Neoclassical economics focuses on how individuals make rational choices to maximize utility and firms aim to maximize profit within competitive markets. It emphasizes supply and demand dynamics, price mechanisms, and equilibrium outcomes to explain economic behavior. Explore the rest of the article to understand how these principles impact Your financial decisions and market trends.

Table of Comparison

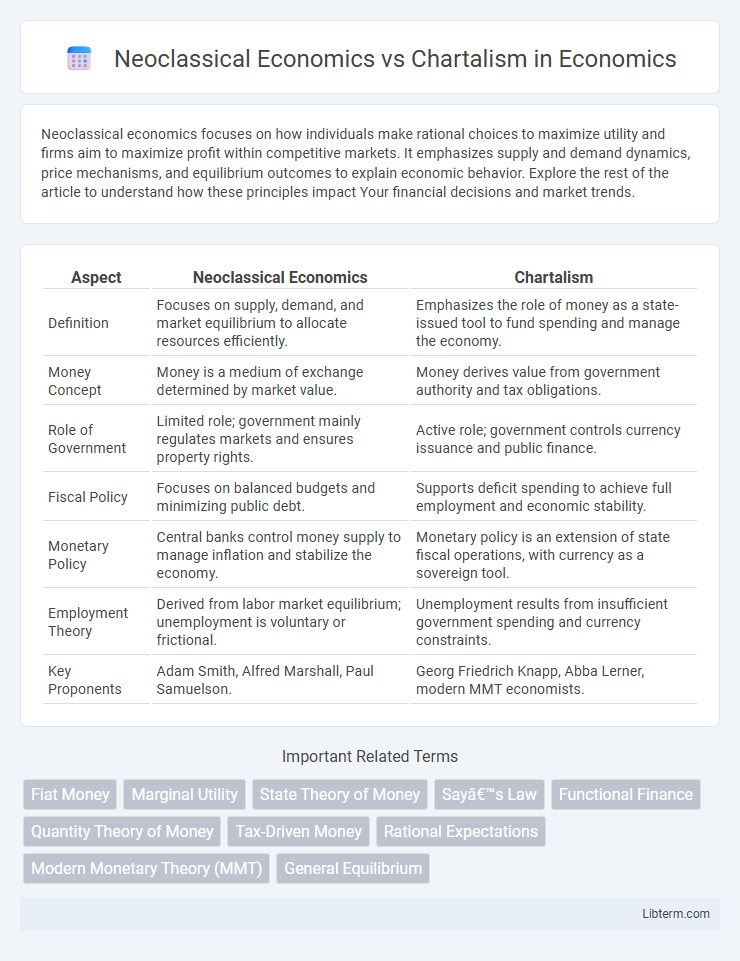

| Aspect | Neoclassical Economics | Chartalism |

|---|---|---|

| Definition | Focuses on supply, demand, and market equilibrium to allocate resources efficiently. | Emphasizes the role of money as a state-issued tool to fund spending and manage the economy. |

| Money Concept | Money is a medium of exchange determined by market value. | Money derives value from government authority and tax obligations. |

| Role of Government | Limited role; government mainly regulates markets and ensures property rights. | Active role; government controls currency issuance and public finance. |

| Fiscal Policy | Focuses on balanced budgets and minimizing public debt. | Supports deficit spending to achieve full employment and economic stability. |

| Monetary Policy | Central banks control money supply to manage inflation and stabilize the economy. | Monetary policy is an extension of state fiscal operations, with currency as a sovereign tool. |

| Employment Theory | Derived from labor market equilibrium; unemployment is voluntary or frictional. | Unemployment results from insufficient government spending and currency constraints. |

| Key Proponents | Adam Smith, Alfred Marshall, Paul Samuelson. | Georg Friedrich Knapp, Abba Lerner, modern MMT economists. |

Introduction to Neoclassical Economics and Chartalism

Neoclassical economics centers on supply and demand dynamics, utility maximization, and market equilibrium, emphasizing individual decision-making and rational behavior in competitive markets. Chartalism, or Modern Monetary Theory, challenges conventional views by asserting that money's value derives from government authority and fiscal policy rather than market forces, highlighting state-issued currency's role in economic stability. These contrasting frameworks shape contemporary debates on monetary policy, government spending, and economic regulation.

Historical Origins and Development

Neoclassical economics emerged in the late 19th century, rooted in marginalist theories that emphasize individual decision-making, market equilibrium, and utility maximization, with key figures such as William Stanley Jevons, Carl Menger, and Leon Walras shaping its foundational principles. Chartalism, also known as the State Theory of Money, was developed by Georg Friedrich Knapp in the early 20th century, emphasizing the role of government-issued money and legal systems in defining currency value. While neoclassical economics developed through an analytical focus on supply, demand, and price mechanisms, Chartalism evolved through institutional and historical analyses highlighting the state's authority in monetary creation and fiscal policy.

Core Principles of Neoclassical Economics

Neoclassical economics centers on the principles of rational choice, utility maximization, and market equilibrium, emphasizing how individuals and firms make decisions to optimize their outcomes based on preferences and resource constraints. It assumes perfect information, competitive markets, and price mechanisms that efficiently allocate resources. In contrast, chartalism challenges these assumptions by focusing on the role of government-issued currency and fiscal policy in influencing demand and economic activity.

Fundamental Tenets of Chartalism

Chartalism emphasizes the state's role in defining money as a legal instrument for tax payments, distinguishing it from neoclassical economics which treats money primarily as a medium of exchange and store of value. The fundamental tenets of Chartalism highlight that government-issued currency gains value through sovereign authority and tax obligations, not market supply and demand. This perspective asserts that fiscal policy, rather than monetary markets, governs money creation and economic stability.

Approaches to Money and Value

Neoclassical Economics views money primarily as a medium of exchange and a store of value, emphasizing its equilibrium effects on supply and demand to determine prices. Chartalism, or modern monetary theory, considers money a social construct defined by state authority and government-issued currency, highlighting its role in public finance and fiscal policy. While Neoclassical models prioritize market-clearing mechanisms, Chartalists focus on money's relational value rooted in legal and institutional frameworks.

Government’s Role in the Economy

Neoclassical economics emphasizes limited government intervention, advocating for market efficiency where supply and demand determine prices and allocate resources. Chartalism, or Modern Monetary Theory (MMT), highlights the government's role as the issuer of currency, enabling it to manage unemployment and stimulate economic activity through fiscal policies without being constrained by revenue. This theory asserts that government deficits can fund public goods and services, challenging neoclassical views on balanced budgets and monetary neutrality.

Policy Implications: Fiscal and Monetary Perspectives

Neoclassical economics emphasizes the effectiveness of monetary policy through interest rate adjustments to control inflation and stabilize output, advocating for limited fiscal intervention to avoid crowding out private investment. Chartalism prioritizes active fiscal policy, asserting that government spending, financed by sovereign currency issuance, is essential for achieving full employment and economic stability, with monetary policy playing a supportive role. These differing views influence policymakers' approaches to managing public debt, inflation, and economic growth, with neoclassical theory favoring austerity and Chartalist principles endorsing proactive budgetary measures.

Critiques and Controversies

Neoclassical economics faces criticism for its reliance on equilibrium models and assumptions of rational behavior, often ignoring the complexities of real-world monetary systems emphasized by Chartalism. Chartalism challenges Neoclassical views by highlighting the state's role in defining currency value and sovereign money creation, which Neoclassical frameworks tend to undervalue or overlook. Controversies arise around policy implications, with Chartalists advocating for active fiscal policy supported by sovereign currency issuance, contrasting with Neoclassical preferences for limited government intervention and monetary neutrality.

Real-World Applications and Case Studies

Neoclassical Economics emphasizes market equilibrium and price mechanisms, widely applied in policy modeling for inflation control and resource allocation, exemplified by the Federal Reserve's interest rate adjustments to influence economic growth. Chartalism, or Modern Monetary Theory, focuses on government-issued currency as a tool for fiscal policy, demonstrated by Japan's extensive public spending funded through sovereign currency issuance without triggering hyperinflation. Real-world case studies include the 2008 financial crisis management, where neoclassical frameworks guided central bank interventions, contrasted with contemporary proposals to address unemployment using chartalist insights on deficit spending and job guarantees.

Comparative Analysis: Strengths and Limitations

Neoclassical Economics emphasizes market equilibrium and individual rationality, providing robust models for predicting consumer behavior and price mechanisms, but often overlooks the role of money and state influence in economic dynamics. Chartalism focuses on the state's sovereign power to issue currency and enforce tax obligations, highlighting fiscal policy's central role in economic stabilization and demand management, yet it may underappreciate market-driven efficiencies and private sector innovation. Both approaches contribute valuable insights; neoclassical models excel in microeconomic analysis and resource allocation, while Chartalism offers a comprehensive framework for understanding monetary sovereignty and government intervention limitations.

Neoclassical Economics Infographic

libterm.com

libterm.com