Profits are the financial gains a company achieves after deducting all expenses from its total revenue, serving as a key indicator of business success and viability. Understanding how to maximize profits involves analyzing cost management, pricing strategies, and revenue growth opportunities. Explore the following article to discover effective ways to enhance Your profitability and sustain business growth.

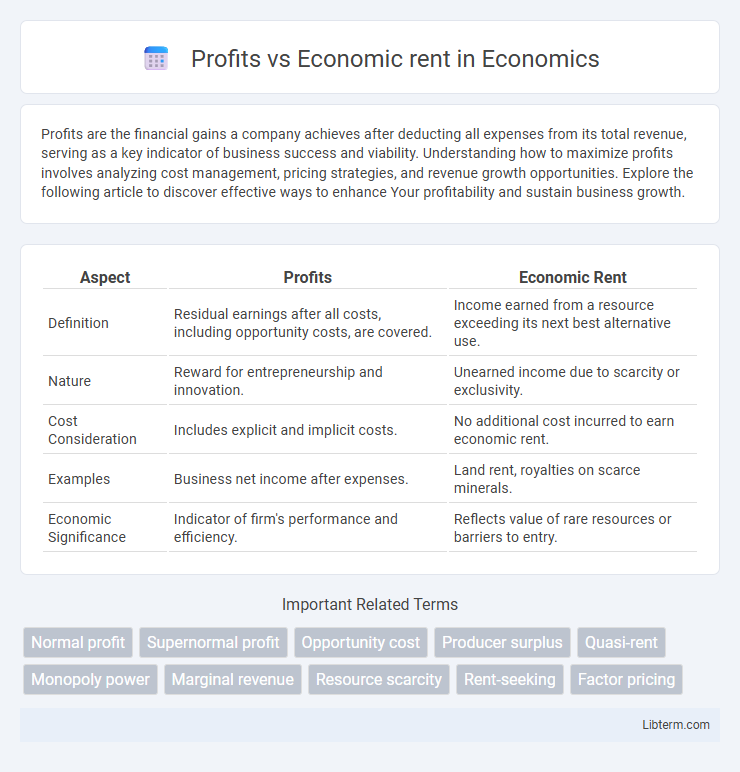

Table of Comparison

| Aspect | Profits | Economic Rent |

|---|---|---|

| Definition | Residual earnings after all costs, including opportunity costs, are covered. | Income earned from a resource exceeding its next best alternative use. |

| Nature | Reward for entrepreneurship and innovation. | Unearned income due to scarcity or exclusivity. |

| Cost Consideration | Includes explicit and implicit costs. | No additional cost incurred to earn economic rent. |

| Examples | Business net income after expenses. | Land rent, royalties on scarce minerals. |

| Economic Significance | Indicator of firm's performance and efficiency. | Reflects value of rare resources or barriers to entry. |

Introduction to Profits and Economic Rent

Profits represent the financial returns earned by entrepreneurs after accounting for all costs, including opportunity costs, highlighting the reward for risk-taking and innovation. Economic rent refers to the surplus income earned from a resource or asset beyond its necessary cost to keep it in its current use, often arising from scarcity or unique advantages. Understanding the distinction between profits and economic rent is crucial for analyzing income distribution and resource allocation in economics.

Defining Profits: Concepts and Types

Profits refer to the financial gains earned by a business after deducting all costs, including explicit and implicit expenses, representing the reward for entrepreneurial risk and innovation. Types of profits include accounting profit, calculated as total revenue minus explicit costs, and economic profit, which also subtracts opportunity costs, reflecting the true profitability of a firm. Economic rent, in contrast, is income earned beyond the normal expected return, often derived from unique resources or market advantages rather than entrepreneurial effort.

Understanding Economic Rent: Meaning and Examples

Economic rent refers to the payment made to a factor of production exceeding what is necessary to keep it in its current use, highlighting surplus earnings beyond normal profits. Unlike profits, which are rewards for entrepreneurial risk and investment, economic rent arises primarily from scarcity or unique advantages, such as prime land location or exclusive resource rights. For example, a landowner receiving high rent from urban property benefits from economic rent due to limited land availability rather than direct business efforts.

Key Differences Between Profits and Economic Rent

Profits represent the total earnings of a business after accounting for all costs, including opportunity costs, while economic rent refers to the surplus income earned from a resource without any effort or productive contribution. Profits vary with the efficiency and innovation of a firm, whereas economic rent is determined by the scarcity and unique advantages of the resource. Unlike profits, economic rent does not incentivize resource allocation or improvement as it arises from fixed supply constraints.

Sources of Profits in Modern Economies

Profits in modern economies primarily arise from innovation, operational efficiency, and strategic market positioning, distinguishing them from economic rent, which stems from ownership of scarce or unique resources. Firms generate profits by improving production processes, introducing new products, and capturing consumer surplus through competitive advantages. Understanding these sources highlights how dynamic market activities drive profitability beyond passive income from resource control.

Origins and Causes of Economic Rent

Economic rent originates from the scarcity and exclusive control over a resource or asset, such as natural resources, land, or unique talents, allowing the owner to earn income beyond the opportunity cost. Unlike profits, which arise from entrepreneurial risk-taking and innovation in production, economic rent is primarily caused by market imperfections, monopoly power, or regulatory barriers that restrict competition and supply. The fundamental cause of economic rent is the inherent limitation or exclusivity of the resource enabling rent extraction without additional cost or effort.

Profits vs Economic Rent in Resource Allocation

Profits represent the returns to entrepreneurship after all costs, including opportunity costs, are covered, guiding resource allocation by signaling where investments are most efficiently utilized. Economic rent, however, refers to earnings above the normal required return, often derived from scarce resources or monopolistic advantages, which can lead to inefficient resource allocation by encouraging rent-seeking behavior rather than productive investment. Understanding the distinction between profits and economic rent is critical in optimizing resource allocation to promote innovation and economic growth without distortions caused by unearned income streams.

Impact on Business Strategies and Investments

Profits represent the total financial gain from business operations after all costs are covered, while economic rent refers to earnings exceeding the minimum required for resource allocation without additional effort. Businesses focus on maximizing profits to sustain growth, but economic rent can influence strategic decisions by signaling scarce resources with high value, often leading firms to invest in barriers to entry or innovation. Investment strategies prioritize capturing economic rent to secure competitive advantages and long-term profitability in dynamic markets.

Policy Implications: Taxation and Regulation

Taxation policies that target economic rents, such as land value taxes, can efficiently capture unearned income without distorting productive incentives, unlike taxes on profits which may reduce investment and innovation. Regulatory frameworks designed to limit monopoly power and promote competition help prevent firms from generating excessive economic rents at the expense of consumer welfare. Effective policy design distinguishes between profits as returns on productive activity and economic rents arising from market power or scarcity, enabling more equitable and growth-friendly economic outcomes.

Conclusion: Balancing Profits and Economic Rent

Balancing profits and economic rent requires distinguishing between entrepreneur-driven returns and unearned income derived from scarcity or ownership. Sustainable business models focus on maximizing profits through innovation and efficiency rather than relying solely on economic rent extraction. Effective policy frameworks promote competition, preventing excessive economic rent that can distort markets and reduce overall welfare.

Profits Infographic

libterm.com

libterm.com