Convertible bonds offer investors the advantage of fixed income with the option to convert the bond into a predetermined number of shares, combining features of both debt and equity. This hybrid instrument provides a balance between risk and reward, potentially benefitting from equity appreciation while maintaining bond-like safety. Discover how convertible bonds can strategically enhance your investment portfolio by reading the rest of the article.

Table of Comparison

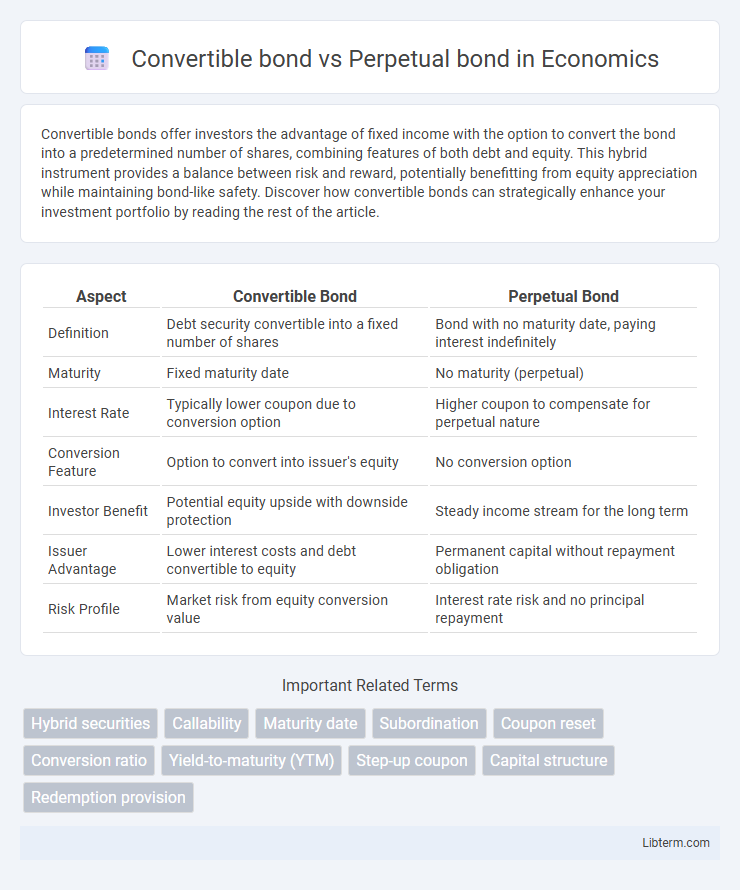

| Aspect | Convertible Bond | Perpetual Bond |

|---|---|---|

| Definition | Debt security convertible into a fixed number of shares | Bond with no maturity date, paying interest indefinitely |

| Maturity | Fixed maturity date | No maturity (perpetual) |

| Interest Rate | Typically lower coupon due to conversion option | Higher coupon to compensate for perpetual nature |

| Conversion Feature | Option to convert into issuer's equity | No conversion option |

| Investor Benefit | Potential equity upside with downside protection | Steady income stream for the long term |

| Issuer Advantage | Lower interest costs and debt convertible to equity | Permanent capital without repayment obligation |

| Risk Profile | Market risk from equity conversion value | Interest rate risk and no principal repayment |

Introduction to Convertible Bonds and Perpetual Bonds

Convertible bonds are hybrid securities that combine features of debt and equity, allowing investors to convert their bonds into a predetermined number of shares of the issuing company. Perpetual bonds, also known as consol bonds, have no maturity date and pay interest indefinitely, making them a permanent source of capital for issuers. Both instruments offer unique risk and return profiles, with convertible bonds providing potential equity upside and perpetual bonds offering steady income without principal repayment.

Key Features of Convertible Bonds

Convertible bonds offer investors the unique advantage of converting debt into equity shares at a predetermined price, combining fixed income with potential capital appreciation. They typically have a maturity date and pay interest like regular bonds but provide conversion options that can enhance returns if the issuer's stock performs well. This hybrid structure allows issuers to lower borrowing costs while giving investors downside protection and upside equity participation.

Key Features of Perpetual Bonds

Perpetual bonds, also known as consol bonds, have no maturity date, allowing issuers to pay interest indefinitely without repaying the principal. These bonds typically offer higher coupon rates to compensate investors for the infinite duration and increased interest rate risk. Convertible bonds, in contrast, provide investors the option to convert the bond into a predetermined number of shares, combining debt security with potential equity upside.

Differences in Structure and Maturity

Convertible bonds have a fixed maturity date, typically ranging from five to ten years, and can be converted into a specified number of the issuer's shares, offering hybrid features of debt and equity. Perpetual bonds, or perpetuals, have no maturity date, effectively functioning as long-term fixed-income instruments with indefinite tenure and pay interest indefinitely without principal repayment. The structural distinction lies in convertibles providing potential equity upside with finite tenure, whereas perpetuals provide ongoing interest without principal redemption, affecting risk profiles and investor appeal.

Risk Profiles: Convertible vs Perpetual Bonds

Convertible bonds carry lower risk profiles compared to perpetual bonds due to their embedded option to convert into equity, which offers potential upside in rising stock markets while providing downside protection as debt instruments. Perpetual bonds present higher interest rate risk and credit risk since they have no maturity date, exposing investors to indefinite market fluctuations and issuer creditworthiness over time. Investors seeking balanced risk may prefer convertible bonds, while those aiming for steady income despite higher risk exposure might opt for perpetual bonds.

Yield Potential and Return Factors

Convertible bonds typically offer lower yield potential compared to perpetual bonds due to the embedded option to convert into equity, providing upside through capital appreciation. Perpetual bonds, lacking maturity dates, usually have higher coupon rates to compensate investors for indefinite risk exposure, enhancing income return stability. Return factors for convertible bonds rely on equity price performance and conversion premium, while perpetual bonds depend mainly on interest rate fluctuations and credit risk of the issuer.

Conversion Options and Equity Participation

Convertible bonds provide the holder with the option to convert debt into a predetermined number of issuing company shares, offering potential upside from equity participation and capital appreciation. Perpetual bonds lack maturity and do not offer conversion rights, functioning solely as fixed-income instruments without direct equity participation. The conversion feature in convertible bonds creates a hybrid security that typically offers lower coupon rates relative to traditional bonds due to the embedded equity option.

Perpetual Bonds and Interest Rate Sensitivity

Perpetual bonds have no maturity date, making them highly sensitive to interest rate fluctuations because their fixed coupon payments continue indefinitely. When interest rates rise, the present value of these fixed coupons declines significantly, causing perpetual bond prices to drop more sharply compared to bonds with finite maturities. This interest rate sensitivity, measured by duration, is typically much higher in perpetual bonds, impacting investor risk and portfolio management strategies.

Investor Suitability and Use Cases

Convertible bonds suit investors seeking a hybrid instrument with fixed income and equity upside potential, ideal for those willing to accept moderate risk for capital appreciation. Perpetual bonds attract income-focused investors prioritizing steady, long-term yield without maturity, suitable for pension funds or insurers requiring consistent cash flow. Corporations issue convertible bonds to lower borrowing costs by offering conversion options, while perpetual bonds help raise permanent capital without repayment obligations.

Conclusion: Choosing Between Convertible and Perpetual Bonds

Choosing between convertible bonds and perpetual bonds depends on investment goals and risk tolerance; convertible bonds offer upside potential through equity conversion with limited downside, while perpetual bonds provide steady income without maturity date but higher interest rate risk. Convertible bonds appeal to investors seeking capital appreciation linked to stock performance, whereas perpetual bonds suit those prioritizing consistent income and long-term exposure to fixed interest payments. Evaluating the issuer's credit quality, market conditions, and income preferences is crucial for selecting the appropriate bond type.

Convertible bond Infographic

libterm.com

libterm.com