Latin American economies showcase a diverse range of growth patterns, driven by natural resource exports, expanding service sectors, and increasing integration into global markets. Challenges such as political instability, infrastructure deficits, and social inequality continue to impact long-term development prospects. Explore the article to understand how these factors shape the economic future of the region and what it means for your investments and opportunities.

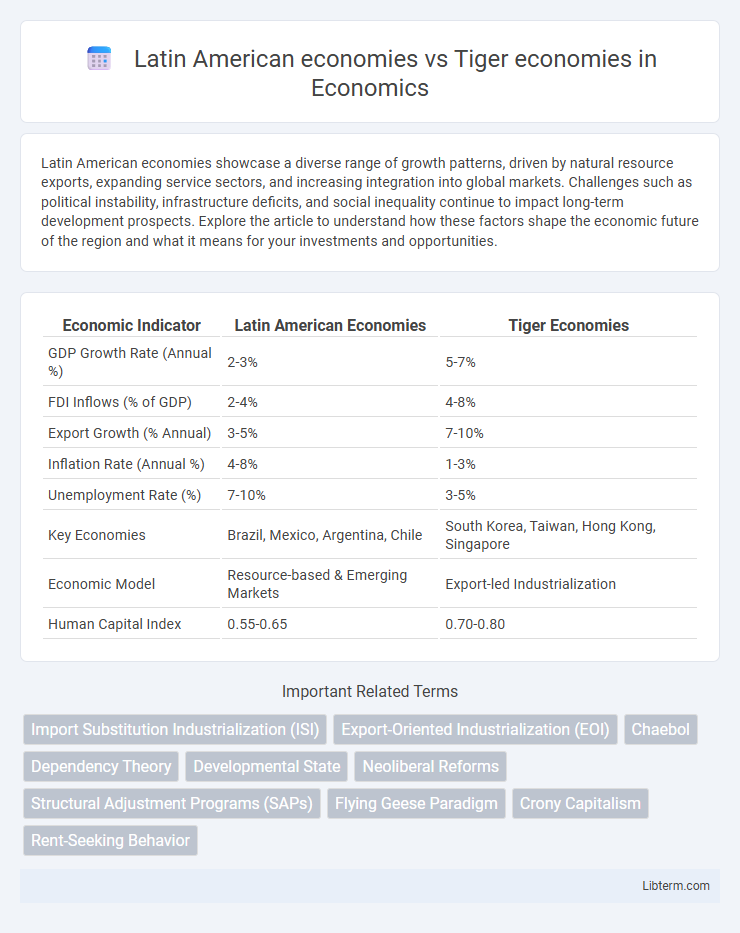

Table of Comparison

| Economic Indicator | Latin American Economies | Tiger Economies |

|---|---|---|

| GDP Growth Rate (Annual %) | 2-3% | 5-7% |

| FDI Inflows (% of GDP) | 2-4% | 4-8% |

| Export Growth (% Annual) | 3-5% | 7-10% |

| Inflation Rate (Annual %) | 4-8% | 1-3% |

| Unemployment Rate (%) | 7-10% | 3-5% |

| Key Economies | Brazil, Mexico, Argentina, Chile | South Korea, Taiwan, Hong Kong, Singapore |

| Economic Model | Resource-based & Emerging Markets | Export-led Industrialization |

| Human Capital Index | 0.55-0.65 | 0.70-0.80 |

Overview: Latin American vs Tiger Economies

Latin American economies, characterized by commodity dependence and moderate growth rates, contrast sharply with the Tiger economies--South Korea, Taiwan, Hong Kong, and Singapore--which exhibit rapid industrialization and high GDP growth driven by export-oriented manufacturing and technology sectors. While Latin America faces challenges such as income inequality and political instability, Tiger economies benefit from strong institutions, investment in education, and integration into global value chains. This divergence influences competitiveness, innovation capacity, and long-term economic resilience between the two regions.

Historical Growth Patterns

Latin American economies experienced moderate growth characterized by commodity dependence, protectionist policies, and political instability throughout the 20th century. In contrast, Tiger economies such as South Korea, Taiwan, Hong Kong, and Singapore showcased rapid industrialization, export-driven growth, and technological advancement beginning in the 1960s. These differing historical growth patterns resulted in higher GDP per capita and diversified economies within the Tiger economies compared to the relatively volatile Latin American markets.

Key Drivers of Economic Development

Latin American economies often rely on natural resources, agriculture, and commodities exports as key drivers of economic development, contrasting with Tiger economies that emphasize rapid industrialization, technological innovation, and export-oriented manufacturing. Infrastructure investment, education, and institutional reforms play a critical role in advancing growth in both regions, yet Tigers prioritize high human capital and integration into global supply chains for sustained development. Foreign direct investment (FDI) and government policies fostering competitive markets significantly differentiate the dynamic growth patterns between Latin American countries and established Asian Tigers.

Trade Policies and Market Integration

Latin American economies often pursue protectionist trade policies with high tariffs and limited regional market integration, hindering export diversification and foreign investment inflows. In contrast, Tiger economies such as South Korea, Taiwan, and Singapore emphasize export-oriented trade policies, low tariffs, and deep integration into global supply chains and regional trade agreements like ASEAN and APEC. This strategic openness has facilitated accelerated industrialization and sustained economic growth, distinguishing Tiger economies from many Latin American counterparts.

Industrialization and Export Strategies

Latin American economies historically relied on import substitution industrialization (ISI), focusing on developing domestic industries to reduce foreign dependency, which often led to limited export diversification and slower economic growth. Tiger economies, including South Korea, Taiwan, Hong Kong, and Singapore, aggressively pursued export-oriented industrialization (EOI), emphasizing technology-intensive manufacturing and integration into global value chains, resulting in rapid industrialization and high export growth. This strategic emphasis on competitive exports and innovation enabled Tiger economies to achieve sustained economic development and higher income levels compared to many Latin American countries.

Role of Foreign Direct Investment

Foreign Direct Investment (FDI) plays a divergent role in Latin American and Tiger economies, with Tiger economies leveraging FDI to boost high-tech manufacturing and export-oriented industries, catalyzing rapid industrialization and GDP growth. Latin American economies often experience FDI concentrated in natural resources and commodities, which limits technological spillovers and diversification. The strategic deployment of FDI in Tiger economies fosters innovation, human capital development, and integration into global value chains, while Latin America's resource-dependent FDI inflows face volatility and slower structural transformation.

Education and Workforce Competitiveness

Latin American economies often face challenges in education quality and workforce competitiveness compared to Tiger economies like South Korea and Singapore, which invest heavily in advanced education systems and vocational training. Tiger economies boast higher literacy rates, STEM proficiency, and adaptability in their labor forces, driving innovation and productivity. In contrast, Latin American countries experience gaps in educational infrastructure and skills mismatches, limiting their global economic competitiveness.

Governance, Institutions, and Corruption

Latin American economies often struggle with weak governance, inconsistent institutions, and high levels of corruption, which hinder sustainable economic growth and investment. In contrast, Tiger economies such as South Korea, Singapore, and Taiwan have established robust institutions, transparent governance, and effective anti-corruption measures that create attractive environments for business and innovation. These differences in institutional quality and governance frameworks significantly impact economic performance and development trajectories between the two regions.

Economic Challenges and Opportunities

Latin American economies face challenges such as political instability, dependency on commodity exports, and income inequality, which limit sustainable growth and diversification. In contrast, Tiger economies like South Korea, Taiwan, and Singapore leverage advanced technology, export-oriented industrialization, and strong governance to drive rapid economic development and innovation. Opportunities for Latin America lie in enhancing infrastructure, investing in education and technology, and fostering regional trade integration to emulate the Tigers' successful industrial policies.

Future Prospects and Growth Trajectories

Latin American economies face challenges such as structural reforms and diversification but hold potential in natural resources and demographic dividends, offering moderate growth trajectories. In contrast, Tiger economies like South Korea, Taiwan, and Singapore exhibit strong innovation capabilities, high investment in technology, and export-driven models projecting faster and more sustainable growth. Future prospects for Latin America hinge on improving governance and infrastructure, while Tiger economies continue leveraging advanced industrial policies and digital transformation for economic resilience.

Latin American economies Infographic

libterm.com

libterm.com