Contract theory explores how agreements are designed to align incentives and manage risks between parties with potentially conflicting interests. It addresses issues such as information asymmetry, moral hazard, and adverse selection to create efficient and enforceable contracts. Discover how understanding these principles can enhance your ability to craft better contracts by reading the full article.

Table of Comparison

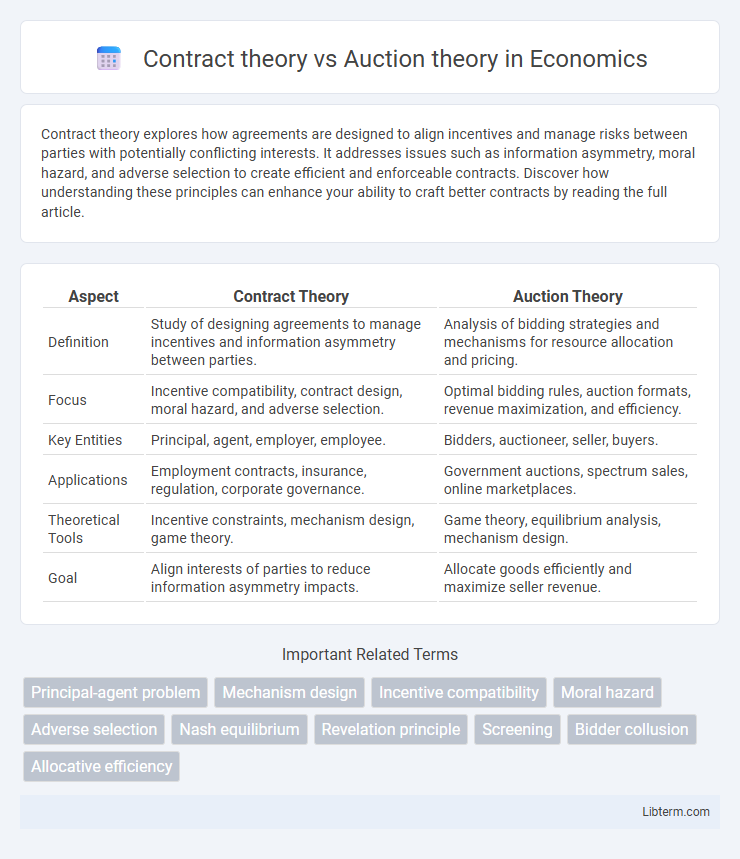

| Aspect | Contract Theory | Auction Theory |

|---|---|---|

| Definition | Study of designing agreements to manage incentives and information asymmetry between parties. | Analysis of bidding strategies and mechanisms for resource allocation and pricing. |

| Focus | Incentive compatibility, contract design, moral hazard, and adverse selection. | Optimal bidding rules, auction formats, revenue maximization, and efficiency. |

| Key Entities | Principal, agent, employer, employee. | Bidders, auctioneer, seller, buyers. |

| Applications | Employment contracts, insurance, regulation, corporate governance. | Government auctions, spectrum sales, online marketplaces. |

| Theoretical Tools | Incentive constraints, mechanism design, game theory. | Game theory, equilibrium analysis, mechanism design. |

| Goal | Align interests of parties to reduce information asymmetry impacts. | Allocate goods efficiently and maximize seller revenue. |

Introduction to Contract Theory and Auction Theory

Contract theory explores the design of agreements between parties under conditions of asymmetric information and incentives, with key concepts such as principal-agent models and moral hazard. Auction theory studies bidding strategies and outcomes in competitive settings where goods or services are allocated based on bid submissions, encompassing formats like English, Dutch, and sealed-bid auctions. Both theories analyze strategic interactions, but contract theory emphasizes incentive alignment within agreements, while auction theory focuses on price discovery and allocation efficiency.

Fundamental Principles of Contract Theory

Contract theory analyzes incentive structures and information asymmetries between principals and agents to design agreements that align interests and minimize opportunistic behavior. It focuses on moral hazard, adverse selection, and mechanism design, ensuring contracts induce truthful revelation and efficient outcomes despite private information. Core principles include optimal contracting under asymmetric information, incentive compatibility, and participation constraints to achieve desired economic performance.

Core Concepts of Auction Theory

Auction theory centers on designing mechanisms that allocate resources efficiently while maximizing seller revenue and ensuring bidder participation. Core concepts include bidding strategies, auction formats (such as English, Dutch, first-price, and second-price auctions), and information asymmetry, which influences strategic behavior under private or common values. The theory also explores optimal reserve prices, winner's curse phenomena, and revenue equivalence, providing a framework to predict outcomes and guide auction design in various economic contexts.

Key Differences Between Contract and Auction Theory

Contract theory explores how parties design agreements under asymmetric information to align incentives and manage risks, emphasizing enforceability and hidden actions. Auction theory analyzes bidding strategies and allocation mechanisms in competitive environments where participants have private valuations, focusing on efficiency and revenue maximization. Key differences lie in contract theory's emphasis on bilateral relationships and incentive compatibility, contrasting with auction theory's focus on strategic bidding and mechanism design in multi-agent settings.

Applications of Contract Theory in Economics

Contract theory is extensively applied in economics to design and analyze agreements between parties with asymmetric information, such as principal-agent models in labor markets, insurance contracts, and corporate governance. It helps optimize incentive structures to mitigate issues like moral hazard and adverse selection, improving efficiency in sectors like finance, regulation, and supply chain management. These applications contrast with auction theory, which primarily focuses on the allocation of resources and bidding strategies in competitive environments.

Real-World Uses of Auction Theory

Auction theory plays a vital role in real-world applications such as spectrum auctions, where governments allocate electromagnetic frequencies to telecommunications companies to maximize revenue and ensure efficient usage. It also underpins online marketplaces like eBay, enabling dynamic pricing and competitive bidding environments. In contrast to contract theory, which designs incentive-compatible agreements between parties, auction theory primarily analyzes bidding strategies and auction formats to optimize resource allocation in competitive settings.

Mechanism Design: Bridging Contract and Auction Theories

Mechanism design serves as a fundamental framework bridging contract theory and auction theory by structuring incentives to achieve desired outcomes in economic environments with asymmetric information. Contract theory focuses on designing agreements under hidden actions or information, optimizing principal-agent relationships, while auction theory analyzes bidding strategies and allocation rules to maximize seller revenue or social welfare. Integrating these theories, mechanism design leverages incentive compatibility and individual rationality constraints to create optimized mechanisms applicable across procurement, regulation, and market design.

Strengths and Limitations of Contract Theory

Contract theory excels in designing agreements that align incentives between parties under conditions of asymmetric information, particularly in principal-agent relationships. Its strength lies in creating tailored contracts that mitigate moral hazard and adverse selection, improving efficiency and cooperation. However, limitations include complexity in modeling real-world behaviors, difficulty in enforcing contracts, and challenges in addressing dynamic or multi-agent environments.

Advantages and Challenges of Auction Theory

Auction theory offers advantages such as efficient resource allocation, price discovery, and incentivizing truthful bidding in various market settings. It faces challenges including strategic bidder behavior, potential for collusion, and complexity in designing optimal auction formats tailored to specific economic environments. Despite these challenges, auction theory provides a robust framework for understanding competitive bidding processes and maximizing seller revenue.

Future Trends in Contract and Auction Theories

Emerging trends in contract theory emphasize integrating artificial intelligence to design adaptive, self-enforcing agreements that adjust to dynamic information environments. Advances in auction theory are focused on improving algorithmic mechanisms for blockchain-based decentralized markets, enabling more efficient allocation of digital assets through smart contracts. Both fields increasingly leverage machine learning to predict participant behavior and optimize incentive structures in complex economic systems.

Contract theory Infographic

libterm.com

libterm.com