Market incompleteness occurs when financial markets lack sufficient instruments or liquidity to allow traders to fully hedge risks or achieve optimal portfolios. This limitation can lead to inefficiencies, higher transaction costs, and increased uncertainty for investors. Explore this article to understand how market incompleteness impacts Your investment strategies and market stability.

Table of Comparison

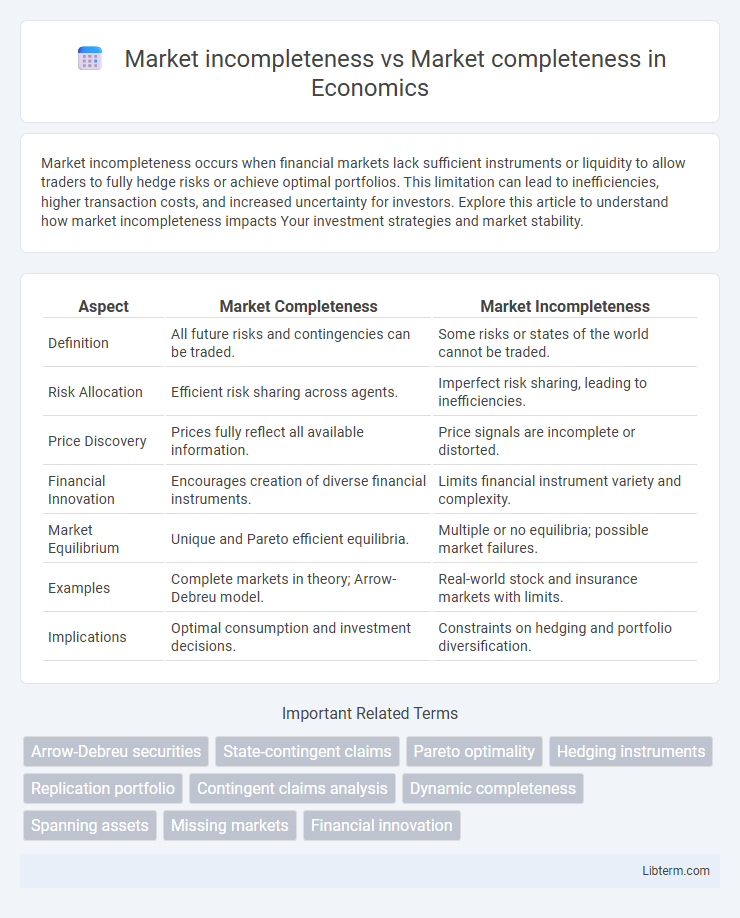

| Aspect | Market Completeness | Market Incompleteness |

|---|---|---|

| Definition | All future risks and contingencies can be traded. | Some risks or states of the world cannot be traded. |

| Risk Allocation | Efficient risk sharing across agents. | Imperfect risk sharing, leading to inefficiencies. |

| Price Discovery | Prices fully reflect all available information. | Price signals are incomplete or distorted. |

| Financial Innovation | Encourages creation of diverse financial instruments. | Limits financial instrument variety and complexity. |

| Market Equilibrium | Unique and Pareto efficient equilibria. | Multiple or no equilibria; possible market failures. |

| Examples | Complete markets in theory; Arrow-Debreu model. | Real-world stock and insurance markets with limits. |

| Implications | Optimal consumption and investment decisions. | Constraints on hedging and portfolio diversification. |

Introduction to Market Completeness and Incompleteness

Market completeness occurs when every contingent claim can be perfectly hedged or replicated through trading available assets, enabling efficient risk sharing and optimal allocation of resources. In contrast, market incompleteness arises when certain risks cannot be fully traded or hedged due to limitations such as missing financial instruments, information asymmetries, or transaction costs. Understanding the distinction between market completeness and incompleteness is crucial for analyzing asset pricing, portfolio optimization, and the design of financial products.

Defining Market Completeness: Key Characteristics

Market completeness refers to a financial market where every contingent claim can be perfectly hedged or replicated using available securities, ensuring no risk remains uninsurable. Key characteristics include the existence of a sufficient number of linearly independent assets and the ability to construct portfolios that span the entire state space. This completeness enables unique, arbitrage-free pricing of derivatives and efficient risk-sharing among participants.

Understanding Market Incompleteness: Main Features

Market incompleteness occurs when financial markets lack the necessary assets or instruments to fully hedge all possible risks, leading to unspanned risks and imperfect risk sharing among investors. Key features include the absence of certain derivatives or securities, information asymmetry, and constraints on trading that prevent achieving Pareto optimal allocations. Understanding market incompleteness is crucial for pricing in incomplete markets, risk management, and the design of financial products that address gaps in risk coverage.

Causes and Examples of Market Incompleteness

Market incompleteness arises from factors such as information asymmetry, lack of financial instruments, and transaction costs that prevent all risks from being fully insured or traded. Incomplete markets often feature missing markets for certain assets or states of nature, exemplified by insurance markets failing to cover rare or catastrophic events and credit markets restricted by borrower creditworthiness. These imperfections hinder efficient risk sharing and optimal allocation of resources, contrasting with complete markets where every contingent claim can be bought or sold.

Theoretical Frameworks: Arrow-Debreu Model

The Arrow-Debreu model provides a foundational theoretical framework for understanding market completeness by postulating a state where every possible future contingent claim can be traded, ensuring efficient risk sharing and Pareto optimality. Market incompleteness arises when some contingent claims are missing, preventing agents from fully insuring against all risks, which leads to suboptimal allocations and challenges in achieving equilibrium. The model's assumptions highlight the significance of complete markets in achieving optimal resource allocation and serve as a benchmark for analyzing real-world deviations caused by informational asymmetries or trading constraints.

Impact of Market Completeness on Asset Pricing

Market completeness allows for the full replication of contingent claims, enabling perfect hedging and leading to asset prices that reflect all available information efficiently. In contrast, market incompleteness restricts trading opportunities and hedging strategies, often resulting in pricing inefficiencies, larger risk premiums, and increased volatility due to unhedgeable risks. Consequently, asset pricing models in complete markets produce unique, arbitrage-free prices, whereas incomplete markets require equilibrium approaches or utility-based valuations to accommodate risk preferences and market frictions.

Real-World Implications of Market Incompleteness

Market incompleteness occurs when some risks cannot be fully traded or hedged due to the absence of certain financial instruments, leading to imperfect risk sharing and inefficient allocation of resources. Incomplete markets often result in limited access to capital for certain firms and individuals, hindering economic growth and exacerbating income inequality. The real-world implications include higher volatility in asset prices, increased vulnerability to financial crises, and suboptimal levels of investment and consumption across the economy.

Risk Sharing and Hedging in Complete vs Incomplete Markets

Market completeness allows for perfect risk sharing and full hedging by enabling the trading of a complete set of contingent claims, which eliminates idiosyncratic and systematic risks effectively. In contrast, incomplete markets lack certain financial instruments, limiting the ability to fully hedge against risks, resulting in residual risk exposure and suboptimal risk sharing. Consequently, risk allocation is less efficient in incomplete markets, influencing asset pricing and financial stability due to the inability to achieve Pareto optimality in risk distribution.

Policy and Regulatory Approaches to Market Incompleteness

Policy and regulatory approaches to market incompleteness focus on enhancing information transparency, improving risk-sharing mechanisms, and reducing transaction costs to bridge gaps in asset markets. Regulatory frameworks emphasize mandatory disclosure requirements, standardized contracts, and the creation of financial intermediaries to facilitate market participation and completeness. Targeted interventions in incomplete markets foster improved allocation of resources and mitigate systemic risks by addressing asymmetric information and externalities.

Future Trends: Bridging Market Gaps

Future trends in financial markets emphasize bridging the gap between market incompleteness and completeness by advancing derivative instruments and improving information transparency. Innovations in blockchain technology and decentralized finance (DeFi) are enabling more efficient risk-sharing and asset diversification, reducing market frictions and enhancing liquidity. Enhanced regulatory frameworks and AI-driven analytics further facilitate market completeness by addressing asymmetric information and promoting seamless access to financial products.

Market incompleteness Infographic

libterm.com

libterm.com