The risk-free rate represents the theoretical return on an investment with zero risk of financial loss, often approximated using government treasury bonds. It serves as a critical benchmark in finance for valuing securities and calculating the cost of capital. Explore the rest of the article to understand how the risk-free rate impacts your investment decisions and portfolio management.

Table of Comparison

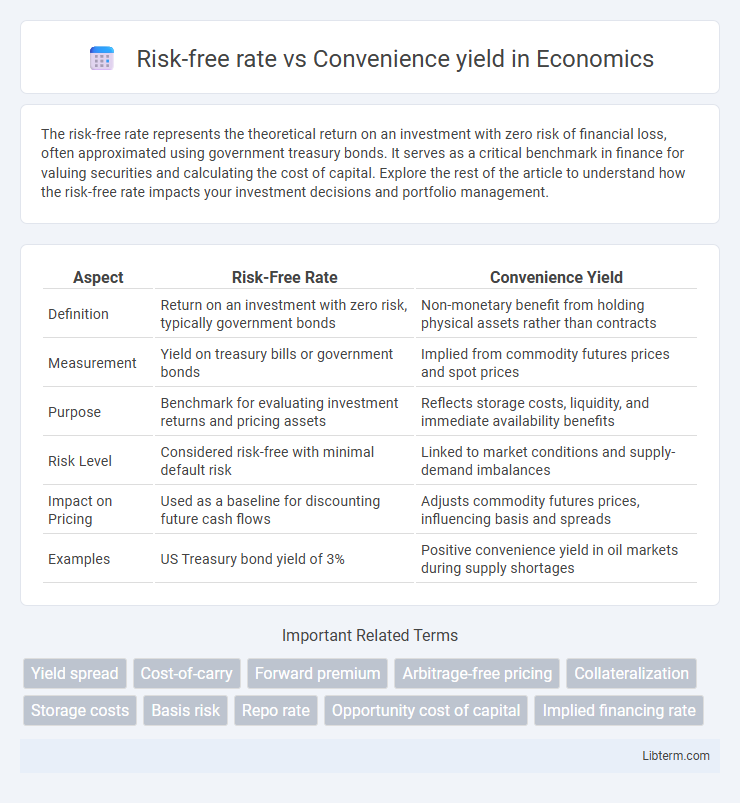

| Aspect | Risk-Free Rate | Convenience Yield |

|---|---|---|

| Definition | Return on an investment with zero risk, typically government bonds | Non-monetary benefit from holding physical assets rather than contracts |

| Measurement | Yield on treasury bills or government bonds | Implied from commodity futures prices and spot prices |

| Purpose | Benchmark for evaluating investment returns and pricing assets | Reflects storage costs, liquidity, and immediate availability benefits |

| Risk Level | Considered risk-free with minimal default risk | Linked to market conditions and supply-demand imbalances |

| Impact on Pricing | Used as a baseline for discounting future cash flows | Adjusts commodity futures prices, influencing basis and spreads |

| Examples | US Treasury bond yield of 3% | Positive convenience yield in oil markets during supply shortages |

Understanding the Risk-Free Rate

The risk-free rate represents the theoretical return on an investment with zero default risk, often proxied by government treasury yields, serving as a benchmark for pricing financial assets. Understanding the risk-free rate involves recognizing its role in discounting future cash flows and evaluating investment performance independent of credit risk. Convenience yield, in contrast, reflects the non-monetary benefits of holding certain physical assets, which can cause deviations in futures prices from the risk-free rate-based expectations.

Defining Convenience Yield

Convenience yield represents the non-monetary benefit or premium associated with holding a physical commodity rather than holding a contract or derivative, reflecting factors like storage costs, liquidity, and immediate availability. Unlike the risk-free rate, which signifies the theoretical return on an investment with zero risk, convenience yield captures the intangible advantages of ownership in commodities markets. This yield influences futures pricing by accounting for the convenience or utility derived from possessing the physical asset, often causing futures prices to deviate from the cost of carry model.

Key Differences Between Risk-Free Rate and Convenience Yield

The risk-free rate represents the return on an investment with zero risk, typically government treasury bonds, while convenience yield reflects the non-monetary benefits of holding a physical commodity rather than a contract or derivative. Risk-free rate is a fundamental input in financial models for discounting cash flows, whereas convenience yield is crucial in commodity pricing to capture benefits like immediate availability and reduced storage costs. Key differences include risk-free rate's basis in credit risk absence versus convenience yield's origin in supply-demand imbalances and market conditions specific to physical assets.

Importance of the Risk-Free Rate in Financial Markets

The risk-free rate represents the theoretical return on an investment with zero risk, serving as the foundational benchmark for pricing assets and calculating the cost of capital in financial markets. Its importance lies in providing a baseline for valuing securities, enabling investors to assess risk premiums and make informed decisions. Unlike convenience yield, which reflects the non-monetary benefits of holding physical assets, the risk-free rate underpins models like the Capital Asset Pricing Model (CAPM) and influences interest rates, derivatives pricing, and portfolio optimization strategies.

Role of Convenience Yield in Commodity Pricing

Convenience yield represents the non-monetary benefits of physically holding a commodity, influencing futures contract prices by creating a premium over the risk-free rate. This yield accounts for factors such as storage costs, availability, and immediate demand, which affect spot and futures price relationships. When convenience yield is high, it signals scarcity or strong demand, leading to backwardation where spot prices exceed futures prices despite the underlying risk-free rate.

Factors Influencing the Risk-Free Rate

The risk-free rate is primarily influenced by government monetary policy, inflation expectations, and the overall economic environment, as it reflects the return on an asset with zero default risk, such as U.S. Treasury securities. In contrast, convenience yield arises from the benefits of holding a physical commodity, including liquidity and immediate availability, which do not directly impact the risk-free rate. Market demand for safe assets and investors' risk appetite also shape the risk-free rate, differentiating it from the convenience yield derived from holding inventory or secured access to essential goods.

Determinants of Convenience Yield

Convenience yield is primarily determined by factors such as asset scarcity, storage costs, and demand for immediate physical possession of the commodity, influencing its non-monetary benefits. Unlike the risk-free rate, which reflects the time value of money and default risk, convenience yield captures the intangible advantage of holding the physical asset, especially during supply disruptions or high inventory risk. Market conditions, seasonality, and asset-specific characteristics also play crucial roles in shaping the convenience yield, impacting futures pricing and hedging strategies.

Practical Applications in Investment Strategies

The risk-free rate serves as the benchmark for evaluating the opportunity cost of capital in investment portfolios, guiding asset allocation and pricing models such as the Capital Asset Pricing Model (CAPM). Convenience yield represents the non-monetary benefits of holding physical commodities, influencing futures pricing and inventory decisions in commodities markets. Incorporating both metrics enables investors to optimize strategies by balancing guaranteed returns against strategic advantages from asset accessibility and market conditions.

Impact on Derivatives and Futures Valuation

The risk-free rate represents the theoretical return on an investment with zero default risk and serves as a fundamental input in discounting future cash flows for derivatives and futures valuation. Convenience yield reflects the non-monetary benefits of holding the underlying asset, such as storage advantages or supply security, impacting futures prices by adjusting the cost-of-carry model. The divergence between the risk-free rate and convenience yield influences the fair value of futures contracts, where a higher convenience yield relative to the risk-free rate often leads to backwardation, altering hedging and pricing strategies in derivatives markets.

Summary: Choosing Between Risk-Free Rate and Convenience Yield

The risk-free rate represents the theoretical return on an investment with zero default risk, commonly derived from government bond yields, serving as a benchmark for pricing and valuation models. Convenience yield reflects the non-monetary benefits of holding a physical commodity, such as liquidity, immediate availability, and protection against supply disruptions, which influences futures pricing and inventory decisions. Selecting between the risk-free rate and convenience yield depends on the context: financial assets prioritize the risk-free rate for opportunity cost measurements, while commodity markets emphasize convenience yield due to its impact on holding incentives and market dynamics.

Risk-free rate Infographic

libterm.com

libterm.com