System dynamics modeling captures the complex interactions and feedback loops within dynamic systems, enabling a deeper understanding of how changes impact overall behavior over time. This approach is widely used in fields like business, environmental science, and engineering to simulate scenarios and improve decision-making processes. Explore the rest of this article to discover how system dynamics modeling can optimize your strategies and outcomes.

Table of Comparison

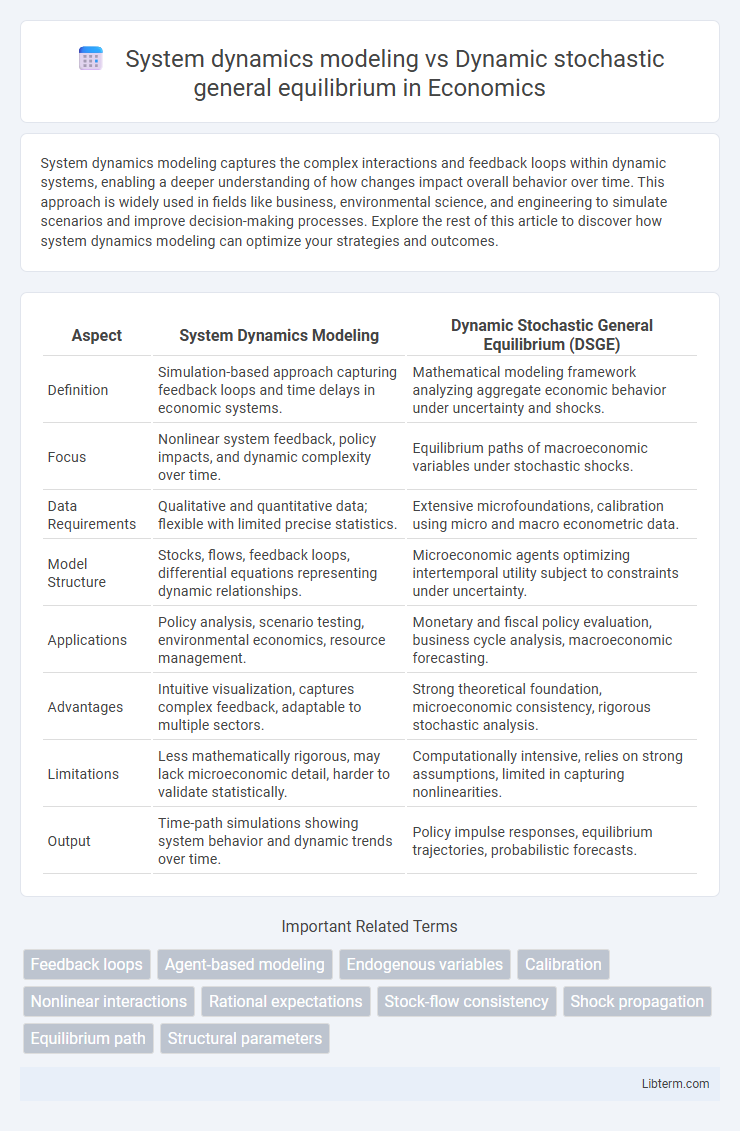

| Aspect | System Dynamics Modeling | Dynamic Stochastic General Equilibrium (DSGE) |

|---|---|---|

| Definition | Simulation-based approach capturing feedback loops and time delays in economic systems. | Mathematical modeling framework analyzing aggregate economic behavior under uncertainty and shocks. |

| Focus | Nonlinear system feedback, policy impacts, and dynamic complexity over time. | Equilibrium paths of macroeconomic variables under stochastic shocks. |

| Data Requirements | Qualitative and quantitative data; flexible with limited precise statistics. | Extensive microfoundations, calibration using micro and macro econometric data. |

| Model Structure | Stocks, flows, feedback loops, differential equations representing dynamic relationships. | Microeconomic agents optimizing intertemporal utility subject to constraints under uncertainty. |

| Applications | Policy analysis, scenario testing, environmental economics, resource management. | Monetary and fiscal policy evaluation, business cycle analysis, macroeconomic forecasting. |

| Advantages | Intuitive visualization, captures complex feedback, adaptable to multiple sectors. | Strong theoretical foundation, microeconomic consistency, rigorous stochastic analysis. |

| Limitations | Less mathematically rigorous, may lack microeconomic detail, harder to validate statistically. | Computationally intensive, relies on strong assumptions, limited in capturing nonlinearities. |

| Output | Time-path simulations showing system behavior and dynamic trends over time. | Policy impulse responses, equilibrium trajectories, probabilistic forecasts. |

Introduction to System Dynamics Modeling and DSGE

System dynamics modeling is a methodology used for understanding complex feedback systems and capturing nonlinear interactions through stocks, flows, and time delays in economic and social systems. Dynamic Stochastic General Equilibrium (DSGE) models are grounded in microeconomic theory, incorporating stochastic shocks and agent optimization to describe macroeconomic behavior under uncertainty. While system dynamics emphasizes qualitative insights and policy simulations, DSGE models focus on quantitative equilibrium analysis within a stochastic framework.

Core Concepts of System Dynamics Modeling

System dynamics modeling centers on feedback loops, stock and flow structures, and time delays to simulate complex systems over time, emphasizing endogenous behavior and policy resistance. It uses causal loop diagrams and differential equations to capture nonlinear interactions and accumulations within social, economic, or ecological systems. In contrast, Dynamic Stochastic General Equilibrium (DSGE) models rely on micro-founded optimization under uncertainty and rational expectations but often overlook the rich feedback structures and delays fundamental to system dynamics.

Fundamental Principles of DSGE Models

Dynamic stochastic general equilibrium (DSGE) models are grounded in microeconomic foundations, incorporating rational expectations and market-clearing conditions to analyze macroeconomic policy effects under uncertainty. They utilize stochastic shocks to capture random economic fluctuations and derive equilibrium outcomes by solving intertemporal optimization problems faced by agents in a general equilibrium framework. Unlike system dynamics modeling, which emphasizes feedback loops and stock-flow structures for dynamic behavior, DSGE models focus on equilibrium conditions driven by optimizing behavior under stochastic processes.

Comparative Methodological Approaches

System dynamics modeling emphasizes feedback loops and time delays within complex systems, using differential equations to simulate non-linear behaviors over time. Dynamic stochastic general equilibrium (DSGE) models rely on micro-founded optimization principles under uncertainty, applying stochastic shocks within equilibrium frameworks to analyze macroeconomic policies. While system dynamics captures qualitative system behavior and endogenous structure changes, DSGE provides quantitatively rigorous, equilibrium-based predictions with explicit microeconomic foundations.

Modeling Assumptions and Real-World Applications

System dynamics modeling assumes feedback loops and time delays within non-linear systems to capture dynamic behavior, often applied in policy analysis and business strategy simulation. Dynamic stochastic general equilibrium (DSGE) models are built on microeconomic foundations with rational expectations and stochastic shocks, primarily used in macroeconomic forecasting and monetary policy evaluation. While system dynamics emphasizes adaptability and qualitative insights across diverse sectors, DSGE focuses on equilibrium conditions and quantitative macroeconomic data validation.

Strengths and Weaknesses of System Dynamics

System dynamics modeling excels at capturing feedback loops, time delays, and nonlinear relationships within complex systems, making it ideal for understanding long-term behavior and policy impacts in macroeconomic and environmental contexts. Its qualitative approach allows for scenario analysis without requiring precise parameter estimation, but it may lack the rigorous microfoundations and stochastic elements present in Dynamic Stochastic General Equilibrium (DSGE) models. This limitation reduces its ability to handle shocks and uncertainties quantitatively, limiting predictive accuracy in highly stochastic economic environments.

Advantages and Limitations of DSGE Models

Dynamic stochastic general equilibrium (DSGE) models provide a structured framework for analyzing macroeconomic policy by incorporating microeconomic foundations and stochastic shocks, enabling the evaluation of policy impacts under uncertainty. The main advantages of DSGE models include their theoretical consistency, ability to capture general equilibrium effects, and suitability for quantitative policy analysis. However, limitations include their reliance on strong assumptions such as rational expectations and representative agents, difficulty in accurately modeling real-world frictions, and challenges in capturing heterogeneous agent behavior and financial market complexities.

Empirical Validation and Calibration Techniques

System dynamics modeling employs empirical validation through historical data comparison and sensitivity analysis, focusing on feedback loops and system structure to ensure model accuracy. Dynamic stochastic general equilibrium (DSGE) models rely on Bayesian estimation and calibration using macroeconomic time series data, emphasizing structural parameter identification under stochastic shocks. Calibration techniques in DSGE models include likelihood-based methods and impulse response matching, whereas system dynamics models prioritize iterative adjustments to align simulated outcomes with observed system behavior.

Use Cases: Policy Analysis and Economic Forecasting

System dynamics modeling excels in policy analysis by capturing feedback loops and nonlinear relationships within complex socioeconomic systems, making it ideal for scenario testing of regulatory impacts and resource management. Dynamic stochastic general equilibrium (DSGE) models provide rigorous economic forecasting through micro-founded equations that incorporate shocks and agents' expectations, supporting monetary and fiscal policy evaluation under uncertainty. Both approaches complement each other: system dynamics offers holistic insights into systemic behavior, while DSGE models deliver quantifiable projections based on equilibrium conditions.

Future Directions in Economic Simulation Modeling

Future directions in economic simulation modeling emphasize integrating system dynamics modeling's feedback loops and non-linear behaviors with DSGE models' micro-founded stochastic elements to capture complex economic realities more accurately. Advancements include enhancing computational efficiency, incorporating heterogeneous agent behaviors, and applying machine learning algorithms for parameter estimation and scenario analysis. These improvements aim to generate robust, policy-relevant forecasts that better reflect dynamic economic interactions and uncertainty.

System dynamics modeling Infographic

libterm.com

libterm.com