Cryptocurrency operates on decentralized blockchain technology, ensuring secure and transparent digital transactions without intermediaries. Its growing popularity has transformed financial markets, offering innovative solutions for investment, remittances, and online purchases. Explore the article to understand how cryptocurrency can impact your financial future and the evolving digital economy.

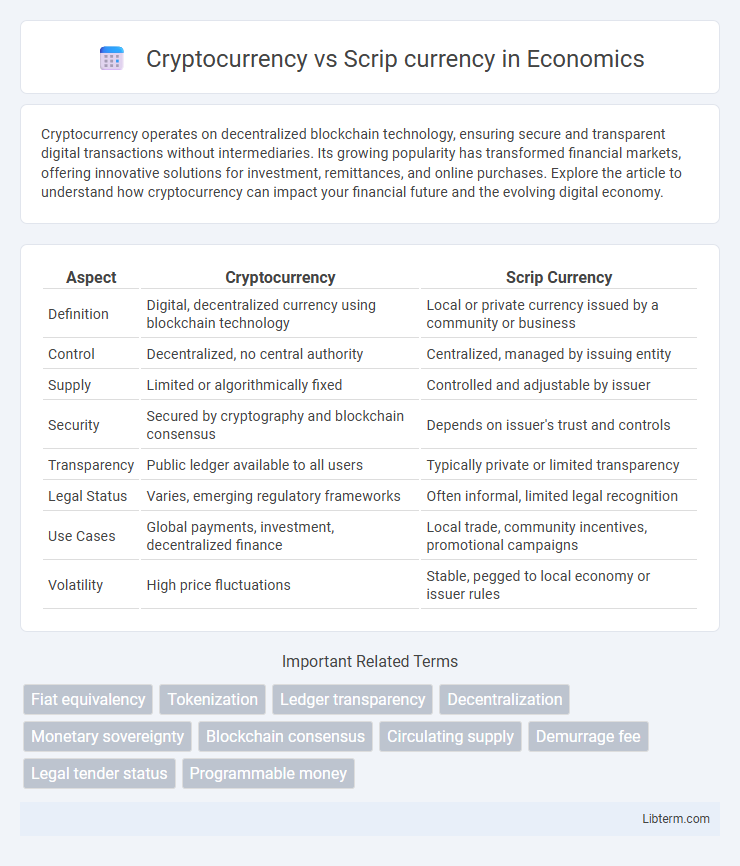

Table of Comparison

| Aspect | Cryptocurrency | Scrip Currency |

|---|---|---|

| Definition | Digital, decentralized currency using blockchain technology | Local or private currency issued by a community or business |

| Control | Decentralized, no central authority | Centralized, managed by issuing entity |

| Supply | Limited or algorithmically fixed | Controlled and adjustable by issuer |

| Security | Secured by cryptography and blockchain consensus | Depends on issuer's trust and controls |

| Transparency | Public ledger available to all users | Typically private or limited transparency |

| Legal Status | Varies, emerging regulatory frameworks | Often informal, limited legal recognition |

| Use Cases | Global payments, investment, decentralized finance | Local trade, community incentives, promotional campaigns |

| Volatility | High price fluctuations | Stable, pegged to local economy or issuer rules |

Introduction to Cryptocurrency and Scrip Currency

Cryptocurrency is a digital or virtual form of currency secured by cryptography, operating on decentralized blockchain technology that ensures transparency and immutability of transactions. Scrip currency, often used as local or company-issued tokens, functions as a substitute for official money within limited environments and lacks the widespread legal tender status. While cryptocurrencies like Bitcoin and Ethereum offer global, peer-to-peer value transfer without intermediaries, scrip currency remains confined to specific communities or organizations for restricted economic activities.

Defining Cryptocurrency: Key Features and Technologies

Cryptocurrency is a digital or virtual currency secured by cryptography, enabling decentralized transactions on blockchain technology, which ensures transparency and immutability. Unlike scrip currency, which is a localized or company-issued substitute for legal tender, cryptocurrency operates independently of centralized authorities and utilizes consensus algorithms like Proof of Work or Proof of Stake. Key features include peer-to-peer transfers, cryptographic security, and tokenization, facilitating secure, borderless, and transparent financial exchanges in the digital economy.

Understanding Scrip Currency: Historical and Modern Contexts

Scrip currency, historically used as a localized form of money during times of economic strain or company control, served as a temporary and limited exchange medium often issued by businesses or municipalities. Unlike cryptocurrency, which is decentralized and secured by blockchain technology, scrip currency lacked transparency and wider acceptance, restricting its utility beyond specific communities or employers. Modern contexts see a revival of scrip-like systems in digital gift cards and loyalty points, but these still fall short of cryptocurrency's global reach and cryptographic security features.

Security and Transparency: A Comparative Analysis

Cryptocurrency offers enhanced security through blockchain technology, which provides a decentralized and immutable ledger that reduces fraud and hacking risks compared to scrip currency. Scrip currency relies on centralized authorities, making it vulnerable to counterfeiting and manipulation while providing limited transparency in transaction records. The transparent nature of cryptocurrency transactions allows for real-time auditing and greater trust among users, setting it apart from the less verifiable and more opaque scrip currency systems.

Accessibility and Usability: Crypto vs Scrip

Cryptocurrency offers global accessibility through internet-enabled devices, allowing borderless transactions without reliance on traditional banking systems, unlike scrip currency, which is typically limited to specific communities or organizations. Usability of cryptocurrency is enhanced by digital wallets and blockchain technology, enabling instant transfers, heightened security, and transparency, whereas scrip currency often requires physical exchange and is confined to localized or closed ecosystems. The technological infrastructure of cryptocurrency supports scalable and diverse financial applications, surpassing the limited acceptability and use cases of scrip currency.

Value Stability and Volatility Differences

Cryptocurrency exhibits significant value volatility due to market speculation, limited regulation, and shifting investor sentiment, resulting in price fluctuations often exceeding 10% within short periods. In contrast, scrip currency, typically issued by local authorities or private entities, maintains greater value stability by being pegged to national currencies or backed by tangible assets, thus reducing market-driven volatility. The decentralized nature of cryptocurrency contrasts with the centralized control of scrip currency, directly influencing their respective stability and user trust.

Regulatory Landscape and Legal Considerations

Cryptocurrency operates within a rapidly evolving regulatory landscape characterized by varying degrees of government oversight, compliance requirements, and legal scrutiny worldwide, with jurisdictions like the U.S. and EU implementing stringent anti-money laundering (AML) and know-your-customer (KYC) regulations. In contrast, scrip currency, often issued by private entities or organizations, typically lacks comprehensive regulatory frameworks, making it subject to fewer legal constraints but also less consumer protection and recognition as a legitimate medium of exchange. Legal considerations for cryptocurrencies include issues related to taxation, securities law classification, and cross-border transaction controls, while scrip currency's legal status is often limited to specific ecosystems and lacks enforceability in broader financial markets.

Adoption and Acceptance in Global Markets

Cryptocurrency adoption has surged globally due to its decentralized nature, lower transaction costs, and enhanced security features, attracting both retail and institutional investors. In contrast, scrip currency, typically issued by local entities or companies, faces limited acceptance outside specific communities or organizations, restricting its global market penetration. Major financial hubs and emerging markets are increasingly integrating cryptocurrencies into payment systems and regulatory frameworks, accelerating mainstream acceptance compared to scrip currencies.

Pros and Cons of Cryptocurrency

Cryptocurrency offers decentralized control, increased security through blockchain technology, and faster transactions compared to traditional scrip currency, which relies on centralized institutions and physical notes. However, cryptocurrencies face challenges such as price volatility, regulatory uncertainty, and limited acceptance in everyday transactions. Scrip currency benefits from widespread recognition and government backing but lacks the transparency and borderless nature that cryptocurrencies provide.

Pros and Cons of Scrip Currency

Scrip currency offers ease of use in localized transactions and can act as a stable medium of exchange within a specific community, reducing reliance on national currencies and avoiding inflation risks tied to fiat money. However, scrip currency faces limitations such as lack of widespread acceptance, low liquidity outside its designated area, and potential regulatory challenges that can inhibit its scalability and integration with broader financial systems. The absence of intrinsic value backing and susceptibility to fraud or misuse also pose significant drawbacks compared to decentralized cryptocurrencies.

Cryptocurrency Infographic

libterm.com

libterm.com