The Keynes Effect describes how lower interest rates, triggered by decreased price levels, stimulate increased investment and consumption, leading to higher aggregate demand. This mechanism plays a crucial role in restoring economic equilibrium during deflationary periods by encouraging spending and reducing unemployment. Explore the rest of the article to understand how this effect influences your economic decisions and policy-making.

Table of Comparison

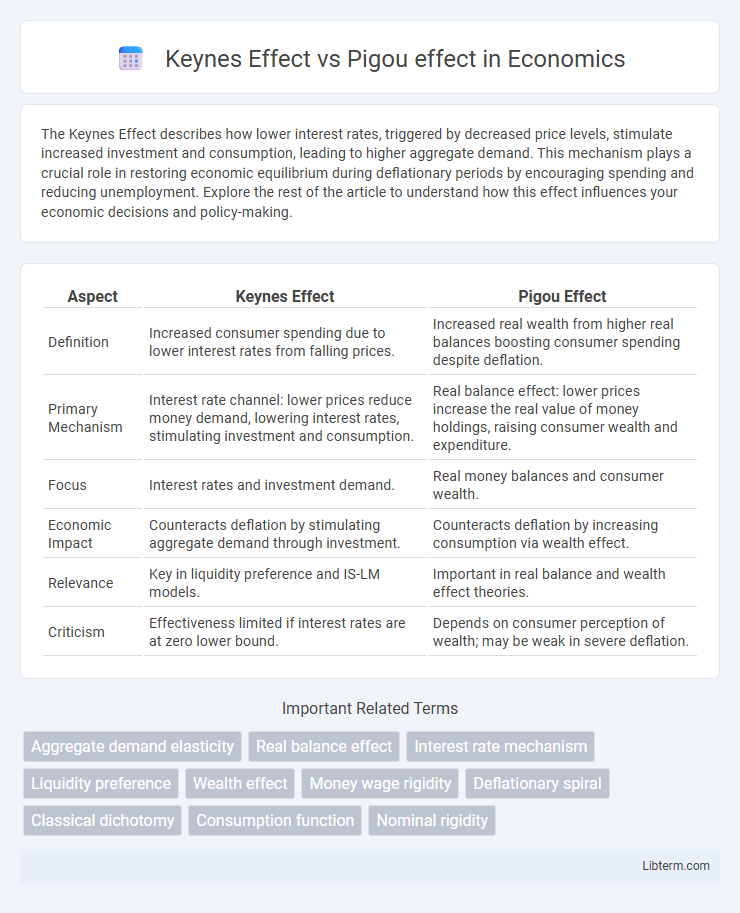

| Aspect | Keynes Effect | Pigou Effect |

|---|---|---|

| Definition | Increased consumer spending due to lower interest rates from falling prices. | Increased real wealth from higher real balances boosting consumer spending despite deflation. |

| Primary Mechanism | Interest rate channel: lower prices reduce money demand, lowering interest rates, stimulating investment and consumption. | Real balance effect: lower prices increase the real value of money holdings, raising consumer wealth and expenditure. |

| Focus | Interest rates and investment demand. | Real money balances and consumer wealth. |

| Economic Impact | Counteracts deflation by stimulating aggregate demand through investment. | Counteracts deflation by increasing consumption via wealth effect. |

| Relevance | Key in liquidity preference and IS-LM models. | Important in real balance and wealth effect theories. |

| Criticism | Effectiveness limited if interest rates are at zero lower bound. | Depends on consumer perception of wealth; may be weak in severe deflation. |

Introduction to Keynes Effect and Pigou Effect

The Keynes Effect describes how a decline in interest rates stimulates investment and increases aggregate demand, addressing liquidity preference and money market equilibrium. The Pigou Effect, also known as the real balance effect, explains how falling price levels raise real wealth and consumption by increasing the real value of money holdings. Both effects illustrate mechanisms through which changes in price levels influence overall economic demand and output.

Historical Context of the Keynes and Pigou Effects

The Keynes Effect and Pigou Effect emerged during the Great Depression, with John Maynard Keynes developing his theory to argue that insufficient aggregate demand causes prolonged unemployment. Arthur Cecil Pigou introduced the Pigou Effect as a counterargument, emphasizing real balance effects where lower prices increase real wealth and thus boost consumption. Both concepts reflect contrasting responses to deflationary gaps in early 20th-century macroeconomic thought, shaping fiscal and monetary policy debates.

Defining the Keynes Effect

The Keynes Effect refers to the mechanism by which a fall in the price level increases real money balances, lowers interest rates, and stimulates investment and aggregate demand in the economy. This effect highlights the liquidity preference theory, where lower interest rates encourage borrowing and spending, boosting output and employment. In contrast, the Pigou Effect centers on the real balance effect, where increased real wealth from lower price levels raises consumption directly.

Explaining the Pigou Effect

The Pigou Effect, also known as the real balance effect, posits that a decrease in the price level increases the real value of money holdings, boosting consumer wealth and thus stimulating higher consumption and aggregate demand. This effect contrasts with the Keynes Effect, which emphasizes changes in interest rates influencing investment demand. By restoring aggregate demand through enhanced purchasing power, the Pigou Effect plays a crucial role in self-correcting deflationary gaps in macroeconomic models.

Core Differences: Keynes Effect vs Pigou Effect

The Keynes Effect emphasizes how changes in interest rates influence investment and aggregate demand, driven by liquidity preference and money supply dynamics. The Pigou Effect focuses on real wealth changes through price level adjustments affecting consumer spending and aggregate demand. Core differences lie in the mechanisms: Keynes highlights interest rate-induced investment shifts, while Pigou stresses price-induced real balance variations impacting consumption.

Mechanisms: How Keynes and Pigou Effects Influence Aggregate Demand

The Keynes Effect operates through interest rate adjustments, where a decline in the price level increases real money balances, lowers interest rates, and stimulates investment, thereby boosting aggregate demand. In contrast, the Pigou Effect focuses on real wealth changes, suggesting that a lower price level raises the real value of money holdings, increasing consumer wealth and consumption, which directly enhances aggregate demand. Both effects highlight different mechanisms--interest rate sensitivity versus real wealth perception--that influence aggregate demand in macroeconomic models.

Assumptions Underlying Each Effect

The Keynes Effect assumes rigid prices and wages, causing interest rates to adjust to restore equilibrium in money markets when output changes. The Pigou Effect relies on real balance changes, presupposing flexible prices and wages so that a price level drop increases real wealth and thus stimulates consumption. Both effects differ fundamentally in their assumptions about price flexibility and the mechanism through which changes in output influence aggregate demand.

Real-World Applications and Evidence

The Keynes Effect highlights how lower interest rates boost investment and aggregate demand during economic downturns, demonstrating significant influence in monetary policy effectiveness observed in post-2008 recession recovery efforts. The Pigou Effect emphasizes increases in real wealth through price level decreases, nudging consumption upward, yet empirical evidence suggests this mechanism is less potent in modern economies with complex financial systems. Real-world data shows that while Keynesian policies often stimulate short-term growth, reliance on the Pigou Effect alone rarely triggers substantial self-correcting economic rebounds.

Policy Implications: Fiscal and Monetary Perspectives

The Keynes Effect emphasizes the role of interest rates in adjusting investment and aggregate demand, advocating for active monetary policy to stimulate economic activity during recessions by lowering interest rates. In contrast, the Pigou Effect highlights the importance of real wealth effects on consumption, supporting fiscal policies that increase wealth or transfer payments to boost spending. Policymakers must balance monetary interventions to influence liquidity preferences and fiscal measures targeting wealth redistribution to effectively manage aggregate demand and stabilize the economy.

Conclusion: Significance in Modern Macroeconomics

The Keynes Effect emphasizes interest rate adjustments influencing aggregate demand through investment changes, while the Pigou Effect highlights real wealth effects on consumption via changes in real balances. Both effects are crucial in modern macroeconomics, as they explain different mechanisms for restoring equilibrium during economic fluctuations. Understanding their interplay aids policymakers in designing effective fiscal and monetary responses to stabilize output and employment.

Keynes Effect Infographic

libterm.com

libterm.com