Perfect competition is a market structure characterized by many buyers and sellers, homogeneous products, and free entry and exit, ensuring no single participant can influence prices. This leads to optimal resource allocation and maximum consumer welfare as firms produce at the lowest possible cost. Explore the article to understand how perfect competition shapes market efficiency and your economic decisions.

Table of Comparison

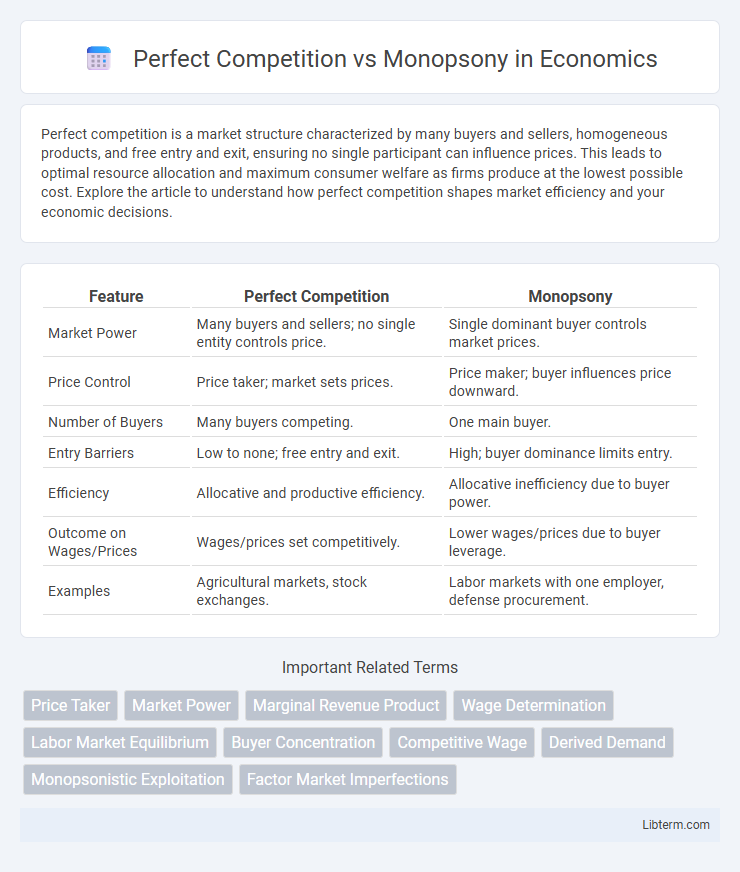

| Feature | Perfect Competition | Monopsony |

|---|---|---|

| Market Power | Many buyers and sellers; no single entity controls price. | Single dominant buyer controls market prices. |

| Price Control | Price taker; market sets prices. | Price maker; buyer influences price downward. |

| Number of Buyers | Many buyers competing. | One main buyer. |

| Entry Barriers | Low to none; free entry and exit. | High; buyer dominance limits entry. |

| Efficiency | Allocative and productive efficiency. | Allocative inefficiency due to buyer power. |

| Outcome on Wages/Prices | Wages/prices set competitively. | Lower wages/prices due to buyer leverage. |

| Examples | Agricultural markets, stock exchanges. | Labor markets with one employer, defense procurement. |

Introduction to Market Structures

Perfect competition features numerous buyers and sellers with identical products, ensuring no single participant influences market prices, leading to efficient resource allocation. Monopsony represents a market with a single dominant buyer facing many sellers, allowing the buyer to exert significant control over price and supply conditions. These contrasting market structures highlight different dynamics in price determination and market power within labor and product markets.

Defining Perfect Competition

Perfect competition is characterized by numerous small firms selling identical products, where no single seller can influence market prices, ensuring price-taking behavior. This market structure features freely accessible information and mobility, allowing resources to allocate efficiently and fostering maximum consumer welfare. Perfect competition contrasts with monopsony, where a single buyer dominates, often leading to reduced input prices and potential market inefficiencies.

Understanding Monopsony

Monopsony occurs in markets where a single buyer dominates the purchasing decisions, significantly influencing prices and wages by controlling demand. Unlike perfect competition, where numerous buyers and sellers interact freely leading to equilibrium prices, monopsonies create market inefficiencies by setting lower prices or wages, often resulting in reduced supply or labor participation. Understanding monopsony is crucial for analyzing labor markets, procurement sectors, and regulatory policies aiming to promote fair competition and prevent buyer exploitation.

Key Characteristics of Perfect Competition

Perfect competition features numerous small firms, homogeneous products, and free market entry and exit, ensuring no single seller influences prices. Firms in this market structure are price takers, with perfectly elastic demand curves reflecting consumer sovereignty. Perfect competition promotes allocative and productive efficiency, maximizing total welfare through market-driven resource allocation.

Main Features of Monopsony

A monopsony is characterized by a single buyer dominating the market, exercising significant control over the price and quantity of goods or labor purchased, which contrasts sharply with the many buyers in perfect competition. The monopsonist's market power often leads to lower prices paid to suppliers or workers, as they can dictate terms without competition. This market structure typically results in reduced output and efficiency compared to a perfectly competitive market, where numerous buyers and sellers create equilibrium prices through competition.

Price Determination: Perfect Competition vs Monopsony

Price determination in perfect competition hinges on the intersection of supply and demand, where numerous buyers and sellers engage freely, resulting in prices equal to marginal cost. In a monopsony, a single buyer exerts significant control over the market, pushing prices below the competitive equilibrium as the buyer maximizes its utility by paying less for inputs. Consequently, perfect competition leads to allocative efficiency and higher prices for producers, while monopsony creates a price distortion that lowers input costs and reduces producer surplus.

Impact on Consumers and Producers

Perfect competition leads to lower prices and higher output, benefiting consumers with more choices and efficient resource allocation. Producers in perfect competition face minimal market power, resulting in normal profits and incentivizing innovation to maintain competitiveness. In contrast, monopsony grants buyers significant control over prices, often reducing producers' revenues and limiting their ability to invest, while consumers may face indirect effects such as reduced product availability or quality due to suppressed producer incentives.

Efficiency and Welfare Implications

Perfect competition maximizes allocative and productive efficiency by enabling numerous buyers and sellers to freely trade at equilibrium prices, resulting in optimal resource allocation and maximum consumer and producer surplus. In contrast, monopsony--where a single buyer dominates the market--typically reduces market efficiency by imposing lower prices on suppliers, causing underproduction and welfare losses due to deadweight loss. Welfare implications under monopsony include decreased producer surplus, potential labor market distortions, and reduced overall social welfare compared to the competitive market benchmark.

Real-World Examples and Case Studies

Perfect competition is exemplified by agricultural markets like wheat trading in Kansas, where numerous farmers sell identical products with negligible entry barriers, resulting in prices driven by supply and demand. In contrast, the U.S. labor market for airline pilots demonstrates monopsony characteristics, as a few major airlines dominate hiring, influencing wages and employment conditions. Case studies of Amazon's control over third-party sellers highlight monopsonistic tendencies in e-commerce, while the stock market's countless buyers and sellers reflect perfect competition dynamics.

Conclusion: Comparing Market Outcomes

Perfect competition results in efficient resource allocation with prices reflecting true supply and demand, maximizing consumer and producer surplus. In contrast, monopsony power leads to lower input prices and reduced quantities purchased, causing allocative inefficiency and potential welfare loss. Comparing market outcomes, perfect competition generally promotes optimal market efficiency, while monopsony distorts price signals and negatively impacts market equilibrium.

Perfect Competition Infographic

libterm.com

libterm.com