Money supply refers to the total amount of money available in an economy at a given time, including cash, coins, and balances in checking and savings accounts. It plays a crucial role in influencing inflation, interest rates, and overall economic growth. Discover how understanding money supply can impact your financial decisions by reading the rest of this article.

Table of Comparison

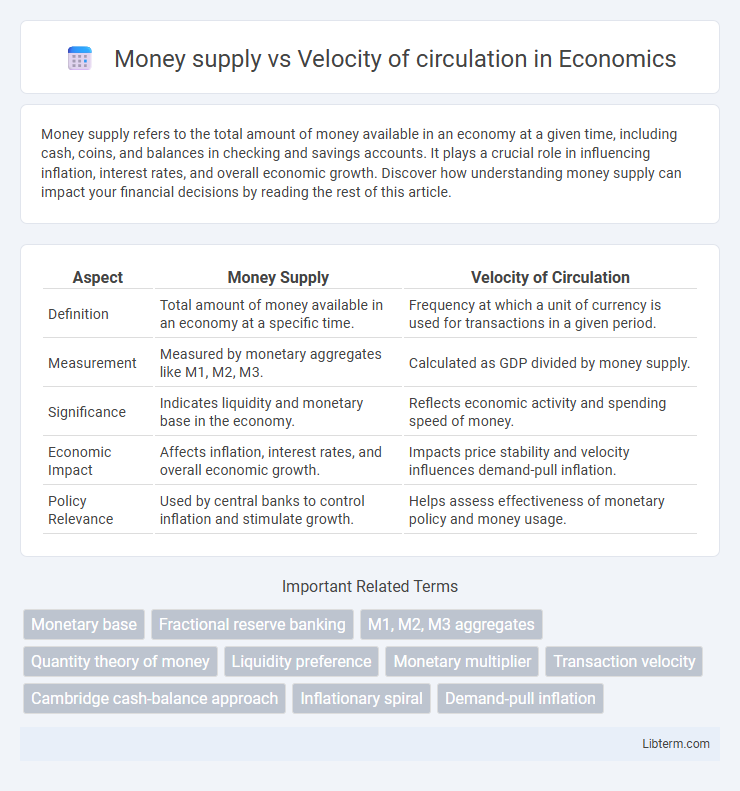

| Aspect | Money Supply | Velocity of Circulation |

|---|---|---|

| Definition | Total amount of money available in an economy at a specific time. | Frequency at which a unit of currency is used for transactions in a given period. |

| Measurement | Measured by monetary aggregates like M1, M2, M3. | Calculated as GDP divided by money supply. |

| Significance | Indicates liquidity and monetary base in the economy. | Reflects economic activity and spending speed of money. |

| Economic Impact | Affects inflation, interest rates, and overall economic growth. | Impacts price stability and velocity influences demand-pull inflation. |

| Policy Relevance | Used by central banks to control inflation and stimulate growth. | Helps assess effectiveness of monetary policy and money usage. |

Introduction to Money Supply

Money supply represents the total amount of monetary assets available in an economy at a specific time, including cash, coins, and balances in checking and savings accounts. Central banks control the money supply through monetary policy tools such as open market operations, reserve requirements, and interest rates to influence inflation and economic growth. Understanding the money supply is crucial for analyzing its interaction with the velocity of circulation, which measures how quickly money exchanges hands in the economy.

Understanding Velocity of Circulation

Velocity of circulation measures the rate at which money changes hands within an economy over a specific period, reflecting how quickly consumers and businesses utilize currency for transactions. It is calculated as the ratio of nominal GDP to the money supply, indicating the efficiency of money usage in promoting economic activity. Understanding velocity of circulation helps policymakers gauge economic health, as variations can signal shifts in spending behavior or monetary demand.

Key Differences Between Money Supply and Velocity

Money supply refers to the total amount of monetary assets available in an economy at a specific time, including cash, coins, and balances in checking and savings accounts. Velocity of circulation measures how frequently a unit of currency is used to purchase goods and services within a given period, reflecting the speed of money movement in the economy. Key differences include that money supply is a stock variable representing quantity, while velocity is a flow variable indicating the rate at which that money changes hands.

Theoretical Foundations and Economic Significance

The money supply represents the total amount of monetary assets available in an economy, directly influencing inflation and purchasing power, while the velocity of circulation measures the rate at which money changes hands, reflecting economic activity intensity. Theoretical foundations such as the Quantity Theory of Money posit a direct relationship between money supply and velocity to determine nominal GDP, highlighting the critical role of velocity in amplifying or dampening the effects of money supply changes. Economically, understanding the interplay between money supply and velocity helps policymakers gauge inflationary pressures, design effective monetary policies, and anticipate shifts in economic growth.

How Money Supply Impacts Economic Growth

Money supply directly influences economic growth by determining the amount of liquidity available for consumption and investment. When the money supply increases, it can boost spending and stimulate demand, leading to higher production and job creation. However, if money supply growth outpaces the velocity of circulation, it may cause inflationary pressures that undermine sustainable economic expansion.

Role of Velocity in Inflation Dynamics

The velocity of circulation significantly influences inflation dynamics by determining how quickly money changes hands within the economy, impacting overall demand levels. When velocity rises, even a stable money supply can lead to accelerated inflation due to increased spending pressure on goods and services. Central banks closely monitor velocity trends alongside money supply to forecast inflationary pressures and adjust monetary policy accordingly.

Factors Influencing Money Supply and Velocity

Money supply is influenced by central bank policies, reserve requirements, and commercial banks' lending activities, while velocity of circulation depends on transaction frequency, payment technologies, and consumer confidence. Changes in interest rates and inflation expectations directly affect borrowing behavior and the velocity at which money changes hands. Economic stability and financial innovation also play crucial roles in determining both the volume and speed of money flow within an economy.

Real-World Examples: Case Studies

The 2008 financial crisis demonstrated how a rapid increase in the money supply through quantitative easing did not correspond with a proportional rise in the velocity of circulation, leading to subdued inflation despite expansive monetary policy. In contrast, hyperinflation in Zimbabwe showed how an excessive surge in money supply coupled with a collapse in velocity caused runaway prices and economic instability. The United States in the post-pandemic era illustrates a nuanced recovery where significant money supply growth met fluctuating velocity, impacting inflation rates and economic growth unevenly across sectors.

Policy Implications for Central Banks

Central banks must carefully monitor the money supply and the velocity of circulation to effectively control inflation and stimulate economic growth. An increase in money supply without a corresponding rise in velocity can lead to excess liquidity and inflationary pressures, whereas a declining velocity signals reduced spending and potential economic stagnation. Policy tools such as interest rate adjustments and open market operations are employed to balance these factors, ensuring price stability and sustainable economic expansion.

Future Trends and Economic Outlook

Future trends indicate a potential slowdown in the velocity of circulation as digital currencies and fintech innovations reshape transaction behaviors, while central banks increasingly employ monetary policies to manage expanding money supplies amid economic uncertainties. The ongoing expansion of money supply, driven by quantitative easing and fiscal stimuli, may face diminishing returns if velocity remains stagnant or declines, influencing inflation rates and real GDP growth. Economic outlooks suggest a critical balance between maintaining liquidity and encouraging transactional velocity to sustain economic momentum in post-pandemic recovery phases.

Money supply Infographic

libterm.com

libterm.com