Capital controls regulate the flow of money in and out of a country to stabilize the economy and protect financial markets from sudden shocks. These measures can include restrictions on currency exchange, investment limitations, and transaction taxes to manage volatility and maintain economic sovereignty. Discover how capital controls impact your investments and global financial stability throughout the rest of this article.

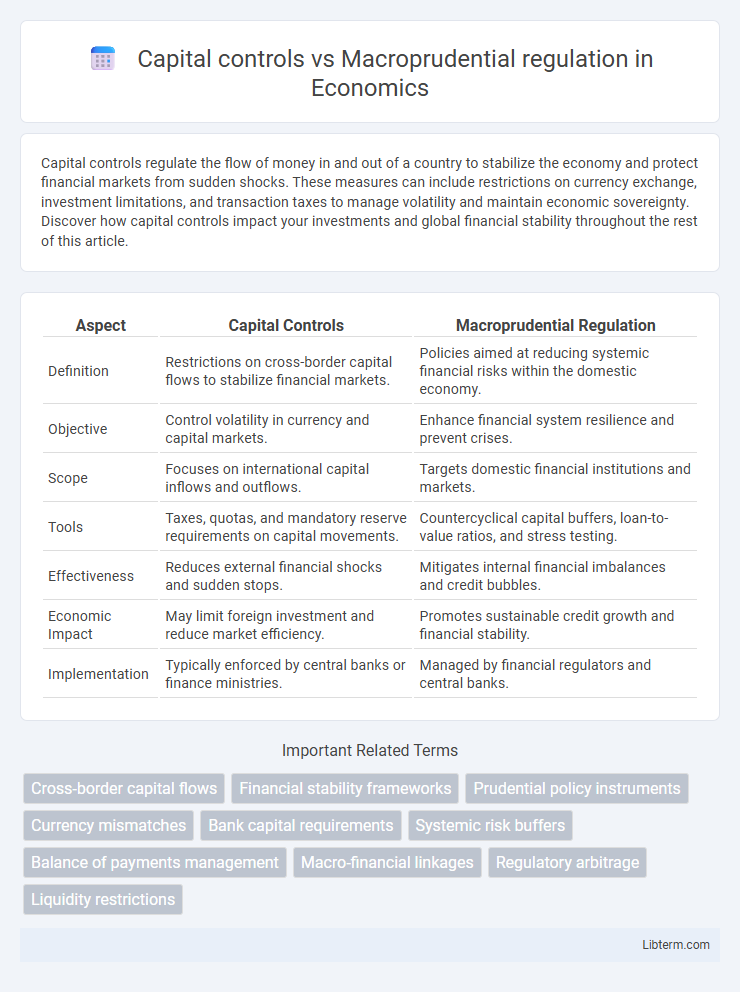

Table of Comparison

| Aspect | Capital Controls | Macroprudential Regulation |

|---|---|---|

| Definition | Restrictions on cross-border capital flows to stabilize financial markets. | Policies aimed at reducing systemic financial risks within the domestic economy. |

| Objective | Control volatility in currency and capital markets. | Enhance financial system resilience and prevent crises. |

| Scope | Focuses on international capital inflows and outflows. | Targets domestic financial institutions and markets. |

| Tools | Taxes, quotas, and mandatory reserve requirements on capital movements. | Countercyclical capital buffers, loan-to-value ratios, and stress testing. |

| Effectiveness | Reduces external financial shocks and sudden stops. | Mitigates internal financial imbalances and credit bubbles. |

| Economic Impact | May limit foreign investment and reduce market efficiency. | Promotes sustainable credit growth and financial stability. |

| Implementation | Typically enforced by central banks or finance ministries. | Managed by financial regulators and central banks. |

Introduction to Capital Controls and Macroprudential Regulation

Capital controls refer to regulatory measures that governments implement to limit or manage the flow of foreign capital in and out of a country's economy, aiming to mitigate financial instability and protect domestic markets. Macroprudential regulation encompasses policies designed to safeguard the financial system as a whole, preventing systemic risks and ensuring overall economic resilience. Both frameworks play critical roles in maintaining financial stability but target different aspects: capital controls focus on external vulnerabilities, while macroprudential regulation addresses internal systemic risks.

Defining Capital Controls: Key Features and Objectives

Capital controls refer to regulatory measures implemented by governments or central banks to restrict or manage the flow of foreign capital in and out of a country's economy, aiming to stabilize financial markets and protect economic sovereignty. Key features include limits on foreign exchange transactions, taxes on cross-border capital movements, and restrictions on foreign investments to prevent excessive volatility and speculative attacks. The primary objectives are to maintain exchange rate stability, reduce financial vulnerabilities, and safeguard domestic economic policies from external shocks.

Understanding Macroprudential Regulation

Macroprudential regulation targets systemic risks within the financial system by monitoring and managing interconnected financial institutions, market infrastructures, and macroeconomic factors to enhance overall economic stability. Unlike capital controls that restrict cross-border capital flows directly, macroprudential policies use tools such as countercyclical capital buffers, loan-to-value ratios, and stress testing to prevent financial imbalances and cyclical vulnerabilities. Effective macroprudential regulation strengthens resilience against shocks, mitigates systemic risk contagion, and promotes sustainable credit growth, thereby supporting long-term financial system robustness.

Historical Evolution of Both Policies

Capital controls emerged prominently during the Great Depression to stabilize fragile economies by restricting capital flows, while macroprudential regulation developed mainly after the 2008 global financial crisis to address systemic risks within financial systems. Early capital controls, such as those under the Bretton Woods system, aimed at preventing capital flight, whereas macroprudential tools, like countercyclical capital buffers and loan-to-value ratios, evolved to manage credit cycles and enhance financial stability. The historical evolution of both policies reflects a shift from controlling external financial shocks to proactively managing internal financial vulnerabilities.

Mechanisms of Capital Controls

Capital controls include restrictions on capital inflows and outflows, such as taxes on cross-border financial transactions, limits on foreign exchange transactions, and requirements for approval or registration of international investments. These mechanisms aim to reduce volatility in foreign exchange markets and prevent excessive short-term capital movements that could destabilize the financial system. By directly influencing the volume and composition of capital flows, capital controls complement macroprudential regulation, which primarily targets systemic risks through measures like capital adequacy requirements and liquidity buffers for financial institutions.

Tools of Macroprudential Regulation

Macroprudential regulation employs tools such as countercyclical capital buffers, loan-to-value (LTV) limits, and debt-to-income (DTI) ratios to mitigate systemic financial risks and enhance banking sector resilience. Unlike capital controls, which restrict cross-border capital flows, these instruments target internal financial stability by addressing credit growth, leverage, and liquidity mismatches. Stress testing and dynamic provisioning also serve as key macroprudential tools to prevent financial crises and promote sustainable economic growth.

Comparative Advantages and Limitations

Capital controls restrict cross-border financial flows to stabilize currency and limit speculative attacks, offering direct intervention but potentially reducing market efficiency and investor confidence. Macroprudential regulation targets systemic risk within the financial system by using tools like countercyclical capital buffers and stress testing, enhancing financial stability without impeding capital mobility. While capital controls offer immediate defense against external shocks, macroprudential policies provide sustainable risk management but require robust institutional frameworks and may face implementation lag.

Case Studies: Global Applications and Outcomes

Capital controls, used in countries like Malaysia during the 1997 Asian Financial Crisis, effectively stabilized currency volatility and limited speculative capital flows, while macroprudential regulation in South Korea post-2008 focused on curbing systemic banking risks through higher capital requirements and loan-to-value limits. In Brazil, a blend of these measures helped moderate excessive foreign inflows and real estate bubbles, demonstrating complementary roles in managing financial stability. Empirical evidence shows capital controls offer immediate external balance protection, whereas macroprudential policies support long-term resilience within the domestic financial system.

Policy Integration: Complementary or Substitutive Roles?

Capital controls and macroprudential regulation serve distinct yet interconnected functions in safeguarding financial stability, where capital controls limit cross-border capital flows to mitigate external shocks, while macroprudential regulation addresses systemic risks within the domestic financial system. Policy integration enhances effectiveness by aligning capital flow management with domestic risk mitigation strategies, leveraging tools such as countercyclical capital buffers and targeted capital flow measures to reduce market volatility and financial vulnerabilities. Understanding their complementary roles aids policymakers in crafting a harmonized framework that balances external resilience with internal financial stability, avoiding policy conflicts and optimizing economic outcomes.

Future Outlook for Financial Stability Strategies

Capital controls and macroprudential regulation represent key tools shaping the future outlook of financial stability strategies by managing systemic risks and capital flow volatility. Emerging trends emphasize advanced data analytics and real-time monitoring mechanisms to enhance the effectiveness of these interventions amid increasing global financial integration. Policymakers are expected to prioritize adaptive frameworks that balance financial openness with resilience against external shocks and market disruptions.

Capital controls Infographic

libterm.com

libterm.com