Interest Rate Parity (IRP) is a fundamental principle in international finance that ensures the relationship between interest rates and exchange rates remains balanced across countries. It helps investors understand how differences in national interest rates affect currency values, minimizing arbitrage opportunities. Discover how IRP shapes your currency investments and global financial decisions in the full article.

Table of Comparison

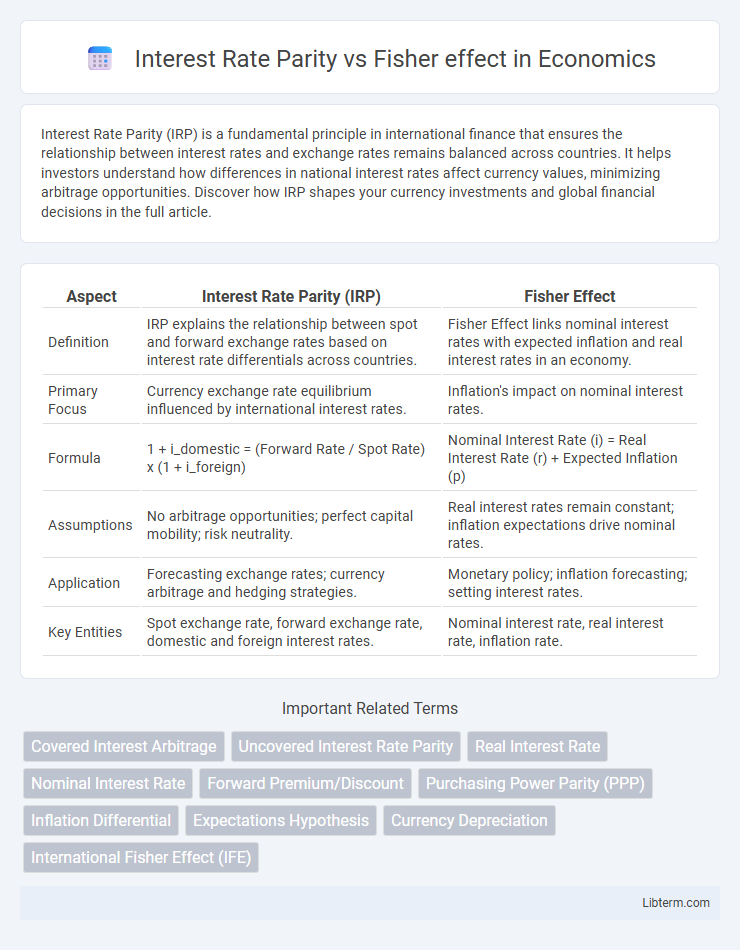

| Aspect | Interest Rate Parity (IRP) | Fisher Effect |

|---|---|---|

| Definition | IRP explains the relationship between spot and forward exchange rates based on interest rate differentials across countries. | Fisher Effect links nominal interest rates with expected inflation and real interest rates in an economy. |

| Primary Focus | Currency exchange rate equilibrium influenced by international interest rates. | Inflation's impact on nominal interest rates. |

| Formula | 1 + i_domestic = (Forward Rate / Spot Rate) x (1 + i_foreign) | Nominal Interest Rate (i) = Real Interest Rate (r) + Expected Inflation (p) |

| Assumptions | No arbitrage opportunities; perfect capital mobility; risk neutrality. | Real interest rates remain constant; inflation expectations drive nominal rates. |

| Application | Forecasting exchange rates; currency arbitrage and hedging strategies. | Monetary policy; inflation forecasting; setting interest rates. |

| Key Entities | Spot exchange rate, forward exchange rate, domestic and foreign interest rates. | Nominal interest rate, real interest rate, inflation rate. |

Introduction to Interest Rate Parity and Fisher Effect

Interest Rate Parity (IRP) explains the relationship between spot and forward exchange rates, ensuring no arbitrage opportunities exist in international finance by equating the return on domestic and foreign investments after adjusting for exchange rate changes. The Fisher Effect describes how nominal interest rates incorporate expected inflation, with real interest rates remaining stable, linking inflation expectations directly to interest rate movements. Together, IRP and the Fisher Effect provide a framework for understanding currency valuation, inflation, and interest rate dynamics in global markets.

Understanding Interest Rate Parity (IRP)

Interest Rate Parity (IRP) is a fundamental theory in foreign exchange markets that links spot exchange rates, forward exchange rates, and interest rates between two countries, ensuring no arbitrage opportunities exist. IRP explains how differences in national interest rates are offset by changes in the forward exchange rate, maintaining equilibrium in international investment returns. This contrasts with the Fisher effect, which focuses on the relationship between nominal interest rates and expected inflation within a single economy.

Exploring the Fisher Effect

The Fisher Effect explains the relationship between nominal interest rates, real interest rates, and expected inflation, asserting that nominal rates adjust to expected inflation to preserve real returns. This concept is pivotal in understanding how inflation expectations influence interest rate movements across economies. Interest Rate Parity, on the other hand, focuses on the relationship between interest rates and exchange rates to prevent arbitrage opportunities, highlighting how currencies adjust to interest rate differentials.

Key Assumptions of IRP and Fisher Effect

Interest Rate Parity (IRP) assumes no arbitrage opportunities exist between different countries' interest rates and exchange rates, ensuring that the forward exchange rate offsets interest rate differentials. The Fisher Effect assumes that nominal interest rates fully reflect expected inflation rates, linking real interest rates, nominal interest rates, and inflation expectations. Both models rely on efficient markets but differ as IRP focuses on currency risk and exchange rates while the Fisher Effect centers on inflation's impact on interest rates.

Mathematical Formulations

Interest Rate Parity (IRP) is mathematically expressed as (1 + i_d) = (1 + i_f) * (F / S), where i_d and i_f represent domestic and foreign interest rates, and F/S is the forward-to-spot exchange rate ratio, indicating no arbitrage in currency markets. The Fisher effect states that the nominal interest rate i equals the real interest rate r plus expected inflation p, formulated as i r + p, linking interest rates with inflation expectations. Both IRP and the Fisher effect use mathematical relationships to connect interest rates, inflation, and exchange rates, but IRP focuses on currency arbitrage mechanisms while the Fisher effect emphasizes the inflation-interest rate nexus.

Comparative Analysis: IRP vs Fisher Effect

Interest Rate Parity (IRP) and the Fisher Effect both describe relationships involving interest rates but focus on different market mechanisms; IRP links spot and forward exchange rates to interest rate differentials between two countries, emphasizing currency arbitrage, while the Fisher Effect connects nominal interest rates to real interest rates and expected inflation within a single economy. IRP is fundamentally concerned with foreign exchange market equilibrium to prevent arbitrage opportunities, whereas the Fisher Effect explains how inflation expectations impact domestic nominal interest rates, influencing monetary policy and investment decisions. Comparing both, IRP operates in the international finance arena addressing exchange rate expectations, whereas the Fisher Effect informs interest rate dynamics driven by inflation, making them complementary yet distinct theories in macroeconomic analysis.

Real-World Applications in International Finance

Interest Rate Parity (IRP) is crucial in forecasting exchange rates by linking interest rates and currency forward premiums, enabling firms to hedge foreign exchange risk in international contracts. The Fisher Effect explains nominal interest rate differences due to varying expected inflation rates, guiding multinational companies in investment and capital budgeting decisions across countries. Both theories underpin strategies in currency arbitrage, risk management, and optimizing cross-border financing by aligning interest rates, inflation expectations, and exchange rate forecasts.

Impacts on Currency Exchange Rates

Interest Rate Parity (IRP) explains currency exchange rates by linking interest rate differentials between countries to expected changes in spot and forward exchange rates, ensuring no arbitrage opportunities exist in the currency market. The Fisher Effect focuses on the relationship between nominal interest rates and expected inflation rates, influencing real interest rates and thereby affecting currency values through altered purchasing power. While IRP directly addresses how interest rate differences guide exchange rate adjustments in the short term, the Fisher Effect impacts currency exchange rates over the long term by incorporating inflation expectations into interest rate structures.

Limitations and Criticisms

Interest Rate Parity (IRP) assumes no transaction costs and perfect capital mobility, which limits its applicability in real-world markets affected by barriers, taxes, and risk premiums. The Fisher Effect, which links nominal interest rates to expected inflation, is criticized for oversimplifying inflation expectations and ignoring factors like monetary policy and risk aversion. Both theories face challenges due to static assumptions and fail to fully account for market imperfections and behavioral influences.

Conclusion and Implications for Investors

Interest Rate Parity (IRP) ensures that arbitrage opportunities are eliminated through the alignment of interest rates and exchange rates, providing investors with a framework for predicting currency movements in foreign investments. The Fisher Effect highlights the relationship between nominal interest rates and expected inflation, guiding investors on the real return expectations in different economies. Understanding both IRP and the Fisher Effect helps investors make informed decisions on hedging currency risks and assessing real yields in global portfolios.

Interest Rate Parity Infographic

libterm.com

libterm.com