A Bertrand competitor engages in price competition where firms simultaneously set prices to attract customers, often leading to price wars and reduced profits. This model assumes products are homogeneous and consumers always choose the lowest-priced option, influencing strategic pricing decisions. Discover how understanding Bertrand competition can enhance your market strategy by reading the full article.

Table of Comparison

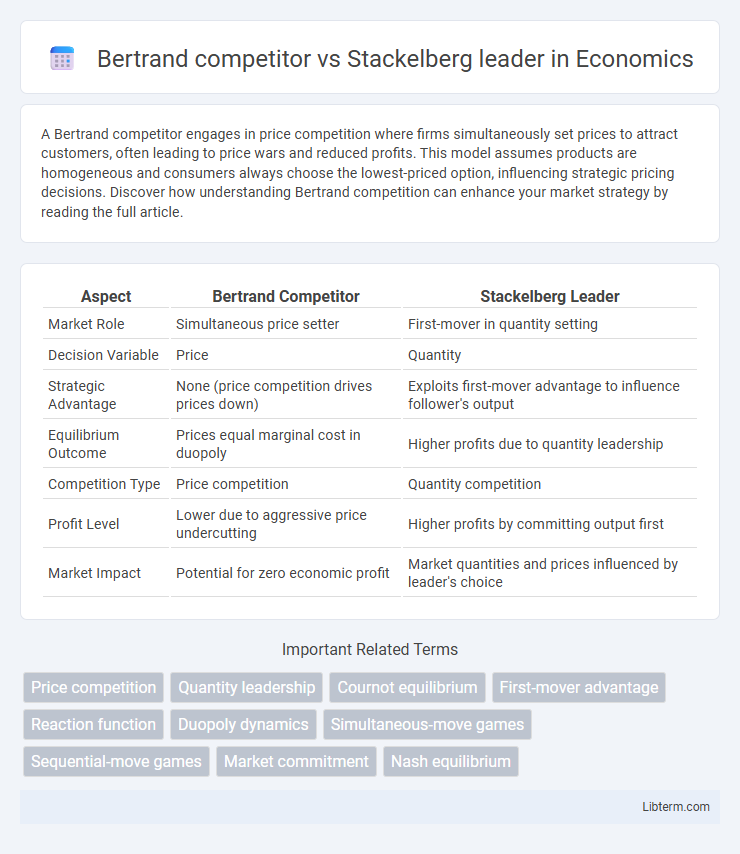

| Aspect | Bertrand Competitor | Stackelberg Leader |

|---|---|---|

| Market Role | Simultaneous price setter | First-mover in quantity setting |

| Decision Variable | Price | Quantity |

| Strategic Advantage | None (price competition drives prices down) | Exploits first-mover advantage to influence follower's output |

| Equilibrium Outcome | Prices equal marginal cost in duopoly | Higher profits due to quantity leadership |

| Competition Type | Price competition | Quantity competition |

| Profit Level | Lower due to aggressive price undercutting | Higher profits by committing output first |

| Market Impact | Potential for zero economic profit | Market quantities and prices influenced by leader's choice |

Introduction to Bertrand and Stackelberg Models

The Bertrand model features firms competing by setting prices simultaneously, leading to price wars and outcomes where prices typically equal marginal costs. In contrast, the Stackelberg model involves a leader-follower dynamic, where the Stackelberg leader commits to an output level first, influencing the follower's decisions and market equilibrium. Both models analyze oligopolistic competition but differ fundamentally in timing and strategic moves, impacting firms' pricing and output strategies.

Key Differences Between Bertrand and Stackelberg Competition

Bertrand competition models firms competing on prices simultaneously, assuming identical products and leading to lower prices close to marginal cost, causing zero economic profit. Stackelberg competition features a sequential move game where the leader firm sets its output first, and the follower firm reacts accordingly, often resulting in higher profits for the leader due to strategic advantage. The key difference lies in timing and decision variables: Bertrand focuses on price competition with simultaneous moves, while Stackelberg involves quantity competition with a first-mover advantage.

The Role of Pricing Strategies: Bertrand vs Stackelberg

Bertrand competition centers on firms simultaneously setting prices, leading to aggressive price undercutting and minimal profit margins, while Stackelberg leadership involves a sequential pricing strategy where the leader sets its price first, influencing the follower's response. The Stackelberg leader benefits from strategic commitment, often securing higher profits by anticipating the follower's price reaction, in contrast to the Bertrand model's equilibrium where firms typically reach marginal cost pricing. Pricing strategies in Bertrand encourage intense rivalry and price wars, whereas Stackelberg models emphasize strategic advantage through commitment and timing in pricing decisions.

Market Structure and Assumptions

Bertrand competition assumes firms compete by setting prices simultaneously in a market with homogeneous products, leading to price equalization at marginal cost under perfect information and no capacity constraints. Stackelberg leadership involves sequential decision-making where the leader firm sets quantity first, influencing a follower's output in a market with differentiated or homogeneous products and observable actions. The market structure in Bertrand is typically characterized by price competition with no first-mover advantage, while Stackelberg reflects quantity competition with strategic commitment and information asymmetry.

Strategic Decision-Making: Simultaneous vs Sequential Moves

Bertrand competitors engage in simultaneous strategic decision-making, choosing prices at the same time without knowledge of the opponent's pricing, which leads to intense price competition and often drives prices down to marginal cost. In contrast, a Stackelberg leader makes sequential moves by setting its price or output first, allowing the follower to observe and respond, resulting in strategic advantages for the leader and potential market power. The sequential nature of Stackelberg competition creates a commitment effect that alters the follower's best response, differentiating market outcomes from the Bertrand equilibrium.

Profit Outcomes: Comparing Bertrand Competitor and Stackelberg Leader

Bertrand competitors typically drive prices down to marginal cost, resulting in minimal or zero economic profits due to intense price competition. Stackelberg leaders, by committing to output first and influencing followers, secure higher profit margins through strategic quantity setting and reduced market competition. Empirical studies confirm that Stackelberg leadership yields greater firm profits compared to Bertrand competition in oligopolistic markets.

Price Wars and Market Equilibrium

In Bertrand competition, firms engage in aggressive price wars by continuously undercutting each other's prices, pushing market prices down to marginal cost, resulting in zero economic profit and a highly competitive equilibrium. In contrast, Stackelberg leaders set prices strategically before followers, maintaining higher equilibrium prices and securing greater market power, which reduces the intensity of price wars. The Stackelberg model achieves a more stable market equilibrium with differentiated pricing outcomes, while Bertrand competition drives prices to the most competitive level, emphasizing the role of timing and commitment in price setting.

Real-World Examples of Bertrand and Stackelberg Competition

In the airline industry, the Bertrand competition model is evident when multiple carriers set ticket prices aggressively, driving fares down as seen with budget airlines competing on similar routes. Conversely, the Stackelberg leadership model appears in the automotive sector, where a dominant firm like Toyota sets production quantities first, and smaller competitors adjust accordingly. These real-world examples highlight how firms strategically price or produce based on rival behaviors, influencing market equilibrium and competitive dynamics.

Implications for Business Strategy

Bertrand competitors price products simultaneously, driving prices down toward marginal cost and intensifying competition in the market. Stackelberg leaders set quantities first, leveraging strategic commitment to influence follower decisions and potentially secure higher profits through first-mover advantage. Businesses adopting a Stackelberg leadership strategy can optimize market share and profitability by anticipating competitor responses, while firms in Bertrand competition must focus on cost efficiency and price-based differentiation to remain competitive.

Conclusion: Choosing Between Bertrand and Stackelberg Approaches

Choosing between Bertrand and Stackelberg models depends on market structure and strategic interaction. Bertrand competition assumes simultaneous price setting with firms choosing prices to maximize profits, typically leading to lower prices and zero economic profit under identical products. Stackelberg leadership involves sequential moves where the leader commits first, enabling strategic advantage and potentially higher profits by influencing the follower's response.

Bertrand competitor Infographic

libterm.com

libterm.com