Value Chain Analysis examines each step of your business processes to identify areas of value creation and opportunities for improvement. By breaking down operations into primary and support activities, it helps optimize efficiency and competitive advantage. Continue reading to uncover how Value Chain Analysis can transform your strategy and boost profitability.

Table of Comparison

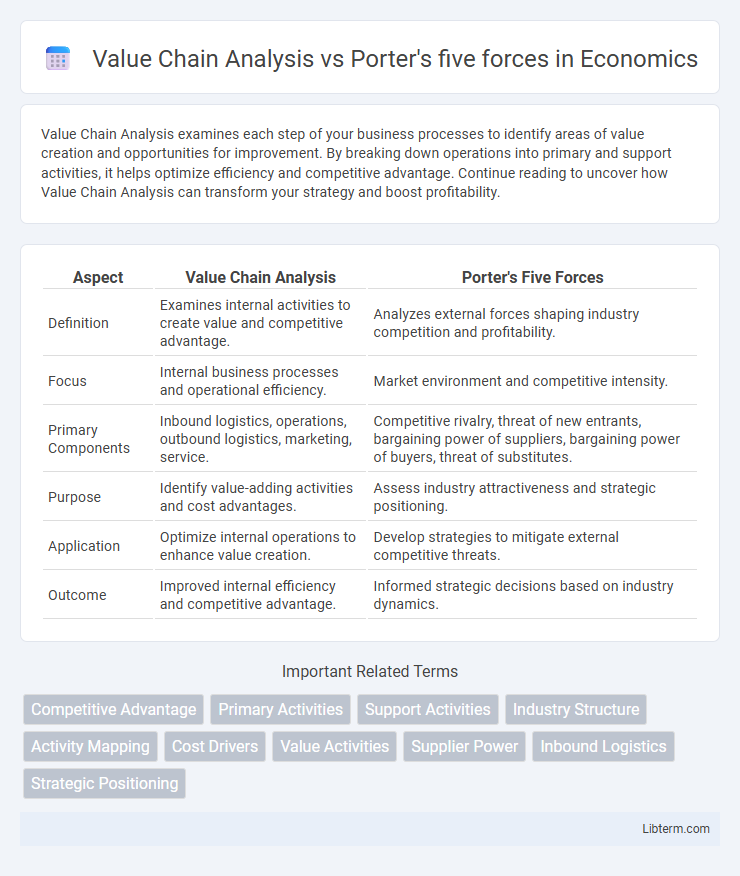

| Aspect | Value Chain Analysis | Porter's Five Forces |

|---|---|---|

| Definition | Examines internal activities to create value and competitive advantage. | Analyzes external forces shaping industry competition and profitability. |

| Focus | Internal business processes and operational efficiency. | Market environment and competitive intensity. |

| Primary Components | Inbound logistics, operations, outbound logistics, marketing, service. | Competitive rivalry, threat of new entrants, bargaining power of suppliers, bargaining power of buyers, threat of substitutes. |

| Purpose | Identify value-adding activities and cost advantages. | Assess industry attractiveness and strategic positioning. |

| Application | Optimize internal operations to enhance value creation. | Develop strategies to mitigate external competitive threats. |

| Outcome | Improved internal efficiency and competitive advantage. | Informed strategic decisions based on industry dynamics. |

Introduction to Value Chain Analysis and Porter's Five Forces

Value Chain Analysis examines the internal activities of a company to identify sources of competitive advantage, by breaking down processes such as operations, marketing, and service into primary and support activities. Porter's Five Forces framework evaluates the external competitive environment by analyzing industry structure through five forces: competitive rivalry, threat of new entrants, bargaining power of suppliers, bargaining power of buyers, and threat of substitutes. Together, these tools provide comprehensive insights for strategic decision-making by addressing both internal capabilities and external market pressures.

Defining Value Chain Analysis

Value Chain Analysis is a strategic tool used to identify and evaluate activities within a company that create value and competitive advantage. It breaks down the organization's operations into primary and support activities, helping businesses optimize processes to enhance efficiency and profitability. This analysis contrasts with Porter's Five Forces, which assesses external competitive pressures rather than internal value creation.

Understanding Porter's Five Forces Framework

Porter's Five Forces framework examines industry competitiveness by analyzing competitive rivalry, threat of new entrants, bargaining power of suppliers, bargaining power of buyers, and threat of substitute products. This model helps businesses identify potential profitability and strategic positioning within an industry by understanding external forces impacting market dynamics. Unlike Value Chain Analysis, which focuses on internal activities and operational efficiencies, Porter's Five Forces provides insight into external pressures shaping industry structure.

Key Components of Value Chain Analysis

Value Chain Analysis centers on key components such as inbound logistics, operations, outbound logistics, marketing and sales, and service, which collectively enhance a firm's competitive advantage by optimizing each activity. In contrast, Porter's Five Forces analyze industry structure through competitive rivalry, threat of new entrants, substitution, buyer power, and supplier power to assess market profitability. Value Chain Analysis provides an internal perspective on activities creating value, while Porter's Five Forces offer an external industry-level competitive assessment.

Core Elements of Porter's Five Forces

Porter's Five Forces framework centers on five core elements: competitive rivalry, threat of new entrants, threat of substitutes, bargaining power of buyers, and bargaining power of suppliers, which collectively assess industry attractiveness and profitability. Value Chain Analysis, in contrast, focuses on internal company activities to identify sources of competitive advantage by optimizing operations and costs. Understanding the Five Forces enables strategic positioning against external pressures, while Value Chain Analysis enhances internal efficiencies.

Comparative Overview: Value Chain vs. Five Forces

Value Chain Analysis dissects internal company activities to identify competitive advantages within operations, whereas Porter's Five Forces examines external industry factors shaping market competition and profitability. Value Chain focuses on primary and support activities generating value, while Five Forces evaluates supplier power, buyer power, threat of new entrants, threat of substitutes, and industry rivalry. Companies use Value Chain for optimizing internal processes and Five Forces for strategic positioning against competitive pressures.

Strategic Applications in Business

Value Chain Analysis dissects internal operations to identify areas for enhancing efficiency and competitive advantage, focusing on activities such as inbound logistics, operations, and marketing. Porter's Five Forces evaluates external industry factors--competitive rivalry, threat of new entrants, threat of substitutes, bargaining power of suppliers, and buyers--to shape strategic positioning against market pressures. Both frameworks guide business strategy by aligning internal capabilities with external market dynamics to optimize profitability and sustain competitive strength.

Advantages and Limitations of Each Framework

Value Chain Analysis enables businesses to identify internal activities that create value and competitive advantage by breaking down operations into primary and support activities, fostering targeted efficiency improvements; however, it may overlook external market dynamics and competitive forces. Porter's Five Forces framework offers a strategic evaluation of industry attractiveness by analyzing competitive rivalry, threat of new entrants, bargaining power of suppliers and buyers, and threat of substitutes, providing insight into external pressures; its limitation lies in underrepresenting internal capabilities and dynamic industry changes. Combining both frameworks can yield a comprehensive understanding of internal value creation and external market positioning for robust strategic decision-making.

Case Studies: Real-World Implementation

Case studies reveal Value Chain Analysis excels in pinpointing internal activities that boost competitive advantage, as demonstrated by Toyota's lean manufacturing optimizing each production stage for cost efficiency. Porter's Five Forces is instrumental in assessing external competitive pressure, with Netflix strategically navigating industry rivalry and threat of new entrants to dominate streaming services. Combining insights from both models enables companies like Apple to strengthen internal capabilities while effectively responding to market forces.

Choosing the Right Framework for Your Strategy

Value Chain Analysis focuses on identifying and optimizing internal activities to create competitive advantage, while Porter's Five Forces assesses external industry dynamics influencing profitability. Choosing the right framework depends on whether your strategic priority is to enhance operational efficiency or to understand market competition and industry attractiveness. Combining insights from both can provide a comprehensive approach to strategy formulation and execution.

Value Chain Analysis Infographic

libterm.com

libterm.com