The Ramsey-Cass-Koopmans model explains long-term economic growth by incorporating household optimization and capital accumulation into a dynamic framework. It highlights how consumer preferences, savings behavior, and productivity influence the steady-state growth path of an economy. Explore the rest of the article to understand how this model can impact your perspective on sustainable economic development.

Table of Comparison

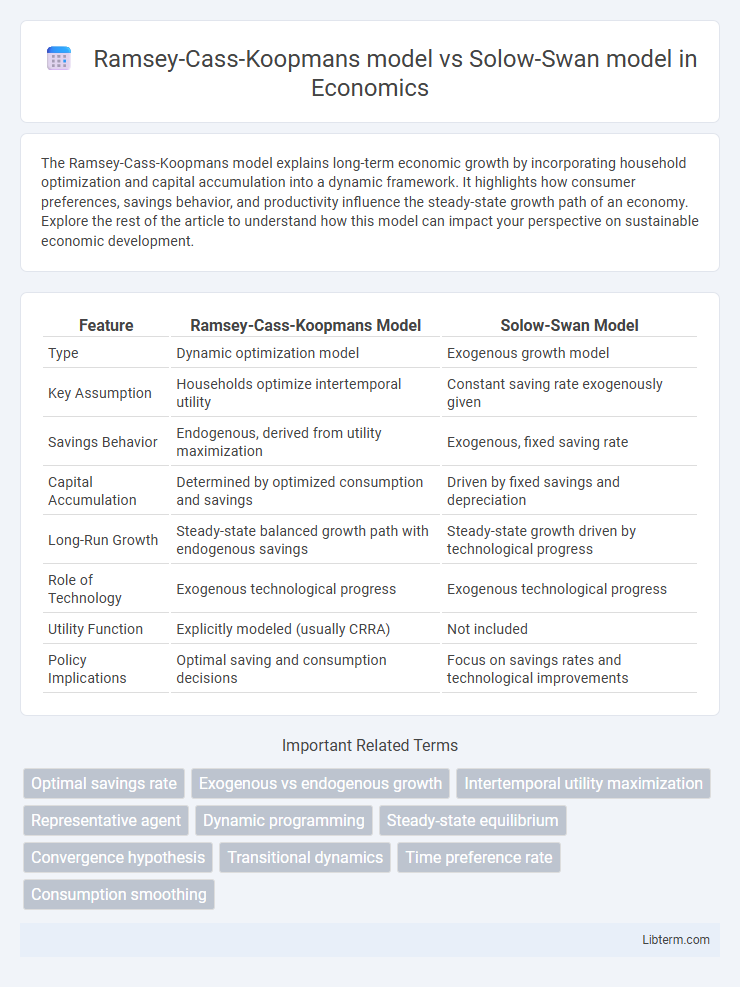

| Feature | Ramsey-Cass-Koopmans Model | Solow-Swan Model |

|---|---|---|

| Type | Dynamic optimization model | Exogenous growth model |

| Key Assumption | Households optimize intertemporal utility | Constant saving rate exogenously given |

| Savings Behavior | Endogenous, derived from utility maximization | Exogenous, fixed saving rate |

| Capital Accumulation | Determined by optimized consumption and savings | Driven by fixed savings and depreciation |

| Long-Run Growth | Steady-state balanced growth path with endogenous savings | Steady-state growth driven by technological progress |

| Role of Technology | Exogenous technological progress | Exogenous technological progress |

| Utility Function | Explicitly modeled (usually CRRA) | Not included |

| Policy Implications | Optimal saving and consumption decisions | Focus on savings rates and technological improvements |

Introduction to Economic Growth Models

The Ramsey-Cass-Koopmans model extends the Solow-Swan model by incorporating intertemporal optimization of consumption and endogenous saving rates, providing a micro-founded framework for economic growth. Unlike the Solow-Swan model, which assumes a fixed savings rate and exogenous technological progress, the Ramsey-Cass-Koopmans model captures dynamic decision-making by households optimizing utility over time. Both models explain steady-state growth paths, but the Ramsey-Cass-Koopmans model offers richer predictions on consumption, capital accumulation, and policy impacts.

Overview of the Solow-Swan Model

The Solow-Swan model emphasizes exogenous technological progress and capital accumulation as primary drivers of long-term economic growth, using a neoclassical production function with diminishing returns to capital and labor. It predicts steady-state growth where output and capital per worker stabilize, while technological progress ensures sustained increases in living standards. Unlike the Ramsey-Cass-Koopmans model, the Solow-Swan framework does not incorporate optimizing consumer behavior or intertemporal utility maximization.

Key Features of the Ramsey-Cass-Koopmans Model

The Ramsey-Cass-Koopmans model incorporates intertemporal optimization by households, allowing for endogenous saving rates driven by utility maximization and consumption preferences over time. It features dynamic capital accumulation influenced by forward-looking agents who balance consumption and investment decisions to maximize lifetime utility. This model contrasts with the Solow-Swan model by endogenizing saving behavior rather than assuming a fixed saving rate, making it more realistic for analyzing long-term economic growth and policy impacts.

Assumptions in Solow-Swan vs Ramsey-Cass-Koopmans

The Solow-Swan model assumes a constant savings rate, exogenous technological progress, and population growth, emphasizing long-run growth dynamics with a representative agent saving a fixed fraction of income. In contrast, the Ramsey-Cass-Koopmans model incorporates an optimizing household with intertemporal utility maximization, allowing endogenous determination of savings based on consumption preferences and time discounting. These differences highlight the Solow-Swan model's exogenous saving behavior versus the Ramsey-Cass-Koopmans model's micro-founded intertemporal optimization approach.

Treatment of Savings and Consumption

The Ramsey-Cass-Koopmans model endogenizes savings by optimizing intertemporal utility, allowing consumers to choose consumption and savings dynamically over time, unlike the Solow-Swan model which treats the savings rate as an exogenous constant. In the Ramsey framework, consumption evolves based on the Euler equation derived from maximizing discounted utility, making savings behavior responsive to economic conditions. The Solow-Swan model simplifies capital accumulation by fixing the savings rate, leading to a steady-state determined externally rather than through individual optimization.

Role of Households: Exogenous vs Endogenous Saving

The Ramsey-Cass-Koopmans model endogenizes household saving decisions by optimizing intertemporal utility, reflecting forward-looking behavior and consumption smoothing over time. In contrast, the Solow-Swan model treats saving as an exogenous, fixed parameter, independent of household preferences or optimization. This fundamental difference highlights how the Ramsey-Cass-Koopmans framework provides a microfounded approach to capital accumulation, whereas the Solow-Swan model relies on predetermined saving rates for growth dynamics.

Capital Accumulation Dynamics

The Ramsey-Cass-Koopmans model features endogenous savings driven by optimizing households, leading to dynamic capital accumulation paths contingent on intertemporal preferences and consumption choices. In contrast, the Solow-Swan model assumes a fixed savings rate, producing a steady capital accumulation trajectory primarily influenced by exogenous factors like technological progress and population growth. The Ramsey-Cass-Koopmans framework offers richer capital dynamics through intertemporal optimization, whereas the Solow-Swan model provides a simpler, steady-state focus on capital stock evolution.

Long-Run Growth Predictions

The Ramsey-Cass-Koopmans model predicts long-run economic growth by incorporating optimizing household behavior and capital accumulation with endogenous saving rates, leading to a balanced growth path influenced by preferences and technology. In contrast, the Solow-Swan model relies on exogenous saving rates and technological progress to determine steady-state growth, emphasizing the role of capital accumulation and diminishing returns. Both models converge to long-run growth driven by technological progress, but the Ramsey-Cass-Koopmans framework offers a deeper microeconomic foundation for savings decisions impacting capital dynamics.

Policy Implications and Model Limitations

The Ramsey-Cass-Koopmans model offers more precise policy implications by incorporating optimizing household behavior and intertemporal consumption choices, leading to nuanced fiscal and savings policies for sustainable growth. In contrast, the Solow-Swan model provides simpler policy guidance focused on capital accumulation and technological progress but lacks explicit microfoundations, potentially oversimplifying long-term growth drivers. Both models face limitations: Ramsey-Cass-Koopmans assumes perfect foresight and infinite planning horizons, which may not reflect real-world decision-making, while Solow-Swan's exogenous technological change assumption restricts its ability to explain endogenous innovation dynamics.

Comparative Summary: Which Model for What Purpose?

The Ramsey-Cass-Koopmans model excels in dynamic optimization by incorporating intertemporal household consumption choices and endogenous saving rates, making it ideal for analyzing optimal savings behavior and welfare implications over time. In contrast, the Solow-Swan model employs exogenous savings rates and focuses on steady-state growth, providing a simpler framework suited for long-term economic growth projections and capital accumulation analysis. Policymakers and researchers choose the Ramsey-Cass-Koopmans model for micro-founded, optimal control insights, while the Solow-Swan model serves best for broad, macro-level growth studies.

Ramsey-Cass-Koopmans model Infographic

libterm.com

libterm.com