Traditional econometric policy models rely on historical data and statistical techniques to forecast economic outcomes and guide decision-making processes. These models often use linear equations to capture relationships between macroeconomic variables, providing a foundation for analyzing policy impacts on growth, inflation, and employment. Explore the rest of the article to understand how these models influence your economic policy decisions.

Table of Comparison

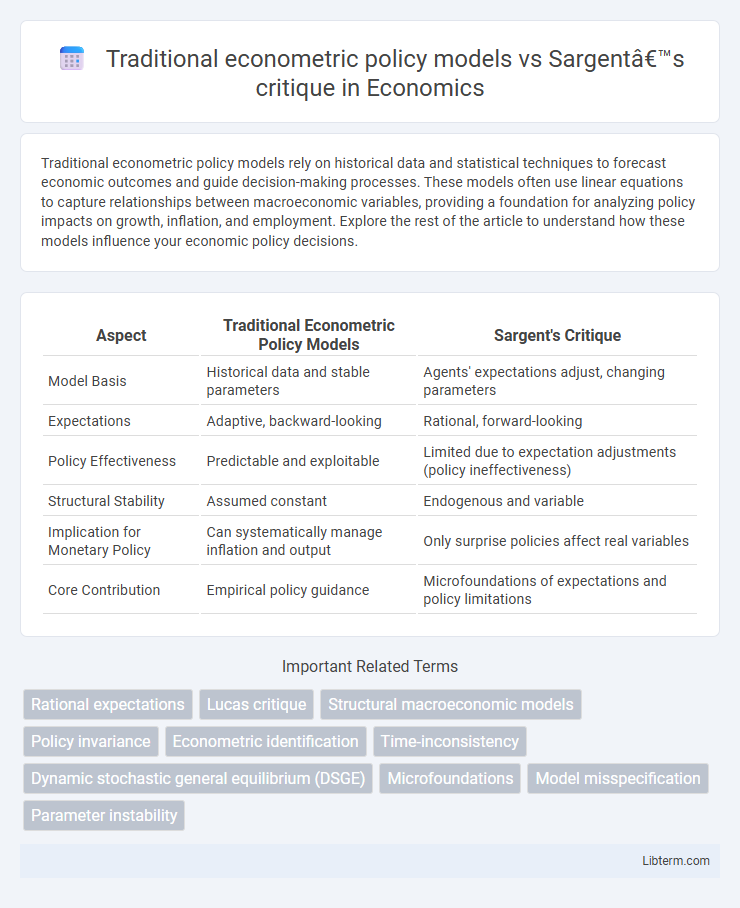

| Aspect | Traditional Econometric Policy Models | Sargent's Critique |

|---|---|---|

| Model Basis | Historical data and stable parameters | Agents' expectations adjust, changing parameters |

| Expectations | Adaptive, backward-looking | Rational, forward-looking |

| Policy Effectiveness | Predictable and exploitable | Limited due to expectation adjustments (policy ineffectiveness) |

| Structural Stability | Assumed constant | Endogenous and variable |

| Implication for Monetary Policy | Can systematically manage inflation and output | Only surprise policies affect real variables |

| Core Contribution | Empirical policy guidance | Microfoundations of expectations and policy limitations |

Introduction to Traditional Econometric Policy Models

Traditional econometric policy models rely on historical data and assume stable behavioral relationships to forecast economic outcomes and guide policy decisions. These models typically employ structural equations based on observed correlations between variables under the premise of policy invariance. The approach assumes that parameters remain constant despite changes in policy, allowing policymakers to predict effects through estimated econometric functions.

Core Assumptions of Econometric Models

Traditional econometric policy models rely on the assumptions of stable, linear relationships and rational expectations to predict economic outcomes, assuming agents respond consistently to policy changes. Sargent's critique highlights the failure of these models to account for agents' adaptive expectations and the dynamic nature of policy effects, emphasizing that policy interventions can alter behavior and invalidate model predictions. Core assumptions challenged include the exogeneity of policy variables and the constancy of structural parameters over time.

Historical Impact of Econometric Policy Approaches

Traditional econometric policy models relied heavily on historical data correlations to predict economic outcomes, assuming stable relationships over time. Sargent's critique, emphasizing rational expectations, challenged this by demonstrating that policy agents adjust their behavior in response to anticipated policies, undermining the reliability of these models. This shift led to the development of new dynamic stochastic general equilibrium (DSGE) models, transforming macroeconomic policy analysis and reinforcing the importance of expectations in economic decision-making.

The Lucas Critique and Its Foundations

Traditional econometric policy models often rely on historical data correlations assuming stable behavioral relationships, neglecting how policy changes can alter these relationships. Robert Lucas's critique fundamentally challenges this approach by emphasizing that policy evaluations must account for changes in agents' expectations and decision rules when policies shift. His foundational work underscores the necessity of incorporating rational expectations and microfoundations to accurately predict the effects of economic policy.

Sargent’s Critique: Key Arguments and Insights

Sargent's critique challenges traditional econometric policy models by highlighting their inability to account for changes in agents' expectations and behavior in response to policy shifts. He emphasizes the importance of rational expectations, arguing that policy effectiveness diminishes when economic agents anticipate and adapt to policy interventions. This insight reshaped macroeconomic modeling, prompting the development of models incorporating forward-looking behavior and expectations consistency.

Microfoundations in Policy Modeling

Traditional econometric policy models often rely on aggregate data and reduced-form relationships, lacking explicit microfoundations that connect individual behavior to macroeconomic outcomes. Sargent's critique emphasizes the importance of incorporating microfoundations through rational expectations and forward-looking agents, arguing that policy models must reflect how individuals optimize based on available information. This shift towards microfounded models enhances policy effectiveness by improving the predictive accuracy of agents' responses to economic policies.

Limitations of Traditional Models Exposed by Sargent

Traditional econometric policy models often rely on fixed structural relationships and assume policy stability, leading to biased or inconsistent estimates when agents adjust their expectations. Sargent's critique revealed these models' inability to account for rational expectations, highlighting how policy interventions may alter economic agents' behavior and thus invalidate prior empirical relationships. This exposed fundamental limitations in forecasting and policy evaluation, emphasizing the need for models that incorporate expectations formation and dynamic responses.

Policy Effectiveness: Old vs. New Paradigms

Traditional econometric policy models assume stable, predictable relationships allowing policymakers to effectively manipulate variables for desired outcomes. Sargent's critique argues that these models fail due to rational expectations, where agents anticipate policy changes, rendering systematic policy ineffective over time. This shift to the new paradigm emphasizes the importance of incorporating expectations and dynamic adjustments in evaluating policy effectiveness.

Evolution of Macroeconomic Modeling Post-Sargent

Traditional econometric policy models relied heavily on historical data to predict economic outcomes, often assuming stable relationships between variables over time. Sargent's critique, rooted in rational expectations theory, challenged these assumptions by emphasizing how agents adapt their expectations, rendering past data less reliable for policy predictions. This shift sparked the evolution of macroeconomic modeling toward dynamic stochastic general equilibrium (DSGE) models, integrating microfoundations and forward-looking behavior for more robust policy analysis.

Implications for Modern Economic Policy Analysis

Traditional econometric policy models emphasize structural estimation based on predetermined equations reflecting economic theory, relying heavily on historical data correlations. Sargent's critique highlights the inconsistency of these models when agents form expectations rationally, leading to policy ineffectiveness due to model misspecification and policy regime shifts. Modern economic policy analysis consequently incorporates microfoundations, rational expectations, and dynamic stochastic general equilibrium (DSGE) models to improve predictive accuracy and policy design under evolving economic behavior.

Traditional econometric policy models Infographic

libterm.com

libterm.com