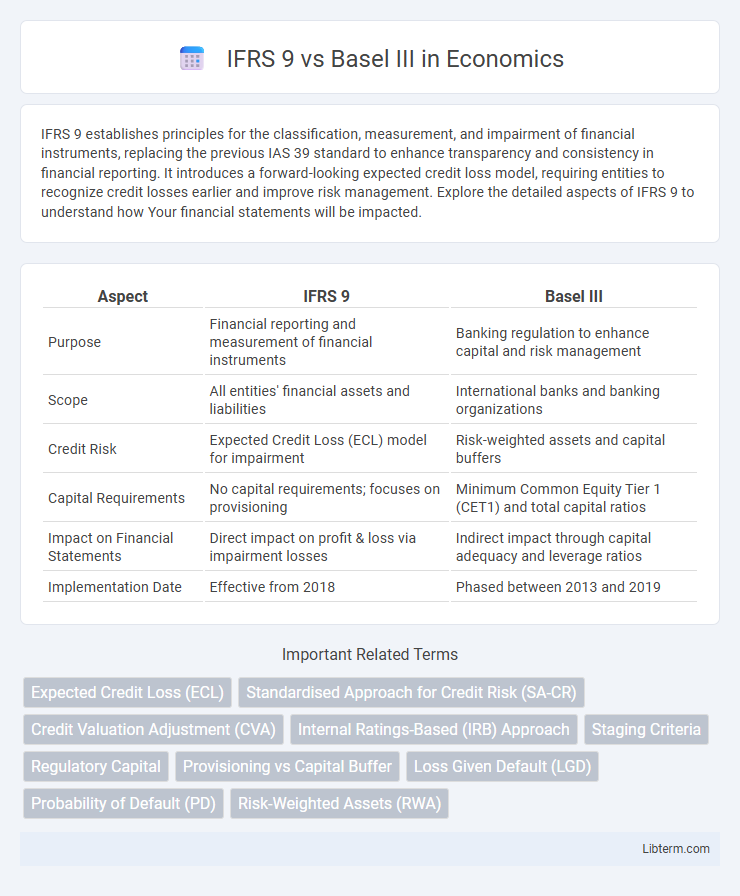

IFRS 9 establishes principles for the classification, measurement, and impairment of financial instruments, replacing the previous IAS 39 standard to enhance transparency and consistency in financial reporting. It introduces a forward-looking expected credit loss model, requiring entities to recognize credit losses earlier and improve risk management. Explore the detailed aspects of IFRS 9 to understand how Your financial statements will be impacted.

Table of Comparison

| Aspect | IFRS 9 | Basel III |

|---|---|---|

| Purpose | Financial reporting and measurement of financial instruments | Banking regulation to enhance capital and risk management |

| Scope | All entities' financial assets and liabilities | International banks and banking organizations |

| Credit Risk | Expected Credit Loss (ECL) model for impairment | Risk-weighted assets and capital buffers |

| Capital Requirements | No capital requirements; focuses on provisioning | Minimum Common Equity Tier 1 (CET1) and total capital ratios |

| Impact on Financial Statements | Direct impact on profit & loss via impairment losses | Indirect impact through capital adequacy and leverage ratios |

| Implementation Date | Effective from 2018 | Phased between 2013 and 2019 |

Introduction to IFRS 9 and Basel III

IFRS 9 is an International Financial Reporting Standard issued by the IASB that governs the classification, measurement, and impairment of financial instruments, emphasizing a forward-looking expected credit loss (ECL) model. Basel III is a global regulatory framework developed by the Basel Committee on Banking Supervision to strengthen bank capital requirements, risk management, and liquidity standards, aiming to enhance the banking sector's resilience. Both frameworks impact financial institutions by influencing credit risk assessment, capital adequacy, and financial reporting transparency.

Key Objectives of IFRS 9

IFRS 9 primarily aims to provide a clearer and more forward-looking framework for the classification and measurement of financial instruments, enhancing transparency in credit risk assessment. It introduces an expected credit loss (ECL) model, which requires earlier recognition of credit impairments compared to previous standards, improving loss provisioning accuracy. Unlike Basel III, which focuses on regulatory capital and risk management for banks, IFRS 9 targets accounting treatment to reflect the economic reality of financial assets and liabilities.

Core Principles of Basel III

Basel III establishes core principles emphasizing robust risk management, enhanced capital adequacy, and improved liquidity standards to strengthen the banking sector's resilience against financial shocks. IFRS 9 focuses on the classification, measurement, and impairment of financial instruments, introducing expected credit loss models that impact banks' provisioning and capital requirements. Together, IFRS 9's forward-looking loss allowance and Basel III's capital buffers ensure sound credit risk assessment and promote financial stability.

Scope and Applicability Comparison

IFRS 9 primarily governs the accounting and financial reporting standards for financial instruments, focusing on classification, measurement, impairment, and hedge accounting applicable to banks and non-bank financial entities globally. Basel III, created by the Basel Committee on Banking Supervision, sets regulatory capital requirements and risk management standards exclusively for internationally active banks to enhance their resilience against financial shocks. While IFRS 9 impacts how financial assets and liabilities are recognized and measured on financial statements, Basel III dictates minimum capital buffers and liquidity requirements, ensuring banking sector stability and systemic risk reduction.

Credit Risk Assessment Approaches

IFRS 9 employs an expected credit loss (ECL) model for credit risk assessment, requiring financial institutions to estimate potential credit losses over the life of a financial asset, incorporating forward-looking information and macroeconomic factors. Basel III, on the other hand, emphasizes regulatory capital requirements based on credit risk using standardized or internal ratings-based (IRB) approaches, focusing on risk-weighted assets to ensure banks maintain adequate capital buffers. While IFRS 9 focuses on accounting for credit impairment and provisioning, Basel III centers on capital adequacy and financial system stability through robust risk quantification and management practices.

Impairment and Provisioning Differences

IFRS 9 and Basel III differ fundamentally in impairment and provisioning approaches; IFRS 9 employs an expected credit loss (ECL) model requiring timely recognition based on forward-looking information, while Basel III emphasizes regulatory capital requirements focusing on incurred losses and risk-weighted assets. IFRS 9 provisions directly impact financial statements by estimating lifetime expected losses for credit-impaired assets, enhancing transparency, whereas Basel III provisions relate primarily to capital buffers affecting bank solvency ratios and macroprudential stability. These differences influence how financial institutions manage credit risk, with IFRS 9 fostering earlier loss recognition and Basel III ensuring resilient capital adequacy under stress scenarios.

Capital Adequacy Requirements

IFRS 9 impacts capital adequacy requirements under Basel III by influencing expected credit loss (ECL) calculations, which affect loan loss provisions and regulatory capital buffers. Basel III mandates banks to maintain minimum capital ratios, incorporating risk-weighted assets adjusted for credit risk, while IFRS 9's impairment model causes earlier recognition of credit losses that can reduce regulatory capital through increased provisions. The interplay between IFRS 9's ECL approach and Basel III's capital framework drives changes in capital planning, stress testing, and helps ensure banks hold sufficient capital against credit risk exposures.

Impact on Financial Reporting

IFRS 9 introduces expected credit loss (ECL) models requiring early recognition of credit impairments, significantly affecting banks' financial reporting by increasing loan loss provisions compared to previous incurred loss models. Basel III primarily imposes stricter capital requirements and leverage ratios to enhance bank resilience, impacting regulatory capital adequacy but not directly altering accounting standards or financial statements. The divergence between IFRS 9's forward-looking impairment approach and Basel III's risk-based capital framework creates a complex interplay in risk management and financial disclosures for banking institutions.

Challenges in Implementation

Implementing IFRS 9 and Basel III presents challenges including complex data requirements and the need for advanced risk modeling systems to accurately assess credit risk and capital adequacy. Financial institutions must address discrepancies in expected loss measurement under IFRS 9 and capital charge calculations under Basel III, complicating compliance efforts. These frameworks demand significant investment in technology, staff training, and process integration to ensure accurate reporting and regulatory alignment.

Future Trends and Regulatory Alignment

Future trends in IFRS 9 and Basel III emphasize enhanced regulatory alignment through integrated risk management frameworks and improved capital adequacy assessments. Both standards increasingly incorporate forward-looking provisions and stress testing methodologies to address credit risk and financial stability in dynamically changing markets. Advances in data analytics and technology are driving convergence in reporting requirements, fostering transparency, consistency, and resilience in global banking regulations.

IFRS 9 Infographic

libterm.com

libterm.com