Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency, often due to economic instability or lack of trust in the local economy. This practice can influence inflation rates, monetary policy effectiveness, and capital flows, affecting overall economic stability. Discover the causes, impacts, and implications of currency substitution in detail throughout this article.

Table of Comparison

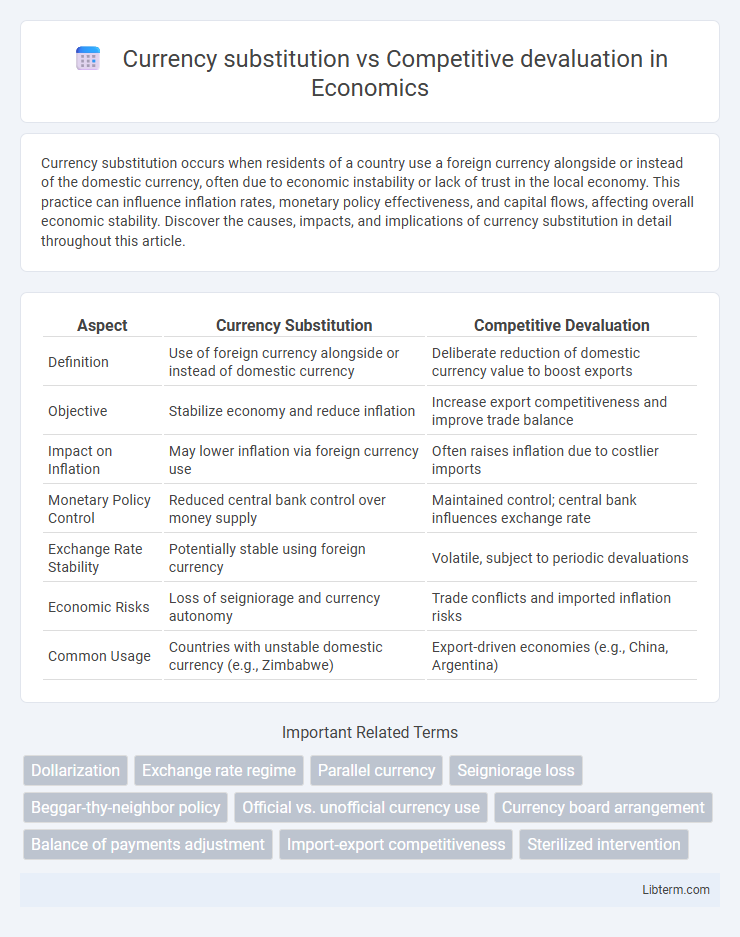

| Aspect | Currency Substitution | Competitive Devaluation |

|---|---|---|

| Definition | Use of foreign currency alongside or instead of domestic currency | Deliberate reduction of domestic currency value to boost exports |

| Objective | Stabilize economy and reduce inflation | Increase export competitiveness and improve trade balance |

| Impact on Inflation | May lower inflation via foreign currency use | Often raises inflation due to costlier imports |

| Monetary Policy Control | Reduced central bank control over money supply | Maintained control; central bank influences exchange rate |

| Exchange Rate Stability | Potentially stable using foreign currency | Volatile, subject to periodic devaluations |

| Economic Risks | Loss of seigniorage and currency autonomy | Trade conflicts and imported inflation risks |

| Common Usage | Countries with unstable domestic currency (e.g., Zimbabwe) | Export-driven economies (e.g., China, Argentina) |

Introduction to Currency Substitution and Competitive Devaluation

Currency substitution occurs when residents of a country use a foreign currency alongside or instead of the domestic currency, often due to loss of confidence in the local currency's stability. Competitive devaluation involves a government deliberately lowering its currency's value to boost exports by making them cheaper in international markets, aiming to improve trade balance. Both strategies significantly impact exchange rates and economic dynamics, influencing inflation, investment, and monetary policy effectiveness.

Defining Currency Substitution: Concepts and Mechanisms

Currency substitution occurs when residents of a country use a foreign currency in parallel to or instead of the domestic currency, often due to instability or lack of confidence in the local currency. This phenomenon can reduce the effectiveness of domestic monetary policy and complicate exchange rate management. The mechanisms driving currency substitution include inflationary pressures, interest rate differentials, and the desire to preserve wealth in a more stable or internationally accepted currency.

Exploring Competitive Devaluation: Key Principles

Competitive devaluation involves a country deliberately lowering its currency value to boost export competitiveness and improve trade balance by making domestic goods cheaper for foreign buyers. This strategy can trigger retaliatory devaluations from trade partners, potentially leading to a currency war and heightened global economic instability. Unlike currency substitution, where foreign currencies replace local money due to economic instability, competitive devaluation is an active policy tool aimed at enhancing national economic growth through export-driven strategies.

Historical Examples of Currency Substitution

Historical examples of currency substitution include the widespread use of the US dollar in Zimbabwe during hyperinflation in the late 2000s, which stabilized the economy by replacing the collapsing Zimbabwean dollar. In Argentina, persistent inflation led to the adoption of the US dollar alongside the peso, reflecting loss of confidence in the domestic currency. Unlike competitive devaluation aimed at boosting exports by lowering currency value, currency substitution reflects a shift in public trust towards more stable foreign currencies amid domestic financial instability.

Notable Cases of Competitive Devaluation

Competitive devaluation has been notably employed by countries such as China during the 2015 yuan devaluation and Argentina amid repeated peso devaluations in 2018-2019 to boost export competitiveness. Unlike currency substitution, where foreign currencies replace domestic money for stability, competitive devaluation intentionally reduces a currency's value to gain trade advantages. These strategies often provoke retaliation and can lead to currency wars, impacting global financial markets and trade relations.

Economic Drivers Behind Currency Substitution

Currency substitution arises primarily due to economic instability, high inflation rates, and loss of confidence in the domestic currency, prompting residents to prefer foreign currencies for transactions and savings. Competitive devaluation, on the other hand, is driven by the desire to boost export competitiveness and improve trade balances by deliberately lowering a country's currency value. Understanding these contrasting economic drivers helps policymakers address inflation control and external balance challenges effectively.

Motivations for Engaging in Competitive Devaluation

Competitive devaluation is driven by motivations to boost export competitiveness and stimulate economic growth by making a country's goods cheaper on the global market. Governments may pursue this strategy to reduce trade deficits and protect domestic industries from foreign competition. Unlike currency substitution, which reflects a loss of confidence in the domestic currency, competitive devaluation is an active policy aimed at achieving macroeconomic objectives through exchange rate adjustments.

Impacts on Monetary Policy and Exchange Rates

Currency substitution undermines domestic monetary policy by reducing central bank control over money supply, leading to diminished effectiveness in controlling inflation and interest rates. Competitive devaluation impacts exchange rates by deliberately lowering a country's currency value to boost exports, often triggering retaliatory devaluations and exchange rate volatility. Both mechanisms significantly influence capital flows, inflation dynamics, and economic stability, challenging policymakers to maintain optimal exchange rate regimes and monetary autonomy.

Risks and Benefits of Each Strategy

Currency substitution reduces exchange rate volatility and can stabilize inflation by promoting the use of a stronger foreign currency, but it risks losing monetary policy control and seigniorage revenue. Competitive devaluation boosts export competitiveness and stimulates economic growth temporarily but may trigger inflation, reduce purchasing power, and provoke retaliatory devaluations from trade partners. Both strategies require careful management of inflation expectations, capital flows, and international relations to balance growth benefits against financial and economic vulnerabilities.

Policy Responses and Future Outlook

Policy responses to currency substitution often involve strengthening domestic currency stability through tighter monetary policies and enhancing financial regulations to restore confidence in the local currency. In contrast, competitive devaluation policies aim to boost export competitiveness by deliberately lowering the currency's value, though this can trigger retaliatory actions and currency wars. Future outlooks suggest a balanced approach combining structural reforms with prudent exchange rate management to mitigate risks associated with both currency substitution and competitive devaluation.

Currency substitution Infographic

libterm.com

libterm.com