Bonds maturity refers to the specified date when the principal amount of a bond is due to be repaid to the investor. Different bonds have varying maturity lengths, such as short-term (less than 3 years), medium-term (3-10 years), and long-term (over 10 years), influencing risk and return characteristics. Explore the rest of the article to understand how bond maturity impacts your investment strategy and financial planning.

Table of Comparison

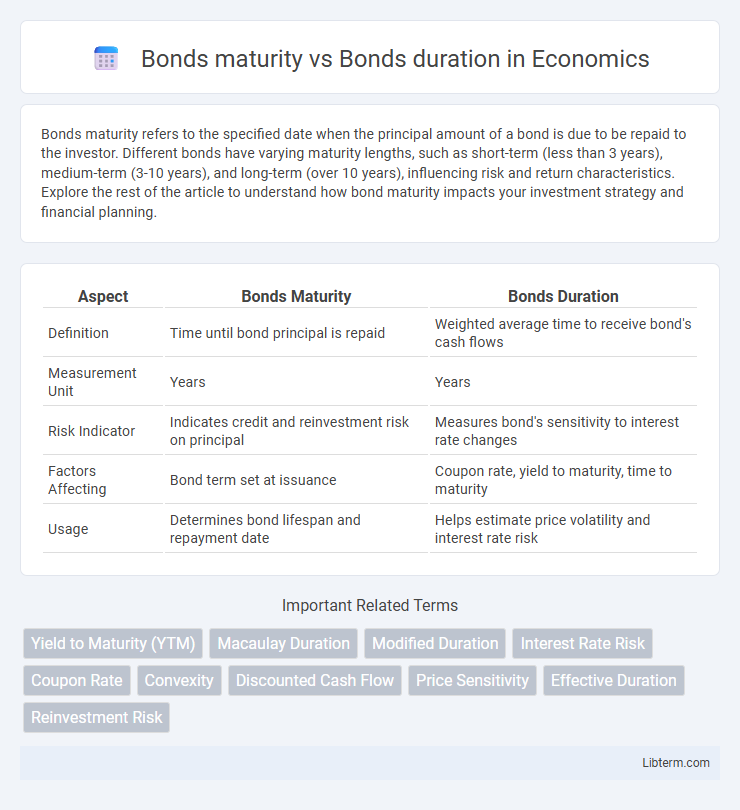

| Aspect | Bonds Maturity | Bonds Duration |

|---|---|---|

| Definition | Time until bond principal is repaid | Weighted average time to receive bond's cash flows |

| Measurement Unit | Years | Years |

| Risk Indicator | Indicates credit and reinvestment risk on principal | Measures bond's sensitivity to interest rate changes |

| Factors Affecting | Bond term set at issuance | Coupon rate, yield to maturity, time to maturity |

| Usage | Determines bond lifespan and repayment date | Helps estimate price volatility and interest rate risk |

Introduction to Bond Maturity and Duration

Bond maturity refers to the specific date when the principal amount of a bond is due to be repaid to the investor, marking the end of the bond's life. Duration measures the weighted average time it takes to receive all cash flows from the bond, including interest payments and principal repayment, reflecting the bond's sensitivity to interest rate changes. Understanding both maturity and duration is crucial for managing interest rate risk and aligning bond investments with financial goals.

Defining Bond Maturity

Bond maturity refers to the specific date when the principal amount of a bond is due to be repaid to the bondholder, marking the end of the bond's life. This fixed timeline distinguishes maturity from bond duration, which measures the weighted average time to receive the bond's cash flows, reflecting interest rate sensitivity. Understanding bond maturity is crucial for investors assessing liquidity needs and reinvestment risk in fixed income portfolios.

Understanding Bond Duration

Bond duration measures the sensitivity of a bond's price to interest rate changes, reflecting the weighted average time until cash flows are received, unlike maturity which simply indicates the bond's final repayment date. Understanding bond duration helps investors assess interest rate risk more accurately by accounting for the timing and size of all coupon payments along with the principal repayment. This concept is crucial for managing portfolio volatility and aligning bond investments with specific risk tolerance and investment horizons.

Key Differences: Maturity vs. Duration

Bonds maturity refers to the specific date when the principal amount of the bond is repaid to the investor, while bond duration measures the sensitivity of the bond's price to interest rate changes, representing the weighted average time to receive cash flows. Maturity is a fixed timeline endpoint, whereas duration fluctuates with interest rates, coupon payments, and time remaining until maturity. Investors use maturity to plan investment horizons, but duration is crucial for assessing interest rate risk and price volatility.

How Maturity Affects Bond Investment

Bond maturity directly influences the repayment timeline, determining when the principal is returned to investors and signaling the end of interest payments. Longer maturities generally expose investors to greater interest rate risk, as price volatility increases with time, affecting the bond's market value. Understanding maturity helps investors balance yield expectations against potential risk, aligning their portfolios with cash flow needs and risk tolerance.

The Importance of Duration in Interest Rate Risk

Bond maturity represents the fixed date when the principal is repaid, while bond duration measures the sensitivity of a bond's price to interest rate changes, reflecting weighted average time to receive cash flows. Duration is a crucial metric for managing interest rate risk, as it estimates potential price volatility when interest rates fluctuate, enabling investors to assess exposure more accurately than maturity alone. Understanding duration allows portfolio managers to hedge interest rate risk effectively and optimize returns by aligning bond investments with their risk tolerance and market outlook.

Calculating Bond Duration: Methods and Examples

Bond duration measures a bond's sensitivity to interest rate changes, differing from bond maturity which is the time until principal repayment. Calculating bond duration can be done using Macaulay duration, which weights the present value of cash flows by time, or modified duration, adjusting Macaulay duration for yield. For example, a 5-year bond with annual coupons and a 4% yield might have a Macaulay duration of 4.5 years, indicating the average time to receive cash flows, while modified duration shows price sensitivity to yield fluctuations.

Practical Implications for Investors

Bond maturity represents the fixed date when the bond's principal is repaid, impacting an investor's liquidity timeline, while bond duration measures price sensitivity to interest rate changes, influencing investment risk. Understanding that longer maturity often leads to higher duration, investors can better assess potential volatility and interest rate risk in their portfolios. Prioritizing bonds with durations aligned to an investor's risk tolerance and investment horizon optimizes both yield expectations and capital preservation strategies.

Strategies for Managing Maturity and Duration

Bond maturity refers to the fixed date when the principal amount is repaid, while bond duration measures the sensitivity of the bond's price to interest rate changes, expressed in years. Strategies for managing maturity involve laddering bonds to spread risk and ensure liquidity at different intervals, whereas managing duration focuses on adjusting portfolio sensitivity by selecting bonds with varying durations to mitigate interest rate risk. Combining maturity and duration management enables investors to balance income needs with interest rate volatility, optimizing overall portfolio stability and performance.

Conclusion: Choosing Between Maturity and Duration

Bonds maturity reveals the fixed date when the principal is repaid, while duration measures the bond's sensitivity to interest rate changes. Investors seeking predictable cash flows and return of principal prefer focusing on maturity, whereas those prioritizing interest rate risk management emphasize duration. Selecting between maturity and duration depends on individual risk tolerance, investment horizon, and interest rate outlook to optimize portfolio stability and performance.

Bonds maturity Infographic

libterm.com

libterm.com