Hyperinflation rapidly erodes the purchasing power of money, leading to skyrocketing prices and destabilizing economies. It causes severe disruptions in trade, savings, and daily life, often resulting from excessive money supply and loss of confidence in currency. Discover how hyperinflation impacts your finances and what measures can protect your wealth in the rest of this article.

Table of Comparison

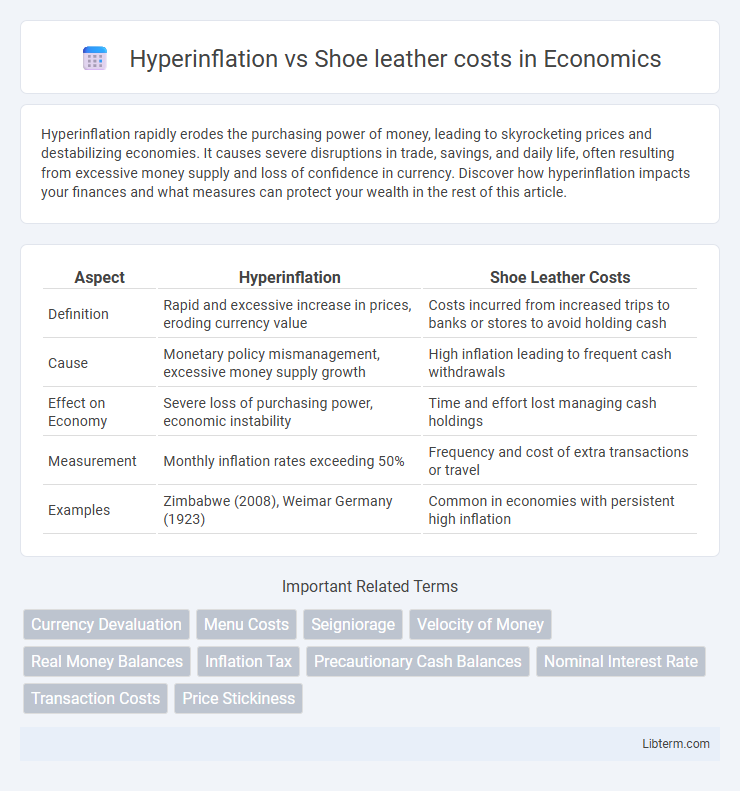

| Aspect | Hyperinflation | Shoe Leather Costs |

|---|---|---|

| Definition | Rapid and excessive increase in prices, eroding currency value | Costs incurred from increased trips to banks or stores to avoid holding cash |

| Cause | Monetary policy mismanagement, excessive money supply growth | High inflation leading to frequent cash withdrawals |

| Effect on Economy | Severe loss of purchasing power, economic instability | Time and effort lost managing cash holdings |

| Measurement | Monthly inflation rates exceeding 50% | Frequency and cost of extra transactions or travel |

| Examples | Zimbabwe (2008), Weimar Germany (1923) | Common in economies with persistent high inflation |

Understanding Hyperinflation: Definition and Causes

Hyperinflation occurs when a country experiences an extremely rapid and out-of-control rise in prices, typically exceeding 50% per month, eroding the real value of money. It is primarily caused by excessive money supply growth often linked to large government deficits financed by printing money, loss of confidence in the currency, and collapse of productive capacity. Shoe leather costs arise as people spend more time and effort trying to minimize holding depreciating cash during hyperinflation, frequently making more frequent trips to banks or markets to convert currency into goods or stable assets.

Shoe Leather Costs: What They Are and Why They Matter

Shoe leather costs refer to the increased time and effort individuals spend reducing their cash holdings during periods of high inflation, which leads to more frequent trips to the bank or store. These costs matter because they represent a real economic burden, reducing productivity and consumer convenience as people try to avoid the loss of purchasing power caused by rapid price increases. Understanding shoe leather costs provides insight into the broader impacts of hyperinflation beyond mere price volatility, highlighting the hidden inefficiencies and disruptions in everyday economic activities.

Key Differences Between Hyperinflation and Shoe Leather Costs

Hyperinflation is an extreme and rapid increase in prices causing severe currency devaluation, whereas shoe leather costs refer to the time and effort individuals spend avoiding holding onto cash during inflationary periods. Hyperinflation disrupts the entire economy by eroding purchasing power drastically, while shoe leather costs represent the microeconomic behavioral response to inflation. The key difference lies in hyperinflation being a macroeconomic phenomenon, and shoe leather costs being an economic cost borne by individuals trying to minimize cash losses.

Economic Impacts of Hyperinflation

Hyperinflation drastically reduces currency value, leading to severe economic instability and a loss of consumer purchasing power. This phenomenon exacerbates shoe leather costs as consumers and businesses frequently withdraw cash to avoid holding rapidly depreciating money, increasing transaction time and effort. The resultant inefficiencies hinder investment, disrupt market functioning, and contribute to a decline in overall economic growth.

The Mechanics Behind Shoe Leather Costs

Shoe leather costs arise from the increased frequency of cash withdrawals during hyperinflation, driving individuals to minimize cash holdings due to rapid currency depreciation. This behavior forces more trips to banks or ATMs, significantly raising the time and effort spent managing money. The underlying mechanism involves a loss of purchasing power that incentivizes reducing idle cash, thus increasing transaction costs and economic inefficiency.

Historical Examples of Hyperinflation Events

Hyperinflation events such as Zimbabwe in the late 2000s and the Weimar Republic in 1920s Germany showcase extreme price escalations that erode currency value, leading to increased shoe leather costs as individuals make frequent trips to banks to convert cash quickly. These episodes reveal how hyperinflation accelerates the velocity of money and heightens transaction costs due to constant money handling. Consequences include rapid depletion of cash holdings, reduced real balances, and significant economic instability tied to the escalating opportunity costs reflected in shoe leather expenditures.

How Shoe Leather Costs Affect Everyday Consumers

Shoe leather costs represent the increased time and effort consumers spend managing cash during hyperinflation, such as making frequent trips to the bank to avoid holding rapidly depreciating money. These costs reduce consumer productivity and increase transaction expenses, as individuals must constantly convert cash into more stable assets or goods. This behavior disrupts everyday financial activities, leading to decreased purchasing power and higher opportunity costs for routine transactions.

Hyperinflation vs Shoe Leather Costs: Policy Implications

Hyperinflation drives rapid erosion of currency value, causing individuals to minimize cash holdings and increase frequency of transactions, leading to significant shoe leather costs characterized by time and effort spent managing cash. Policymakers face challenges balancing inflation control with minimizing these inefficiencies, as aggressive monetary tightening to combat hyperinflation can exacerbate economic contraction while lenient policies prolong currency instability. Effective measures include stabilizing the currency through credible fiscal reform and improving payment systems to reduce reliance on cash, thereby mitigating shoe leather costs and enhancing overall economic efficiency.

Preventing Hyperinflation and Minimizing Shoe Leather Costs

Preventing hyperinflation requires implementing stringent monetary policies that control excessive money supply growth and maintaining fiscal discipline to avoid large deficits financed by money printing. Minimizing shoe leather costs involves improving the efficiency of cash management through digital payment systems and reducing the frequency of cash withdrawals, thereby lowering the opportunity cost of holding money. Coordinated monetary and fiscal strategies help stabilize inflation expectations, ensuring both hyperinflation prevention and reduced transactional frictions linked to shoe leather costs.

Conclusion: Navigating Inflationary Challenges

Hyperinflation drastically erodes currency value, forcing consumers and businesses to make frequent transactions, which significantly increases shoe leather costs due to time and effort spent managing cash holdings. Efficient navigation of these inflationary challenges requires adopting robust monetary policies and digital payment systems to minimize physical cash handling and stabilize the economy. Understanding the relationship between hyperinflation and shoe leather costs helps policymakers design interventions that reduce economic inefficiencies and protect purchasing power.

Hyperinflation Infographic

libterm.com

libterm.com