A duopoly occurs when two companies dominate a specific market, controlling the majority of supply or sales. This market structure often leads to competitive strategies that can influence prices, innovation, and consumer choices. Explore the rest of the article to understand how a duopoly impacts your purchasing decisions and market dynamics.

Table of Comparison

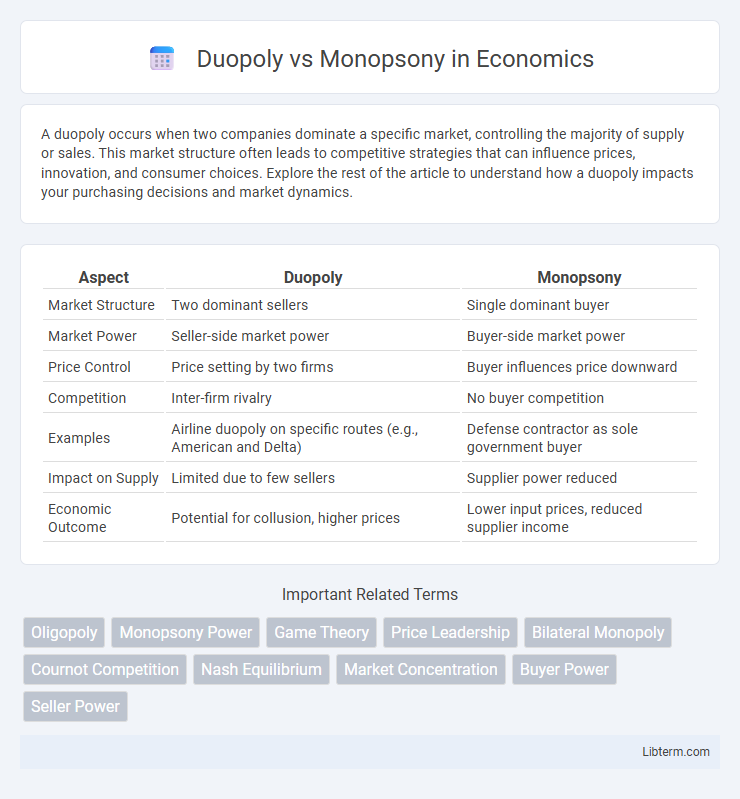

| Aspect | Duopoly | Monopsony |

|---|---|---|

| Market Structure | Two dominant sellers | Single dominant buyer |

| Market Power | Seller-side market power | Buyer-side market power |

| Price Control | Price setting by two firms | Buyer influences price downward |

| Competition | Inter-firm rivalry | No buyer competition |

| Examples | Airline duopoly on specific routes (e.g., American and Delta) | Defense contractor as sole government buyer |

| Impact on Supply | Limited due to few sellers | Supplier power reduced |

| Economic Outcome | Potential for collusion, higher prices | Lower input prices, reduced supplier income |

Understanding Duopoly and Monopsony: Key Definitions

A duopoly is a market structure characterized by two dominant firms controlling the majority of market share, leading to strategic interactions influencing prices and output. A monopsony occurs when a single buyer wields substantial market power over many sellers, affecting wage levels and supplier terms. Understanding these concepts is crucial for analyzing competitive behaviors and market equilibria in economics.

Market Structure Comparison: Duopoly vs Monopsony

A duopoly features two firms dominating a market, creating competitive interdependence that influences pricing and production decisions. In contrast, a monopsony consists of a single buyer controlling market demand, which allows significant power to influence supplier prices and output levels. While duopolies center on seller competition, monopsonies concentrate buyer power, shaping different market dynamics and economic outcomes.

Main Characteristics of Duopoly Markets

Duopoly markets feature two dominant firms that control the majority of market share, leading to strategic interactions in pricing and output decisions. These firms often engage in competitive behaviors such as price wars or collusion to maximize profits, impacting consumer choices and market efficiency. Barriers to entry are typically high, preserving the duopolistic structure and limiting competition from smaller players.

Core Features of Monopsony Markets

Monopsony markets are characterized by a single dominant buyer exerting significant control over suppliers, enabling the buyer to influence prices and terms of purchase. The core features include limited competition among buyers, which often leads to lower input costs and potentially suppresses supplier wages or prices below competitive levels. This market power creates an imbalance, contrasting with duopoly markets where two dominant sellers compete, often focusing on price or product differentiation strategies.

Price Determination Mechanisms

In duopoly markets, price determination hinges on strategic interaction between two dominant sellers who often engage in competitive pricing or collusion to influence market prices. Monopsony, characterized by a single buyer, sets prices primarily through its bargaining power, driving input prices down to maximize buyer surplus. The contrast lies in duopolies adjusting prices based on rival responses, while monopsonies leverage sole buyer dominance to dictate terms.

Impact on Consumers and Suppliers

A duopoly, characterized by two dominant firms, often leads to competitive pricing that benefits consumers with lower prices and improved product variety, while suppliers may face moderate negotiation power due to limited buyer concentration. In contrast, a monopsony features a single dominant buyer, which significantly reduces suppliers' bargaining power, leading to lower input prices and potentially reduced quality or supplier investment. Consumers in a monopsony might experience higher prices or fewer choices if the monopsonist uses its market power to suppress supplier innovation or limit product availability.

Strategic Behavior and Competition

In a duopoly, strategic behavior revolves around firms anticipating and reacting to each other's pricing, output, and innovation decisions to maximize market share and profits, often leading to competitive tactics such as price wars or product differentiation. In contrast, a monopsony exerts significant buyer power by controlling demand and influencing input prices, compelling suppliers to compete aggressively for market access under less favorable terms. The competitive dynamics in a duopoly foster mutual rivalry and interdependence, whereas a monopsony creates an imbalance where the single buyer dictates market conditions, limiting supplier bargaining power.

Real-World Examples of Duopoly and Monopsony

A duopoly in the real world is exemplified by the commercial aircraft manufacturing industry, dominated primarily by Boeing and Airbus, where two firms control most of the market share, influencing pricing and innovation. Monopsony cases appear in labor markets like professional sports leagues such as the NFL, where the league holds significant purchasing power over player contracts and salaries, limiting negotiating alternatives for athletes. These examples highlight how market structures shape competitive dynamics and bargaining power in specific industries.

Regulatory Challenges and Policy Responses

Regulatory challenges in duopolies often revolve around preventing collusion and market dominance that restrict competition, requiring antitrust laws and vigilant market monitoring. In contrast, monopsonies pose unique issues related to buyer power suppressing wages or supplier prices, necessitating policies like labor protections and supplier diversity initiatives. Effective responses include tailored enforcement strategies that address the specific market structures to ensure fair competition and economic balance.

Future Trends in Duopoly and Monopsony Markets

Duopoly and monopsony markets are expected to evolve with increased digitalization and data-driven decision-making, enhancing market transparency and competitive dynamics. Advances in artificial intelligence and blockchain technology may reduce entry barriers, intensifying competition in duopolistic markets while empowering buyers in monopsony scenarios through improved procurement efficiency. Regulatory frameworks will likely adapt to these technological shifts, aiming to balance market power and encourage innovation.

Duopoly Infographic

libterm.com

libterm.com