The Lorenz curve graphically represents income or wealth distribution within a population, illustrating inequality by plotting cumulative population percentages against cumulative income shares. It helps quantify disparity through metrics like the Gini coefficient, which measures how far the distribution deviates from perfect equality. Discover how understanding the Lorenz curve can provide insight into economic inequality in the rest of this article.

Table of Comparison

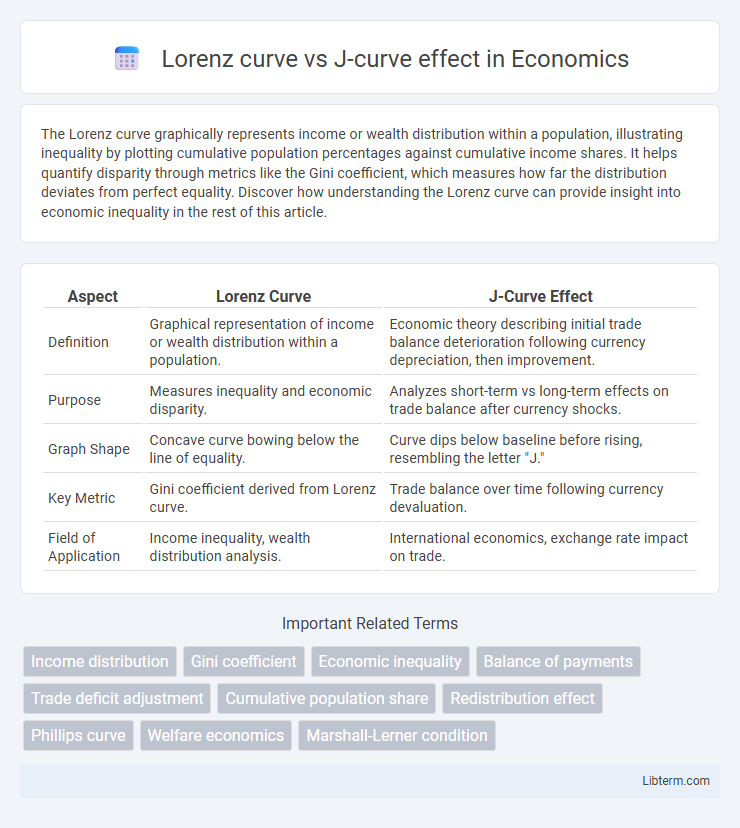

| Aspect | Lorenz Curve | J-Curve Effect |

|---|---|---|

| Definition | Graphical representation of income or wealth distribution within a population. | Economic theory describing initial trade balance deterioration following currency depreciation, then improvement. |

| Purpose | Measures inequality and economic disparity. | Analyzes short-term vs long-term effects on trade balance after currency shocks. |

| Graph Shape | Concave curve bowing below the line of equality. | Curve dips below baseline before rising, resembling the letter "J." |

| Key Metric | Gini coefficient derived from Lorenz curve. | Trade balance over time following currency devaluation. |

| Field of Application | Income inequality, wealth distribution analysis. | International economics, exchange rate impact on trade. |

Introduction to the Lorenz Curve and J-Curve Effect

The Lorenz Curve graphically represents income or wealth distribution within a population, illustrating inequality by plotting the cumulative percentage of total income against the cumulative percentage of recipients. The J-Curve effect describes an initial economic decline following currency depreciation or trade shocks, followed by a gradual recovery and improvement in the trade balance. Understanding the Lorenz Curve aids in measuring inequality, while the J-Curve explains dynamic adjustments in international trade and currency value over time.

Defining the Lorenz Curve: Concept and Applications

The Lorenz curve is a graphical representation of income or wealth distribution within a population, illustrating inequality by plotting cumulative income shares against cumulative population percentages. It is widely used in economics and social sciences to assess economic disparity and to calculate the Gini coefficient, a key measure of inequality. Unlike the J-curve effect, which describes a time-related phenomenon in trade balance or economic recovery, the Lorenz curve provides a static snapshot of distributional equity for policy analysis and welfare evaluation.

Understanding the J-Curve Effect: Economic Dynamics

The J-Curve effect describes a short-term decline in a country's trade balance following a currency depreciation, followed by a subsequent improvement as export volumes increase and import volumes adjust. This dynamic occurs because initial contracts and prices are rigid, causing import costs to rise faster than export revenues immediately after devaluation. Over time, the volume effect dominates, reflecting enhanced competitiveness and improved trade balance, which contrasts with the Lorenz curve's focus on income inequality distribution.

Key Differences Between Lorenz Curve and J-Curve Effect

The Lorenz curve visually represents income or wealth distribution within a population, highlighting inequality by plotting cumulative population percentages against cumulative income percentages. In contrast, the J-curve effect describes a country's trade balance initially worsening following currency depreciation before improving over time, reflecting dynamic economic adjustments. While the Lorenz curve is static and focuses on distribution at a point in time, the J-curve effect captures temporal economic fluctuations influenced by exchange rate changes.

Visual Representation: Comparing Curve Shapes

The Lorenz curve displays income or wealth distribution as a concave, bowed line that illustrates inequality by showing cumulative shares of population against cumulative shares of income. In contrast, the J-curve effect often appears as a sharp dip followed by a steep rise, representing a temporal economic adjustment before improvement, commonly in trade balance or currency value analyses. Visually, the Lorenz curve's smooth, continuous curve contrasts with the J-curve's asymmetric, dynamic shape that highlights an initial downturn before recovery.

Applications in Economics and Policy Analysis

The Lorenz curve graphically represents income or wealth distribution, facilitating analysis of economic inequality and guiding progressive taxation or social welfare policies. The J-curve effect illustrates the short-term deterioration and long-term improvement of a country's trade balance following currency depreciation, informing exchange rate and trade policy decisions. Both tools provide critical insights for policymakers aiming to balance equity and economic stability in fiscal and trade strategies.

Measuring Inequality: The Role of the Lorenz Curve

The Lorenz curve graphically represents income or wealth distribution within a population, illustrating the extent of inequality by plotting cumulative percentages of total income against cumulative population percentages. It provides a clear visualization of disparities, where the further the curve lies from the line of equality, the greater the inequality. The J-curve effect contrasts economic indicators over time, but for measuring static inequality, the Lorenz curve remains a fundamental and precise tool.

Trade Balance and Adjustment: The J-Curve Explained

The J-Curve effect describes the short-term deterioration followed by long-term improvement in a country's trade balance after currency depreciation, emphasizing how initial import costs outweigh export gains before adjustment takes hold. In contrast, the Lorenz curve measures income or wealth distribution inequality within an economy, unrelated to immediate trade dynamics. Understanding the J-Curve is crucial for policymakers anticipating transitional trade deficits as currency values adjust and price elasticities influence export-import volumes.

Limitations and Criticisms of Each Curve

The Lorenz curve faces limitations in capturing dynamic economic changes and may oversimplify income distribution by focusing solely on inequality without addressing underlying causes. The J-curve effect is criticized for its assumptions about short-term economic adjustments, often failing to predict long-term currency fluctuations accurately due to external factors like trade policies and global market conditions. Both curves can mislead policymakers if used without considering broader economic contexts and complementary indicators.

Conclusion: Choosing the Right Analytical Tool

The Lorenz curve provides a clear graphical representation of income or wealth inequality, making it ideal for assessing distributional disparities within populations. The J-curve effect, on the other hand, highlights dynamic economic responses, particularly in trade and currency valuation over time, useful for analyzing short-term adjustment processes. Selecting the right analytical tool depends on whether the focus is on static inequality measurement or dynamic economic behavior analysis.

Lorenz curve Infographic

libterm.com

libterm.com