Forward premium refers to the situation where the forward exchange rate of a currency is higher than its spot exchange rate, indicating market expectations of currency appreciation. It plays a crucial role in international finance by influencing hedging strategies, investment decisions, and risk assessments. Discover how understanding forward premiums can enhance your financial planning in the rest of this article.

Table of Comparison

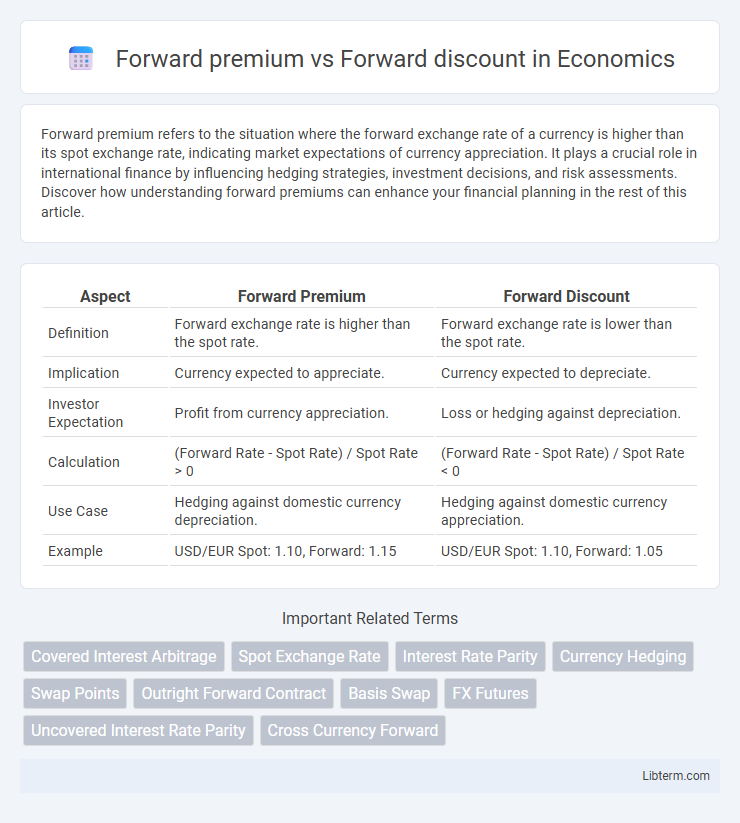

| Aspect | Forward Premium | Forward Discount |

|---|---|---|

| Definition | Forward exchange rate is higher than the spot rate. | Forward exchange rate is lower than the spot rate. |

| Implication | Currency expected to appreciate. | Currency expected to depreciate. |

| Investor Expectation | Profit from currency appreciation. | Loss or hedging against depreciation. |

| Calculation | (Forward Rate - Spot Rate) / Spot Rate > 0 | (Forward Rate - Spot Rate) / Spot Rate < 0 |

| Use Case | Hedging against domestic currency depreciation. | Hedging against domestic currency appreciation. |

| Example | USD/EUR Spot: 1.10, Forward: 1.15 | USD/EUR Spot: 1.10, Forward: 1.05 |

Understanding Forward Premium and Forward Discount

Forward premium occurs when the forward exchange rate is higher than the spot exchange rate, indicating that a currency is expected to appreciate in the future. Forward discount arises when the forward exchange rate is lower than the spot exchange rate, signaling an anticipated depreciation of the currency. Understanding forward premium and forward discount helps investors and businesses hedge foreign exchange risk by predicting currency movements based on interest rate differentials and market expectations.

Definition of Forward Premium

Forward premium occurs when the forward exchange rate of a currency is higher than its spot exchange rate, indicating that the currency is expected to appreciate in the future. This situation reflects higher interest rates or stronger economic conditions compared to the foreign currency. Forward discount, on the other hand, happens when the forward rate is lower than the spot rate, suggesting the currency is expected to depreciate.

Definition of Forward Discount

Forward discount occurs when the forward exchange rate is lower than the spot exchange rate, indicating that a currency is expected to depreciate in the future. It reflects market expectations of lower value for the base currency relative to the quote currency at the contract maturity date. Traders and investors use forward discount as an indicator to hedge against potential losses or to speculate on currency movements.

Causes of Forward Premium

A forward premium occurs when the forward exchange rate of a currency is higher than the spot exchange rate, typically driven by interest rate differentials between two countries. Higher domestic interest rates compared to foreign rates lead investors to demand a premium for holding the currency forward, reflecting expectations of currency appreciation. Inflation rates, political stability, and economic growth prospects also influence the forward premium by shaping market perceptions of future currency strength.

Causes of Forward Discount

Forward discount occurs when the forward exchange rate is lower than the spot exchange rate, typically caused by higher interest rates in the domestic country compared to the foreign country, reflecting expected depreciation of the domestic currency. Market expectations of weaker domestic economic performance or lower inflation relative to foreign economies also contribute to the forward discount. Central bank interventions and differences in inflation rates between countries can further influence the forward exchange rate leading to a forward discount.

Forward Premium vs Forward Discount: Key Differences

Forward premium occurs when the forward exchange rate is higher than the spot rate, indicating the base currency is expected to strengthen. Forward discount arises when the forward rate is lower than the spot rate, signaling an expected depreciation of the base currency. Key differences include the direction of currency movement implied and their impact on hedging strategies in foreign exchange markets.

Impact on Currency Trading

Forward premium occurs when a currency's forward rate is higher than its spot rate, signaling expectations of currency appreciation, which encourages traders to buy the currency in anticipation of gains. Forward discount happens when the forward rate is lower than the spot rate, indicating expected depreciation, often leading traders to sell or avoid holding that currency. These forward rate differentials influence hedging strategies, speculative trades, and risk management decisions in currency markets.

Role in International Finance

Forward premium and forward discount are critical indicators in international finance, reflecting differences between spot exchange rates and forward exchange rates. A forward premium occurs when the forward exchange rate is higher than the spot rate, signaling a strengthening foreign currency and influencing hedging strategies for multinational corporations. Conversely, a forward discount indicates a weaker foreign currency relative to the spot rate, affecting investment decisions and risk management in foreign exchange markets.

Calculating Forward Premium and Forward Discount

Calculating forward premium involves determining the percentage difference between the forward exchange rate and the spot exchange rate, relative to the spot rate, typically expressed on an annualized basis. Forward discount is calculated similarly, but it occurs when the forward exchange rate is lower than the spot rate, indicating the foreign currency is expected to depreciate. The formula for both uses [(Forward Rate - Spot Rate) / Spot Rate] x (360 / number of days) x 100 to quantify the premium or discount in foreign exchange markets.

Practical Examples and Real-World Implications

Forward premium occurs when a currency's forward exchange rate is higher than its spot rate, indicating expected appreciation, such as the USD trading at 1.10 EUR spot and 1.12 EUR forward, benefiting exporters receiving foreign currency payments later. Conversely, a forward discount means the forward rate is lower than the spot rate, suggesting depreciation, as seen when the JPY trades at 110 spot but 108 forward, affecting importers who pay in yen and face lower future costs. These currency expectations influence hedging strategies, investment decisions, and international trade contracts, impacting profit margins and risk management for multinational corporations and financial institutions.

Forward premium Infographic

libterm.com

libterm.com