Liquidity Preference Theory explains how investors prioritize holding cash or liquid assets to meet immediate needs or take advantage of investment opportunities, influencing interest rates in the economy. It suggests that the demand for liquidity is inversely related to interest rates, as higher rates encourage holding less cash. Discover how this theory impacts your financial decisions and market behavior by reading the full article.

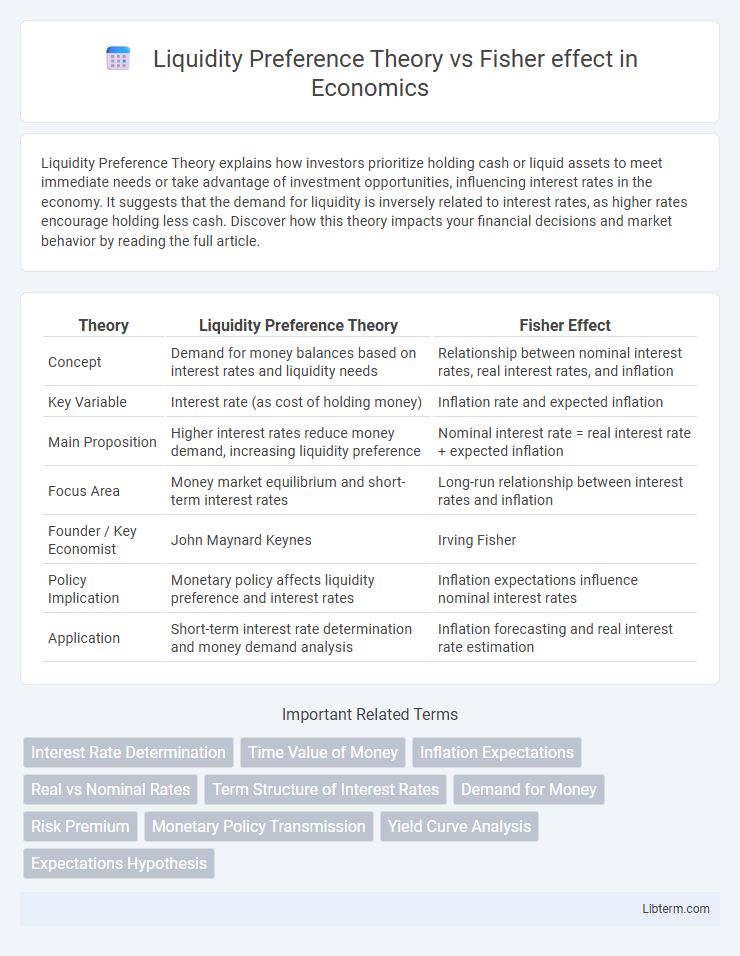

Table of Comparison

| Theory | Liquidity Preference Theory | Fisher Effect |

|---|---|---|

| Concept | Demand for money balances based on interest rates and liquidity needs | Relationship between nominal interest rates, real interest rates, and inflation |

| Key Variable | Interest rate (as cost of holding money) | Inflation rate and expected inflation |

| Main Proposition | Higher interest rates reduce money demand, increasing liquidity preference | Nominal interest rate = real interest rate + expected inflation |

| Focus Area | Money market equilibrium and short-term interest rates | Long-run relationship between interest rates and inflation |

| Founder / Key Economist | John Maynard Keynes | Irving Fisher |

| Policy Implication | Monetary policy affects liquidity preference and interest rates | Inflation expectations influence nominal interest rates |

| Application | Short-term interest rate determination and money demand analysis | Inflation forecasting and real interest rate estimation |

Introduction to Liquidity Preference Theory and Fisher Effect

Liquidity Preference Theory, developed by John Maynard Keynes, explains the demand for money based on the preference for liquidity, emphasizing that individuals prefer holding cash for transactions, precautionary, and speculative motives, which impacts interest rates. The Fisher Effect, formulated by Irving Fisher, describes the relationship between nominal interest rates and expected inflation, asserting that nominal rates adjust to maintain constant real interest rates over time. Both theories address interest rate dynamics but from different perspectives--liquidity preference focusing on money demand and transactions, while the Fisher Effect centers on inflation expectations and real returns.

Core Concepts: Understanding Liquidity Preference Theory

Liquidity Preference Theory centers on the demand for money based on liquidity, emphasizing that individuals prefer holding cash for transactions, precaution, and speculative motives, influencing interest rates and the money supply. It contrasts with the Fisher effect, which links nominal interest rates to inflation expectations, asserting that real interest rates remain constant in the long run. Understanding Liquidity Preference Theory is crucial for analyzing short-term interest rate fluctuations driven by monetary policy and shifts in money demand.

Key Principles of the Fisher Effect

The Fisher Effect explains the relationship between nominal interest rates, real interest rates, and expected inflation, asserting that nominal rates adjust one-for-one with changes in expected inflation. It emphasizes that real interest rates remain stable over time despite fluctuations in inflation, guiding investors and policymakers in predicting interest rate movements. Unlike Liquidity Preference Theory, which centers on money demand and short-term interest rates, the Fisher Effect focuses on long-term interest rates and inflation expectations.

Money Demand and Interest Rates: Liquidity Preference Perspective

Liquidity Preference Theory emphasizes that money demand depends on interest rates because individuals prefer liquidity for transactions and precautionary motives, causing higher interest rates to reduce money holdings. In contrast, the Fisher effect centers on the relationship between nominal interest rates and expected inflation, suggesting real interest rates remain stable. From the liquidity preference perspective, shifts in money demand directly influence interest rates by balancing the supply of money with the public's preference for cash versus bonds.

Inflation Expectations and Nominal Interest Rates: Fisher Effect Explained

The Fisher effect describes the direct relationship between nominal interest rates and expected inflation, asserting that nominal rates rise one-for-one with anticipated inflation to maintain real interest rates. In contrast, the Liquidity Preference Theory emphasizes the role of money demand and supply in determining interest rates, focusing more on short-term interest rate adjustments and liquidity preferences rather than inflation expectations. Inflation expectations are central to the Fisher effect, as they drive nominal interest rates to adjust accordingly, ensuring investors receive a stable real return despite changing price levels.

Comparative Analysis: Assumptions and Implications

Liquidity Preference Theory assumes that investors prefer more liquid assets to minimize risk, emphasizing interest rates as a reward for parting with liquidity, while the Fisher Effect posits that nominal interest rates adjust one-for-one with expected inflation, assuming stable real interest rates. The theory's implication on monetary policy differs; Liquidity Preference Theory suggests interest rates are influenced by money supply and demand for liquidity, whereas Fisher Effect implies that inflation expectations primarily determine nominal rates, limiting monetary policy's control over real rates. Both models provide insights into interest rate behavior but differ fundamentally in their assumptions about investor preferences and the role of inflation expectations.

Real-World Applications of Liquidity Preference Theory

Liquidity Preference Theory explains how interest rates are influenced by money demand for transactions, precaution, and speculative motives, impacting central banks' monetary policies and liquidity management strategies in real-world markets. This theory guides commercial banks and financial institutions in managing cash reserves to balance profitability and liquidity, especially during economic fluctuations or financial crises. In contrast to the Fisher effect, which links nominal interest rates solely to inflation expectations, Liquidity Preference Theory provides a practical framework for immediate money supply adjustments and interest rate stabilization.

Practical Significance of the Fisher Effect in Financial Markets

The Fisher Effect explains the direct relationship between nominal interest rates and expected inflation, crucial for investors in adjusting their real returns and making informed decisions in bond and equity markets. Liquidity Preference Theory, by contrast, emphasizes the demand for money based on liquidity and interest rates, primarily affecting short-term interest rates and monetary policy. The Fisher Effect's practical significance lies in its ability to guide inflation expectations, influencing asset pricing, interest rate forecasts, and inflation-indexed securities in financial markets.

Limitations and Criticisms of Both Theories

Liquidity Preference Theory faces criticism for its assumption that interest rates solely balance money demand and supply, overlooking factors like inflation expectations and global capital flows that influence interest rates. The Fisher Effect is limited by its presumption of perfect inflation foresight and immediate adjustment of nominal rates, which empirical evidence often contradicts due to lagged responses and varying inflation risk premiums. Both theories simplify complex financial environments, neglecting behavioral elements, market imperfections, and short-term fluctuations that can distort interest rate dynamics.

Conclusion: Synthesis and Policy Implications

Liquidity Preference Theory emphasizes the role of money demand and interest rates in determining equilibrium, while the Fisher Effect highlights the relationship between nominal interest rates and expected inflation. Synthesizing both, monetary policy must balance controlling inflation expectations with managing liquidity to influence real interest rates effectively. Policymakers should ensure transparency to anchor inflation expectations while providing sufficient liquidity to stabilize interest rates and support economic growth.

Liquidity Preference Theory Infographic

libterm.com

libterm.com