An exchange rate anchor stabilizes a country's currency by pegging it to a stable foreign currency or basket of currencies, reducing inflation and promoting economic confidence. This mechanism helps maintain predictable trade and investment conditions essential for economic growth. Explore the rest of the article to understand how an exchange rate anchor can impact Your financial strategy and economic stability.

Table of Comparison

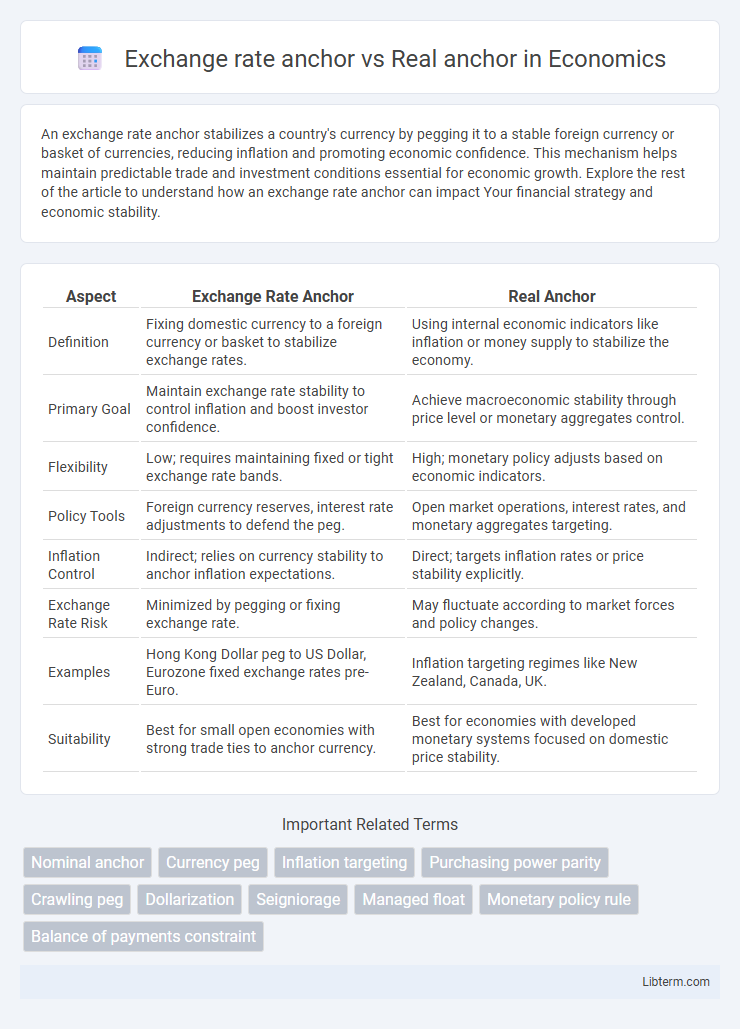

| Aspect | Exchange Rate Anchor | Real Anchor |

|---|---|---|

| Definition | Fixing domestic currency to a foreign currency or basket to stabilize exchange rates. | Using internal economic indicators like inflation or money supply to stabilize the economy. |

| Primary Goal | Maintain exchange rate stability to control inflation and boost investor confidence. | Achieve macroeconomic stability through price level or monetary aggregates control. |

| Flexibility | Low; requires maintaining fixed or tight exchange rate bands. | High; monetary policy adjusts based on economic indicators. |

| Policy Tools | Foreign currency reserves, interest rate adjustments to defend the peg. | Open market operations, interest rates, and monetary aggregates targeting. |

| Inflation Control | Indirect; relies on currency stability to anchor inflation expectations. | Direct; targets inflation rates or price stability explicitly. |

| Exchange Rate Risk | Minimized by pegging or fixing exchange rate. | May fluctuate according to market forces and policy changes. |

| Examples | Hong Kong Dollar peg to US Dollar, Eurozone fixed exchange rates pre-Euro. | Inflation targeting regimes like New Zealand, Canada, UK. |

| Suitability | Best for small open economies with strong trade ties to anchor currency. | Best for economies with developed monetary systems focused on domestic price stability. |

Introduction to Exchange Rate and Real Anchors

Exchange rate anchors stabilize a country's currency by pegging it to a foreign currency, helping to control inflation and build investor confidence through fixed exchange rates. Real anchors, such as targeting inflation rates or money supply growth, focus on underlying economic fundamentals to guide monetary policy and maintain price stability. Understanding both exchange rate anchors and real anchors is essential for designing effective strategies to achieve macroeconomic stability and sustainable growth.

Defining Exchange Rate Anchors

Exchange rate anchors refer to the policy strategy where a country's currency value is fixed or closely managed against a stable foreign currency to stabilize inflation and build market confidence. Real anchors encompass broader economic indicators such as wage growth, price indexes, or monetary aggregates that guide monetary policy to maintain price stability without strictly fixing the exchange rate. Defining exchange rate anchors involves selecting a credible foreign currency benchmark--often the US dollar or euro--that serves as a nominal anchor to influence expectations and control inflation in an open economy.

Understanding Real Anchors

Real anchors stabilize an economy by targeting fundamental variables like inflation, output, and employment, rather than relying solely on fixed exchange rates. Unlike exchange rate anchors that can be vulnerable to speculative attacks and external shocks, real anchors provide a more flexible and sustainable framework for monetary policy. Understanding real anchors involves analyzing indicators such as inflation targeting, nominal GDP targeting, or monetary aggregates that directly influence long-term macroeconomic stability.

Mechanisms of Exchange Rate Anchoring

Exchange rate anchoring stabilizes inflation expectations by pegging the domestic currency to a stable foreign currency, enforcing monetary discipline through predictable currency values. This mechanism reduces exchange rate volatility and import price fluctuations, supporting price stability by anchoring inflation to the performance of the anchor currency country. In contrast, a real anchor focuses on stabilizing real economic variables like output or employment, often using targets such as a nominal GDP level or price level, and relies less on currency stability than on underlying economic fundamentals.

Mechanisms of Real Anchoring

Real anchoring mechanisms stabilize inflation expectations by linking nominal variables to real economic fundamentals such as productivity growth and output gaps. Unlike exchange rate anchors that fix the currency value, real anchors adjust according to economic performance, enhancing credibility through transparency in fiscal and monetary policy rules. This approach reduces vulnerability to external shocks and avoids rigidities inherent in fixed exchange rate regimes.

Advantages of Exchange Rate Anchors

Exchange rate anchors provide stability by pegging a country's currency to a major foreign currency, reducing exchange rate volatility and fostering investor confidence. This fixed or semi-fixed exchange rate regime helps control inflation by importing monetary discipline from the anchor currency's country. Exchange rate anchors also facilitate international trade and investment by minimizing currency risk and promoting price predictability.

Benefits of Real Anchors

Real anchors provide greater economic stability by targeting fundamental variables like inflation or output gaps, thereby reducing vulnerability to exchange rate volatility. Unlike exchange rate anchors, real anchors allow for monetary policy flexibility, supporting sustainable growth and price stability even amid external shocks. Empirical studies show that countries using real anchors experience lower inflation rates and more resilient financial markets over the long term.

Risks and Limitations of Exchange Rate Anchors

Exchange rate anchors involve pegging a country's currency to a stable foreign currency to control inflation but carry risks such as vulnerability to external shocks and loss of independent monetary policy. Real anchors, based on fundamental economic indicators like price levels or inflation targets, offer more flexibility in responding to domestic economic conditions. Exchange rate anchors may lead to balance-of-payments crises and speculative attacks when market expectations diverge, limiting their effectiveness in volatile or emerging market economies.

Challenges Associated with Real Anchors

Real anchors, such as inflation targeting or nominal GDP targeting, face challenges including the difficulty of accurately measuring economic variables in real time, which can lead to policy missteps. Economic shocks and structural changes may undermine the credibility of real anchors by causing persistent deviations from target variables. Additionally, real anchors require strong institutional frameworks and central bank independence to maintain effectiveness amid political and market pressures.

Choosing the Optimal Anchor: Key Considerations

Choosing the optimal anchor involves evaluating the stability offered by an exchange rate anchor against the flexibility of a real anchor tied to fundamental economic indicators like inflation and output. Exchange rate anchors provide strong nominal stability by pegging the currency to a stable foreign currency, reducing exchange rate volatility and inflation expectations. Real anchors prioritize long-term economic fundamentals, allowing for more adaptive monetary policy that can respond to shocks without rigid currency commitments.

Exchange rate anchor Infographic

libterm.com

libterm.com