Consumer surplus measures the difference between what consumers are willing to pay for a good or service and what they actually pay, reflecting the extra value gained by buyers. It plays a critical role in economic analysis, helping to assess market efficiency and the benefits consumers receive from trade. Dive deeper into how consumer surplus impacts your purchasing decisions and market outcomes in the rest of this article.

Table of Comparison

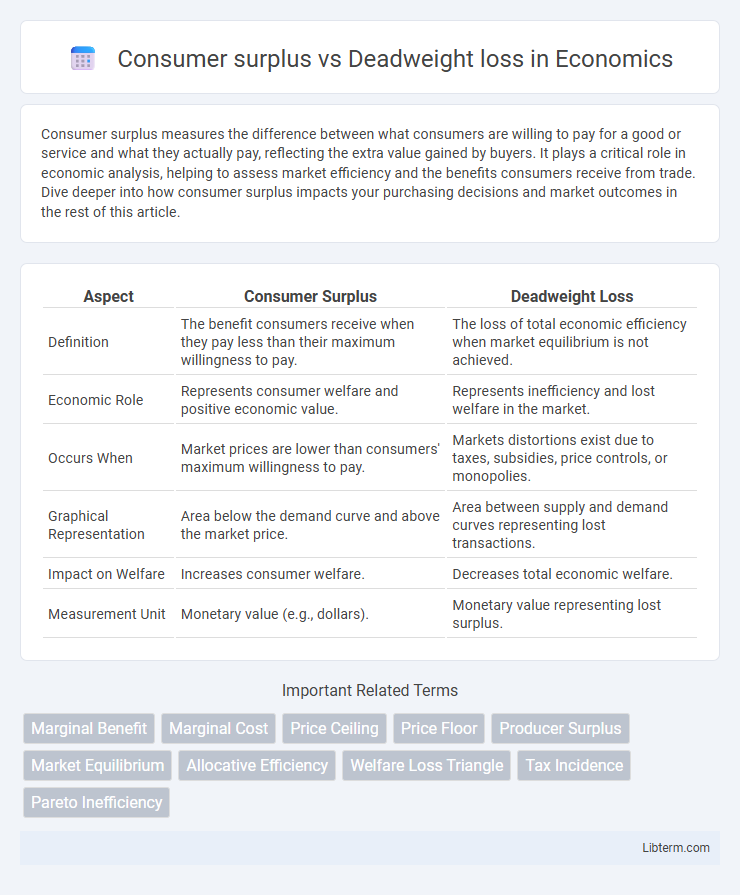

| Aspect | Consumer Surplus | Deadweight Loss |

|---|---|---|

| Definition | The benefit consumers receive when they pay less than their maximum willingness to pay. | The loss of total economic efficiency when market equilibrium is not achieved. |

| Economic Role | Represents consumer welfare and positive economic value. | Represents inefficiency and lost welfare in the market. |

| Occurs When | Market prices are lower than consumers' maximum willingness to pay. | Markets distortions exist due to taxes, subsidies, price controls, or monopolies. |

| Graphical Representation | Area below the demand curve and above the market price. | Area between supply and demand curves representing lost transactions. |

| Impact on Welfare | Increases consumer welfare. | Decreases total economic welfare. |

| Measurement Unit | Monetary value (e.g., dollars). | Monetary value representing lost surplus. |

Introduction to Consumer Surplus and Deadweight Loss

Consumer surplus represents the difference between what consumers are willing to pay for a good or service and what they actually pay, quantifying the net benefit to buyers in a market. Deadweight loss refers to the loss of economic efficiency that occurs when the equilibrium outcome is not achieved, often due to market distortions like taxes, subsidies, or price controls. Both concepts are crucial in welfare economics for analyzing how changes in prices, taxation, or policy interventions impact consumer welfare and overall market efficiency.

Defining Consumer Surplus

Consumer surplus represents the difference between the maximum price consumers are willing to pay and the actual market price they pay, reflecting the net benefit to buyers. It quantifies the economic advantage gained by consumers when purchasing a product below their willingness to pay. Understanding consumer surplus is essential for analyzing market efficiency and the impact of pricing strategies on consumer welfare.

Understanding Deadweight Loss

Deadweight loss represents the economic inefficiency that occurs when market equilibrium is not achieved, leading to lost consumer and producer surplus. It arises from factors such as price floors, price ceilings, taxes, or subsidies that distort supply and demand. Unlike consumer surplus, which measures the benefit consumers receive from purchasing goods at market prices, deadweight loss quantifies the total loss of welfare to society due to market distortions.

The Economic Significance of Consumer Surplus

Consumer surplus measures the economic benefit gained by consumers when they pay less for a product than their maximum willingness to pay, reflecting the additional value received beyond market price. It is a critical indicator of consumer welfare and market efficiency, as higher consumer surplus generally signifies greater satisfaction and purchasing power. In contrast, deadweight loss represents the net loss of total surplus due to market inefficiencies, such as taxes or price controls, which reduce consumer surplus and overall economic welfare.

Causes of Deadweight Loss

Deadweight loss occurs when market inefficiencies prevent the optimal allocation of resources, often caused by taxes, price ceilings, price floors, or monopolistic pricing. These distortions reduce consumer surplus by decreasing the quantity of goods traded below the socially efficient level. Consumer surplus measures the benefit consumers receive when paying less than their willingness to pay, but deadweight loss represents the lost value from transactions that no longer occur due to these inefficiencies.

Graphical Representation: Consumer Surplus vs Deadweight Loss

Consumer surplus is graphically represented as the area between the demand curve and the price level, up to the quantity traded, illustrating the net benefit consumers receive from purchasing a good at a market price lower than their maximum willingness to pay. Deadweight loss appears on the graph as the triangular area between the supply and demand curves, beyond the equilibrium quantity, representing the loss of total surplus due to market inefficiencies like taxes or price controls. Both areas are critical for analyzing welfare economics, where consumer surplus measures consumer benefit and deadweight loss quantifies inefficiency costs in the market.

Real-World Examples of Consumer Surplus

Consumer surplus represents the difference between what consumers are willing to pay and what they actually pay, exemplified by shoppers purchasing discounted electronics below regular prices, thereby gaining extra value. In contrast, deadweight loss occurs in markets with inefficiencies such as taxes or price floors, where transactions that could have benefited both buyers and sellers do not happen, like the surplus lost when minimum wage laws reduce employment opportunities. Real-world consumer surplus is evident in cases like airline ticket sales where price discrimination allows some travelers to pay less than their maximum willingness, enhancing overall consumer welfare.

Policy Implications: Reducing Deadweight Loss

Reducing deadweight loss enhances consumer surplus by increasing market efficiency and ensuring resources are allocated optimally. Policies that minimize distortions, such as lowering taxes or removing price controls, directly expand consumer welfare without sacrificing producer interests. Implementing such reforms encourages economic growth and maximizes the total surplus within the market.

Comparing Consumer Welfare and Market Efficiency

Consumer surplus represents the difference between what consumers are willing to pay and what they actually pay, reflecting consumer welfare in a market. Deadweight loss measures the loss of total surplus, including both consumer and producer surplus, due to market inefficiencies like taxes, price floors, or monopolies. Comparing these concepts highlights that consumer surplus captures individual welfare benefits, while deadweight loss indicates the overall reduction in market efficiency and total economic welfare.

Conclusion: Balancing Surplus and Loss in Markets

Consumer surplus represents the net benefit consumers receive when paying less than their maximum willingness to pay, while deadweight loss signals inefficiencies causing lost welfare in markets. Effective market interventions aim to maximize consumer surplus without generating excessive deadweight loss, maintaining optimal resource allocation. Balancing these economic measures ensures enhanced consumer satisfaction alongside minimized efficiency losses, promoting healthier market dynamics.

Consumer surplus Infographic

libterm.com

libterm.com