The Permanent Income Hypothesis explains how individuals base their consumption choices on expected long-term average income rather than current income fluctuations. This theory highlights that spending patterns are more stable and influenced by future earnings anticipation rather than temporary changes in earnings. Explore the rest of the article to understand how this concept impacts your financial planning and economic behavior.

Table of Comparison

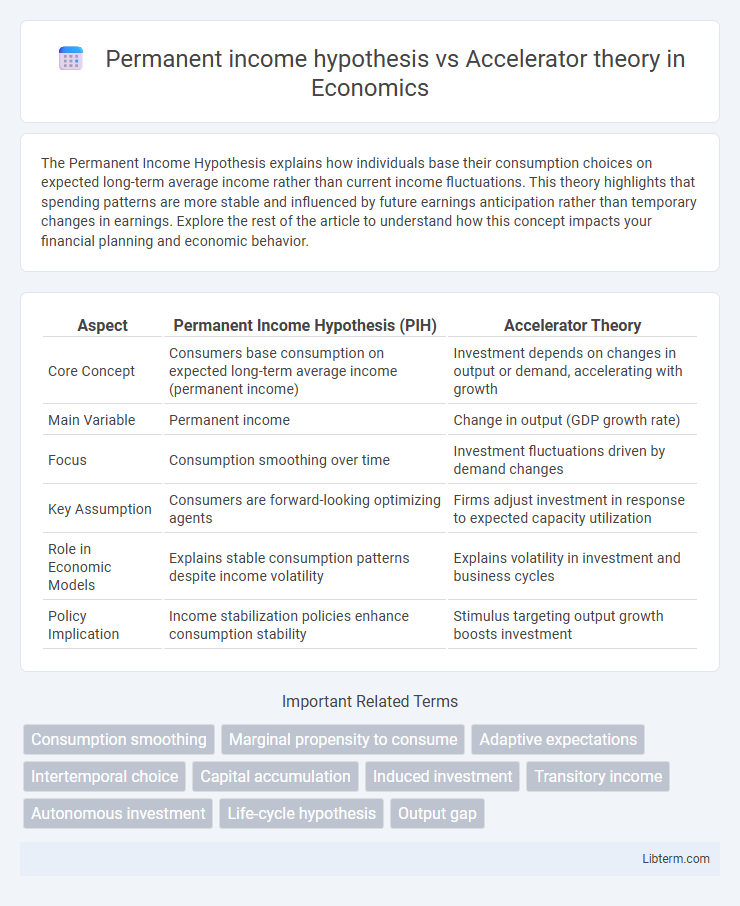

| Aspect | Permanent Income Hypothesis (PIH) | Accelerator Theory |

|---|---|---|

| Core Concept | Consumers base consumption on expected long-term average income (permanent income) | Investment depends on changes in output or demand, accelerating with growth |

| Main Variable | Permanent income | Change in output (GDP growth rate) |

| Focus | Consumption smoothing over time | Investment fluctuations driven by demand changes |

| Key Assumption | Consumers are forward-looking optimizing agents | Firms adjust investment in response to expected capacity utilization |

| Role in Economic Models | Explains stable consumption patterns despite income volatility | Explains volatility in investment and business cycles |

| Policy Implication | Income stabilization policies enhance consumption stability | Stimulus targeting output growth boosts investment |

Introduction to Economic Consumption and Investment Theories

The Permanent Income Hypothesis, developed by Milton Friedman, posits that consumer spending is determined by long-term income expectations rather than current income fluctuations, emphasizing consumption smoothing over time. In contrast, the Accelerator Theory links investment decisions directly to changes in economic output or demand, suggesting that firms increase investment when there is rising demand to expand capacity. These foundational theories provide critical insights into how households allocate consumption and how businesses plan investment, driving macroeconomic fluctuations.

What is the Permanent Income Hypothesis?

The Permanent Income Hypothesis, developed by economist Milton Friedman, posits that individuals base their consumption decisions on their expected long-term average income rather than current income fluctuations. This theory explains that temporary changes in income have little effect on consumer spending because people smooth their consumption over time using savings or credit. In contrast, the Accelerator Theory emphasizes investment driven by changes in output or demand, highlighting different mechanisms behind economic behavior.

Core Principles of the Accelerator Theory

The core principle of the Accelerator Theory posits that investment demand is primarily driven by changes in output or sales rather than income levels, where firms increase capital investment proportionally to the rate of output growth. This theory emphasizes the responsiveness of investment to variations in consumer demand, implying that sudden increases in production requirements lead to accelerated capital expenditures to accommodate higher future output. Unlike the Permanent Income Hypothesis, which links consumption to long-term income expectations, the Accelerator Theory centers on investment fluctuations triggered by short-term shifts in economic activity.

Key Assumptions and Mechanisms: PIH vs. Accelerator Theory

The Permanent Income Hypothesis (PIH) assumes that consumers base their consumption on expected long-term average income, smoothing out short-term fluctuations through saving and borrowing mechanisms. In contrast, the Accelerator Theory posits that investment spending is directly driven by changes in output or sales, where higher demand induces firms to increase capital stock to meet future production needs. While PIH focuses on consumption behavior under income expectations, the Accelerator Theory emphasizes the dynamic relationship between demand changes and investment decisions.

Comparative Historical Development of Both Theories

The Permanent Income Hypothesis (PIH), developed by Milton Friedman in the 1950s, emphasized that consumer spending is driven by long-term income expectations rather than current income fluctuations, marking a significant shift from earlier Keynesian consumption models. The Accelerator Theory, originating in the early 20th century through the work of economists like Thomas Kaldor and Evsey Domar, focused on investment demand as a function of changes in output or sales, highlighting the role of induced investment in economic cycles. Historically, PIH advanced the understanding of consumption smoothing over time, while the Accelerator Theory provided key insights into investment-driven business cycle dynamics, each shaping different dimensions of macroeconomic theory.

Empirical Evidence Supporting Each Theory

Empirical evidence supporting the Permanent Income Hypothesis (PIH) includes numerous studies showing that consumer spending correlates more strongly with expected long-term income rather than current income fluctuations, as demonstrated by Friedman's foundational research and subsequent analyses using panel data. In contrast, the Accelerator Theory finds empirical support in investment behavior during economic expansions and contractions, where firms increase capital expenditures in response to rising demand, evidenced by studies linking output growth rates with investment spikes. However, empirical tests often reveal that investment decisions incorporate both permanent income expectations and short-term demand changes, suggesting a complementary rather than exclusive validity of the two theories.

Implications for Consumption Behavior and Investment Decisions

The Permanent Income Hypothesis explains consumption behavior through long-term income expectations, suggesting that individuals smooth consumption despite short-term income fluctuations, which stabilizes aggregate demand. In contrast, the Accelerator Theory links investment decisions directly to changes in output or demand, causing more volatile capital spending tied to current economic conditions. These differing perspectives imply that consumption responds gradually to perceived wealth changes, while investment is more sensitive to immediate shifts in production and demand.

Macroeconomic Policy Insights: PIH vs. Accelerator Theory

The Permanent Income Hypothesis (PIH) suggests that consumers base consumption on long-term income expectations, implying that fiscal stimulus may have limited effects on short-term spending, guiding policymakers to focus on structural reforms for sustained growth. In contrast, the Accelerator Theory emphasizes investment driven by changes in output, indicating that demand management policies can effectively stimulate economic activity by boosting business investment. Combining insights from PIH and Accelerator Theory allows macroeconomic policies to balance long-term income expectations with short-run demand fluctuations, enhancing the effectiveness of fiscal and monetary interventions.

Criticisms and Limitations of Both Approaches

The Permanent Income Hypothesis faces criticism for its reliance on rational expectations and assumption of stable consumption patterns, which often fail to capture short-term fluctuations in consumer behavior during economic volatility. The Accelerator Theory is limited by its simplistic linkage between investment and changes in output, neglecting factors like financing constraints and anticipatory investment decisions. Both approaches struggle to incorporate real-world complexities such as heterogeneous agents, informational asymmetries, and the influence of external shocks on consumption and investment dynamics.

Conclusion: Integrating Permanent Income Hypothesis and Accelerator Theory

Integrating the Permanent Income Hypothesis and Accelerator Theory reveals a nuanced understanding of consumption and investment behavior, where long-term income expectations guide aggregate demand while capital stock adjustments respond to short-term output fluctuations. Empirical evidence supports that permanent income shapes sustainable consumption patterns, whereas accelerator effects drive cyclical investment changes, highlighting the importance of both in macroeconomic modeling. Policymakers benefit from this integration by targeting both income stability and investment incentives to foster balanced economic growth.

Permanent income hypothesis Infographic

libterm.com

libterm.com