Interest rate cuts can stimulate economic growth by lowering borrowing costs, encouraging businesses and consumers to invest and spend more. These adjustments influence inflation and employment levels, making them critical tools for central banks in managing economic stability. Explore the rest of the article to understand how interest rate cuts impact your finances and the broader economy.

Table of Comparison

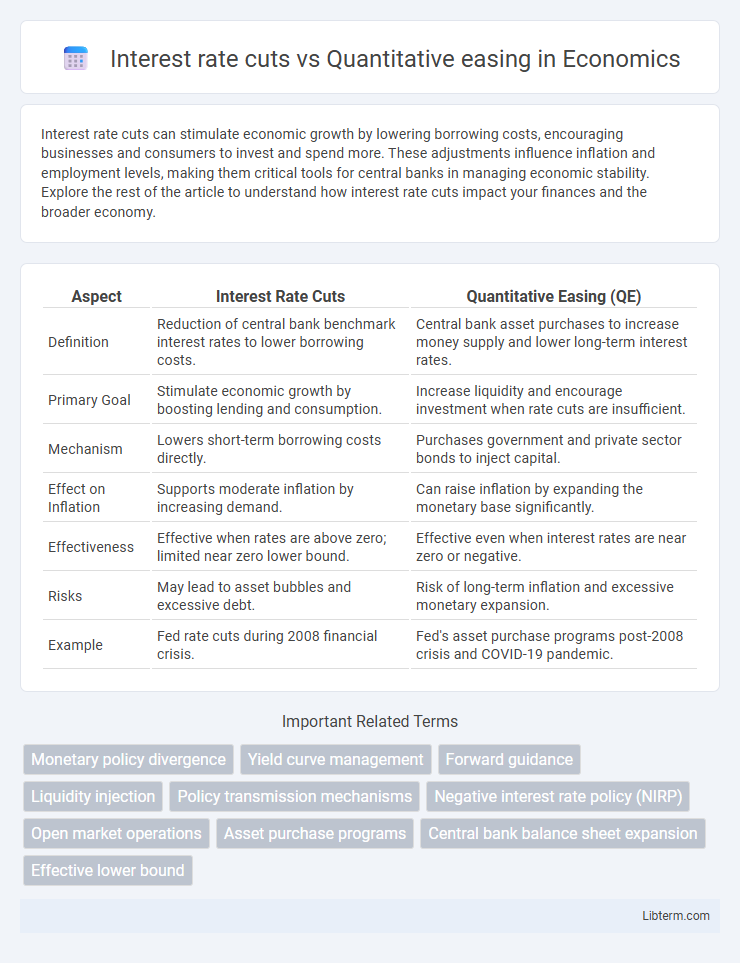

| Aspect | Interest Rate Cuts | Quantitative Easing (QE) |

|---|---|---|

| Definition | Reduction of central bank benchmark interest rates to lower borrowing costs. | Central bank asset purchases to increase money supply and lower long-term interest rates. |

| Primary Goal | Stimulate economic growth by boosting lending and consumption. | Increase liquidity and encourage investment when rate cuts are insufficient. |

| Mechanism | Lowers short-term borrowing costs directly. | Purchases government and private sector bonds to inject capital. |

| Effect on Inflation | Supports moderate inflation by increasing demand. | Can raise inflation by expanding the monetary base significantly. |

| Effectiveness | Effective when rates are above zero; limited near zero lower bound. | Effective even when interest rates are near zero or negative. |

| Risks | May lead to asset bubbles and excessive debt. | Risk of long-term inflation and excessive monetary expansion. |

| Example | Fed rate cuts during 2008 financial crisis. | Fed's asset purchase programs post-2008 crisis and COVID-19 pandemic. |

Understanding Interest Rate Cuts

Interest rate cuts involve central banks lowering the benchmark interest rates to reduce borrowing costs, stimulate economic growth, and encourage consumer spending and business investment. This monetary policy tool directly influences short-term interest rates, making loans and credit cheaper for individuals and corporations. Unlike quantitative easing, which increases money supply by purchasing financial assets, interest rate cuts immediately affect lending rates and aggregate demand.

What is Quantitative Easing?

Quantitative easing (QE) is a monetary policy tool used by central banks to stimulate the economy by purchasing long-term securities, such as government bonds and mortgage-backed assets, to increase money supply and lower long-term interest rates. QE aims to encourage lending and investment when traditional interest rate cuts have limited effectiveness, particularly during periods of near-zero interest rates. By expanding the central bank's balance sheet, QE helps to boost asset prices, improve market liquidity, and support economic growth.

Key Differences Between Interest Rate Cuts and Quantitative Easing

Interest rate cuts involve reducing the benchmark interest rate set by central banks to lower borrowing costs and stimulate economic activity, directly influencing consumer and business loans. Quantitative easing (QE) is an unconventional monetary policy where central banks purchase long-term securities to increase money supply and encourage lending when interest rates are already near zero. The key difference lies in the mechanism: interest rate cuts adjust short-term borrowing costs, while QE injects liquidity into the financial system by expanding central bank balance sheets.

How Interest Rate Cuts Stimulate the Economy

Interest rate cuts lower the borrowing costs for consumers and businesses, encouraging increased spending and investment. Lower rates reduce monthly loan payments, boosting disposable income and consumer demand, which drives economic growth. Central banks use this tool to directly influence credit availability and stimulate faster economic expansion during downturns.

The Mechanism of Quantitative Easing

Quantitative easing (QE) involves central banks purchasing long-term securities to inject liquidity directly into the financial system, lowering long-term interest rates and encouraging lending and investment. Unlike interest rate cuts that influence short-term borrowing costs, QE targets broader financial conditions by expanding the money supply and increasing asset prices. This mechanism helps stimulate economic growth when conventional monetary policy tools are limited by near-zero interest rates.

Situations Favoring Interest Rate Cuts

Interest rate cuts are favored in situations where central banks aim to stimulate borrowing and consumer spending by lowering the cost of credit, especially during mild economic slowdowns or when inflation is below target. They are effective in boosting short-term economic activity by directly influencing lending rates for businesses and households. Interest rate cuts are less complex to implement and signal monetary easing more transparently than quantitative easing, making them the preferred tool when financial markets remain relatively stable.

When Central Banks Choose Quantitative Easing

Central banks choose quantitative easing when conventional interest rate cuts reach their lower bound and fail to stimulate economic growth effectively. This monetary policy involves large-scale asset purchases to increase the money supply and lower long-term interest rates, targeting financial market liquidity and credit expansion. Quantitative easing is typically implemented during severe recessions or deflationary periods when traditional rate cuts alone cannot revive demand.

Impact on Financial Markets: Interest Rates vs. QE

Interest rate cuts directly lower borrowing costs, stimulating lending and investment, which often leads to immediate declines in bond yields and boosts stock prices. Quantitative easing (QE) involves central banks purchasing assets to inject liquidity, suppress longer-term interest rates, and support asset prices beyond the effects of conventional rate adjustments. Both tools enhance market liquidity, but QE exerts more influence on long-duration bonds and broader financial conditions, while rate cuts primarily affect short-term borrowing costs.

Risks and Limitations of Each Policy Tool

Interest rate cuts can lead to diminished returns for savers and may trigger inflation if lowered excessively, while their effectiveness wanes when rates approach zero, limiting monetary policy space. Quantitative easing carries risks of asset bubbles, increased income inequality by inflating financial asset prices, and may cause long-term inflationary pressures due to expanded central bank balance sheets. Both tools face limitations in stimulating real economic growth if structural issues like low productivity or fiscal imbalances remain unaddressed.

Long-Term Economic Implications

Interest rate cuts stimulate borrowing and spending by lowering the cost of credit, promoting short-term economic growth but potentially fueling inflation if maintained for extended periods. Quantitative easing involves central banks purchasing large-scale assets to increase money supply, aiming to stabilize financial markets and encourage lending during crises, yet risks asset bubbles and long-term inflationary pressures. Over time, reliance on quantitative easing may weaken central bank balance sheets and reduce policy effectiveness, while sustained low interest rates can distort savings and investment decisions, affecting economic stability.

Interest rate cuts Infographic

libterm.com

libterm.com