Value-added tax (VAT) is a consumption tax applied at each stage of the production and distribution process, based on the value added to goods and services. Businesses collect VAT on behalf of the government, making it essential to understand its impact on pricing and accounting. Explore the article to learn how VAT affects your transactions and compliance requirements.

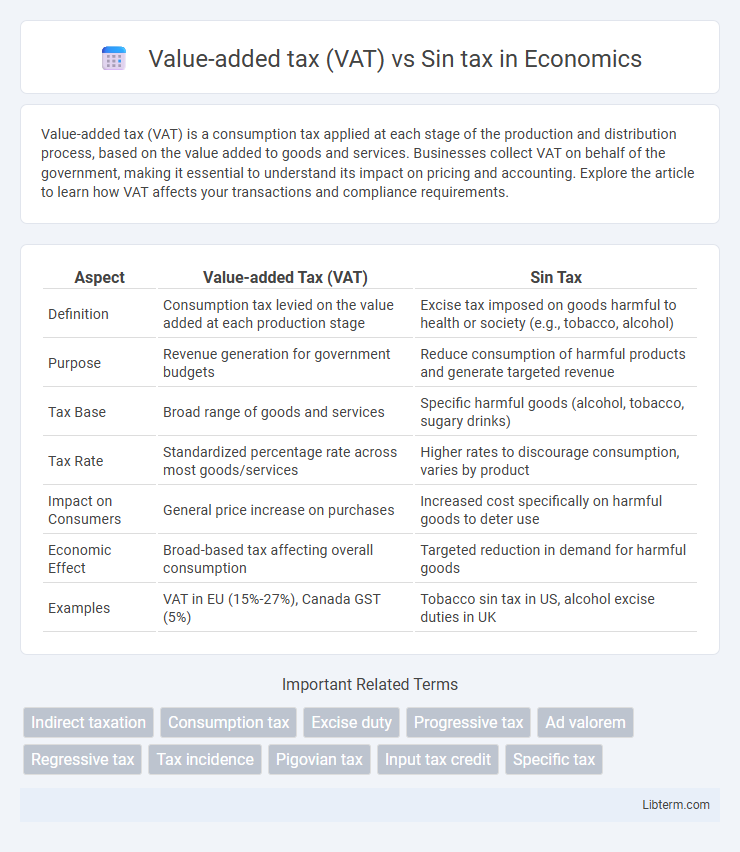

Table of Comparison

| Aspect | Value-added Tax (VAT) | Sin Tax |

|---|---|---|

| Definition | Consumption tax levied on the value added at each production stage | Excise tax imposed on goods harmful to health or society (e.g., tobacco, alcohol) |

| Purpose | Revenue generation for government budgets | Reduce consumption of harmful products and generate targeted revenue |

| Tax Base | Broad range of goods and services | Specific harmful goods (alcohol, tobacco, sugary drinks) |

| Tax Rate | Standardized percentage rate across most goods/services | Higher rates to discourage consumption, varies by product |

| Impact on Consumers | General price increase on purchases | Increased cost specifically on harmful goods to deter use |

| Economic Effect | Broad-based tax affecting overall consumption | Targeted reduction in demand for harmful goods |

| Examples | VAT in EU (15%-27%), Canada GST (5%) | Tobacco sin tax in US, alcohol excise duties in UK |

Introduction to Value-Added Tax (VAT) and Sin Tax

Value-Added Tax (VAT) is a consumption tax levied at each stage of production or distribution on the added value of goods and services, enhancing government revenue through widespread application across various sectors. Sin tax specifically targets products deemed harmful, such as tobacco, alcohol, and sugary drinks, aiming to reduce consumption by increasing their prices, thereby promoting public health. While VAT affects a broad range of goods and services, sin tax serves as both a fiscal tool and a behavioral regulator by discouraging unhealthy habits.

Definition and Core Principles of VAT

Value-added tax (VAT) is a consumption tax levied on the value added at each stage of production or distribution of goods and services, ensuring tax is collected incrementally. VAT's core principles include tax neutrality, where businesses act as tax collectors without bearing the final tax burden, and broad tax base coverage, minimizing exemptions to increase revenue efficiency. Sin tax, in contrast, targets specific goods like tobacco and alcohol to discourage unhealthy behaviors while generating government revenue, differing fundamentally from the general application and structure of VAT.

Definition and Core Principles of Sin Tax

Value-added tax (VAT) is a consumption tax levied at each stage of the production and distribution process based on the value added to goods and services, while sin tax specifically targets products considered harmful to health or society, such as tobacco, alcohol, and sugary beverages. The core principles of sin tax involve discouraging consumption of harmful goods, improving public health outcomes, and generating government revenue to offset social costs. Sin taxes are typically set at higher rates than VAT to create a price deterrent that reflects the external costs associated with these goods.

Key Differences Between VAT and Sin Tax

Value-added tax (VAT) is a consumption tax levied on the value added to goods and services at each stage of production or distribution, typically charged as a percentage of the sale price. Sin tax targets specific products deemed harmful, such as tobacco, alcohol, and sugary drinks, aiming to reduce consumption through higher tax rates. Unlike VAT, which applies broadly across many goods and services, sin tax is selective and functions both as a revenue source and a public health tool.

Economic Impact of VAT vs Sin Tax

Value-added tax (VAT) generates broad-based government revenue by taxing consumption across most goods and services, promoting fiscal stability and funding public services without targeting specific behaviors. Sin tax specifically targets goods like tobacco, alcohol, and sugary drinks, aiming to reduce consumption of harmful products while generating revenue that can offset public health costs. Economically, VAT sustains wide economic activities by uniformly increasing prices, whereas sin tax influences market behavior by discouraging unhealthy consumption, potentially lowering long-term healthcare costs and productivity losses.

Revenue Generation: Comparing VAT and Sin Tax

Value-added tax (VAT) generates broad-based revenue by applying a percentage charge on the value added to goods and services at each production stage, making it a significant contributor to national budgets. Sin tax, levied specifically on products like tobacco, alcohol, and sugary beverages, aims to reduce consumption while generating targeted revenue for healthcare and social programs. While VAT ensures consistent income across multiple sectors, sin tax provides both fiscal benefits and public health incentives by discouraging harmful behaviors.

Social Implications of VAT and Sin Tax

Value-added tax (VAT) generates revenue through broad-based consumption taxes, often impacting lower-income households disproportionately due to its regressive nature, potentially exacerbating social inequality. Sin taxes, imposed on products like tobacco and alcohol, aim to reduce harmful behaviors while funding healthcare and social programs, which can improve public health outcomes but may also disproportionately burden disadvantaged groups. Both tax types influence social behavior and equity, necessitating careful policy design to balance revenue generation with social welfare objectives.

Administration and Collection Processes

Value-added tax (VAT) is administered through a system of invoicing and input tax credits, requiring businesses to charge VAT on sales and remit the net difference to tax authorities, ensuring comprehensive tracking and compliance. Sin tax is typically imposed on specific goods like tobacco or alcohol, collected at production or import points, with simpler but targeted administration to discourage consumption of harmful products. Both taxes rely on effective enforcement and monitoring, but VAT's broad base necessitates extensive record-keeping, whereas sin tax hinges on controlling supply chains for particular goods.

Global Examples: VAT and Sin Tax in Practice

Value-added tax (VAT) is a consumption tax levied at each stage of the supply chain, commonly applied worldwide with rates ranging from 5% in Canada to over 25% in Sweden, while sin taxes specifically target goods like tobacco, alcohol, and sugary drinks to reduce consumption, exemplified by Mexico's soda tax and the United Kingdom's high duty on cigarettes and spirits. Countries such as India implement both VAT and sin taxes, with VAT applied broadly on goods and services and sin taxes imposed on liquor and tobacco to address public health concerns. In Australia, the Goods and Services Tax (GST) at 10% functions as a VAT system, alongside significant excise duties on tobacco and alcohol products serving as sin taxes to discourage harmful consumption.

Conclusion: Choosing the Right Tax Approach

Value-added tax (VAT) provides a broad-based revenue stream by taxing consumption at multiple stages, enhancing tax compliance and economic efficiency. Sin tax targets specific goods like tobacco and alcohol to curb harmful behavior while generating dedicated funds for public health initiatives. Selecting the appropriate tax depends on policy objectives: VAT suits general revenue needs, whereas sin tax effectively promotes public health and discourages consumption of harmful products.

Value-added tax (VAT) Infographic

libterm.com

libterm.com