The permanent income hypothesis explains that individuals base their consumption decisions on expected long-term average income rather than current income fluctuations, smoothing their spending over time. It suggests that temporary changes in income have less impact on consumption compared to permanent changes, influencing economic behavior and policy design. Discover how this theory shapes personal finance strategies and economic models throughout the article.

Table of Comparison

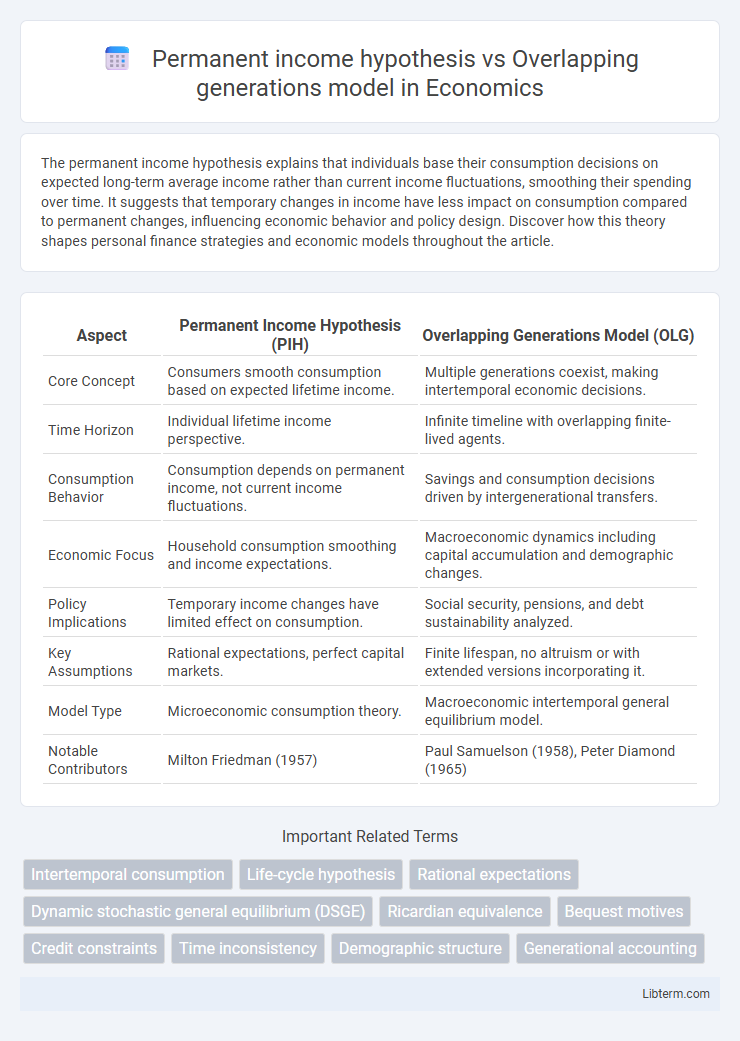

| Aspect | Permanent Income Hypothesis (PIH) | Overlapping Generations Model (OLG) |

|---|---|---|

| Core Concept | Consumers smooth consumption based on expected lifetime income. | Multiple generations coexist, making intertemporal economic decisions. |

| Time Horizon | Individual lifetime income perspective. | Infinite timeline with overlapping finite-lived agents. |

| Consumption Behavior | Consumption depends on permanent income, not current income fluctuations. | Savings and consumption decisions driven by intergenerational transfers. |

| Economic Focus | Household consumption smoothing and income expectations. | Macroeconomic dynamics including capital accumulation and demographic changes. |

| Policy Implications | Temporary income changes have limited effect on consumption. | Social security, pensions, and debt sustainability analyzed. |

| Key Assumptions | Rational expectations, perfect capital markets. | Finite lifespan, no altruism or with extended versions incorporating it. |

| Model Type | Microeconomic consumption theory. | Macroeconomic intertemporal general equilibrium model. |

| Notable Contributors | Milton Friedman (1957) | Paul Samuelson (1958), Peter Diamond (1965) |

Introduction to Consumption Theories

The Permanent Income Hypothesis (PIH), developed by Milton Friedman, posits that individuals base consumption decisions on their expected lifetime income rather than current income, emphasizing the role of stable income expectations in smoothing consumption over time. The Overlapping Generations (OLG) model, introduced by Paul Samuelson and further developed by Peter Diamond, offers a macroeconomic framework where multiple generations interact, highlighting the effects of saving and consumption decisions across different age cohorts on aggregate demand and capital accumulation. Both theories contribute to understanding consumption behavior, with PIH focusing on individual consumption smoothing and OLG addressing intertemporal resource allocation and demographic impacts on the economy.

Overview of the Permanent Income Hypothesis

The Permanent Income Hypothesis posits that individuals base their consumption decisions on expected long-term average income rather than current income fluctuations, promoting smoother consumption patterns over time. It emphasizes the role of lifetime wealth in determining spending, incorporating forward-looking behavior and intertemporal optimization. This contrasts with the Overlapping Generations Model, which analyzes intertemporal economic dynamics across different cohorts without assuming perfect foresight about permanent income.

Fundamentals of the Overlapping Generations Model

The Overlapping Generations Model (OLG) fundamentally represents an economy where individuals live for two periods, working when young and consuming when old, incorporating intergenerational trade and savings behavior. It contrasts with the Permanent Income Hypothesis by explicitly modeling multiple generations coexisting and interacting in capital markets, emphasizing the role of demographics and time in economic dynamics. The OLG framework is crucial for analyzing public debt sustainability, capital accumulation, and the effects of fiscal policy across different cohorts.

Core Assumptions: PIH vs OLG

The Permanent Income Hypothesis (PIH) assumes consumers optimize lifetime utility based on expected permanent income, smoothing consumption despite income fluctuations. The Overlapping Generations (OLG) model bases its framework on distinct cohorts that live for two periods, with intergenerational transfers and capital accumulation shaping economic dynamics. PIH focuses on individual consumption decisions under uncertainty, while OLG emphasizes demographic structure and intertemporal equilibrium in macroeconomic analysis.

Consumption Smoothing and Lifecycle Behavior

The Permanent Income Hypothesis asserts that consumers smooth consumption based on expected long-term income, minimizing fluctuations in spending despite temporary income changes. The Overlapping Generations Model emphasizes lifecycle behavior, where individuals optimize consumption and savings decisions over their finite lifespans, considering both current and future income streams. Both frameworks explain consumption smoothing but differ: Permanent Income Hypothesis focuses on forward-looking income expectations while Overlapping Generations Model incorporates age-structured intergenerational dynamics and savings patterns.

Savings Decisions in PIH and OLG

The Permanent Income Hypothesis (PIH) explains savings decisions as individuals smoothing consumption based on expected lifetime income, saving during high-income periods and dissaving when income is low or uncertain. In contrast, the Overlapping Generations Model (OLG) focuses on intergenerational transfers and savings behavior influenced by life-cycle motives, where individuals save for retirement while younger generations dissave. Both models address savings differently: PIH emphasizes consumption smoothing through forward-looking expectations, whereas OLG emphasizes lifecycle incentives and demographic structure impacts on aggregate savings.

Role of Expectations and Uncertainty

The Permanent Income Hypothesis assumes consumers form expectations about their lifetime income and smooth consumption based on anticipated rather than current income, highlighting rational expectations and uncertainty about future earnings. In contrast, the Overlapping Generations Model emphasizes intergenerational transfers and demographic uncertainty, where agents' expectations about future population growth and economic conditions significantly influence saving and consumption patterns. Both frameworks incorporate uncertainty, but the Permanent Income Hypothesis centers on individual lifetime income predictions, whereas the Overlapping Generations Model stresses macroeconomic dynamics and demographic shifts in shaping economic behavior.

Policy Implications: Comparing the Models

The Permanent Income Hypothesis (PIH) suggests that fiscal policies aimed at temporary income changes have limited effects on consumer spending, emphasizing permanent income alterations for effective demand management. The Overlapping Generations (OLG) model highlights intergenerational transfers and the sustainability of public debt, underscoring the importance of policies addressing long-term fiscal imbalances to avoid burdens on future generations. Comparing both, PIH informs short-term consumption responses, while OLG stresses the structural impact of policies on generational equity and debt dynamics.

Empirical Evidence and Model Validation

The Permanent Income Hypothesis (PIH) shows strong empirical support through consumption smoothing observed in longitudinal household data, confirming that individuals base spending on expected lifetime income rather than current earnings. In contrast, the Overlapping Generations (OLG) model finds validation in macroeconomic data reflecting intertemporal budget constraints and generational debt dynamics, effectively explaining phenomena like social security impacts and debt sustainability. Comparative studies reveal that while PIH excels in micro-level consumption behavior prediction, OLG models provide robust frameworks for policy analysis involving generational transfers and national savings.

Conclusion: Strengths and Limitations

The Permanent Income Hypothesis (PIH) excels in explaining consumer behavior under uncertainty by linking consumption to expected lifetime income, but it struggles with liquidity constraints and changing preferences. The Overlapping Generations (OLG) model provides valuable insights into intergenerational wealth transfer and demographic effects on the economy, yet it often relies on simplifying assumptions that limit its real-world applicability. Both models offer critical frameworks for understanding economic dynamics, but integrating their strengths could address individual consumption patterns and macroeconomic intertemporal issues more comprehensively.

Permanent income hypothesis Infographic

libterm.com

libterm.com