocks | Reduced growth, corruption, currency appreciation (Dutch disease) |

| Governance Issue | Weak institutions hinder economic complexity | Rent-seeking and weak political institutions fueled by resource rents |

| Examples | Canada's early economy, parts of Sub-Saharan Africa | Venezuela, Nigeria, Angola |

| Policy Recommendations | Economic diversification and investment in human capital | Transparent resource management and strengthening institutions |

Understanding the Staple Trap

The staple trap refers to an economy's overreliance on exporting natural resources or primary commodities, which hinders diversification and long-term growth. Understanding the staple trap involves recognizing how dependence on volatile global markets and limited value-added industries can stifle innovation and institutional development. This contrasts with the resource curse, which emphasizes the negative effects of resource wealth on governance and social stability.

Defining the Resource Curse

The Resource Curse refers to the paradox where countries rich in natural resources often experience slower economic growth and worse development outcomes than those with fewer resources. This phenomenon is characterized by overreliance on resource exports, leading to economic volatility, governance challenges, and underinvestment in other sectors. Unlike the Staple Trap, which highlights dependency on a narrow range of staple commodities limiting diversification, the Resource Curse specifically emphasizes the negative political and economic effects triggered by resource wealth.

Historical Contexts: Staple Trap vs Resource Curse

The staple trap refers to a historical economic phenomenon where countries relying heavily on a narrow range of primary commodities experienced limited industrial diversification and sustained economic vulnerability, often seen in colonial and post-colonial economies of Latin America and Africa during the 19th and early 20th centuries. The resource curse, emerging as a concept in the late 20th century, describes the paradox where countries rich in natural resources such as oil, minerals, or gas frequently suffer from slower economic growth, governance challenges, and conflict compared to resource-poor nations, exemplified by cases in the Middle East, Sub-Saharan Africa, and parts of Asia since the 1960s. Both concepts highlight how resource dependence has historically constrained economic development, but the staple trap emphasizes long-term structural dependency on commodity exports, while the resource curse focuses more on the political and institutional distortions linked to resource wealth.

Key Drivers Behind Each Phenomenon

The staple trap occurs when economies become overly dependent on exporting a narrow range of primary commodities, limiting industrial diversification and long-term growth due to volatile global prices and inadequate value addition. The resource curse emerges from abundant natural resource wealth fostering poor governance, rent-seeking behavior, and institutional weaknesses, which undermine economic development and political stability. Both phenomena share the critical drivers of economic reliance on natural resources but diverge based on governance quality and structural economic policies.

Economic Impacts on Developing Nations

Staple trap theory highlights the economic vulnerability of developing nations relying heavily on primary commodity exports, which limits diversification and hinders sustainable growth. The resource curse describes how abundant natural resource wealth often leads to economic volatility, governance challenges, and a lack of investment in other productive sectors. Both concepts emphasize how dependence on specific resources can impede long-term economic development and structural transformation in emerging economies.

Political Consequences of Resource Dependence

Staple trap theory highlights how reliance on a narrow range of export commodities leads to economic stagnation and limited political diversification, fostering weak institutions and rent-seeking behavior. In contrast, the resource curse emphasizes how abundant natural resource wealth can entrench authoritarian regimes, undermine democratic accountability, and exacerbate corruption. Both frameworks identify resource dependence as a catalyst for political instability, but the staple trap centers on structural economic underdevelopment while the resource curse focuses on governance deterioration due to resource wealth.

Case Studies: Real-World Examples

Norway exemplifies success in overcoming the resource curse by transforming oil wealth into a sovereign wealth fund that supports long-term economic stability. In contrast, countries like Nigeria and Venezuela illustrate the staple trap, where reliance on petroleum exports led to economic volatility, underinvestment in other sectors, and governance challenges. Botswana represents a unique case of managing diamond resources effectively through transparent institutions, avoiding the negative impacts commonly associated with the resource curse.

Policy Approaches to Break the Cycle

Effective policy approaches to break the staple trap and resource curse involve diversifying the economy beyond reliance on extractive industries and raw commodity exports. Investing in human capital development, innovation, and infrastructure fosters value-added industries and sustainable growth. Strengthening institutions to ensure transparent governance, sound fiscal management, and resource revenue stabilization funds mitigates volatility and corruption risks associated with resource dependence.

Comparing Solutions: Prevention and Mitigation

Prevention of the staple trap emphasizes economic diversification through investing in manufacturing and knowledge-based sectors to reduce reliance on primary commodities, while mitigation of the resource curse often involves implementing transparent governance frameworks and sovereign wealth funds to manage resource revenues effectively. Both strategies prioritize institutional quality and policy reforms to foster sustainable growth and avoid volatility linked to commodity price fluctuations. Effective prevention requires proactive economic planning, whereas mitigation focuses on improving resource management and social equity after resource dependency is established.

Future Outlook for Resource-Rich Economies

Resource-rich economies face a critical challenge in avoiding the staple trap, where dependence on a few primary commodities hampers diversification and sustainable development. Technological innovation, investment in human capital, and sound governance are key factors shaping the future outlook for these countries. Diversifying economic activities beyond extractive sectors and fostering resilient institutions enhance long-term growth prospects and reduce vulnerability to global market fluctuations.

Staple trap Infographic

libterm.com

libterm.com