Price rigidity occurs when prices remain stable despite changes in supply and demand, often due to factors like menu costs, long-term contracts, or customer loyalty. This phenomenon can impact market efficiency and influence business strategies in various industries. Explore the full article to understand how price rigidity affects economic dynamics and your financial decisions.

Table of Comparison

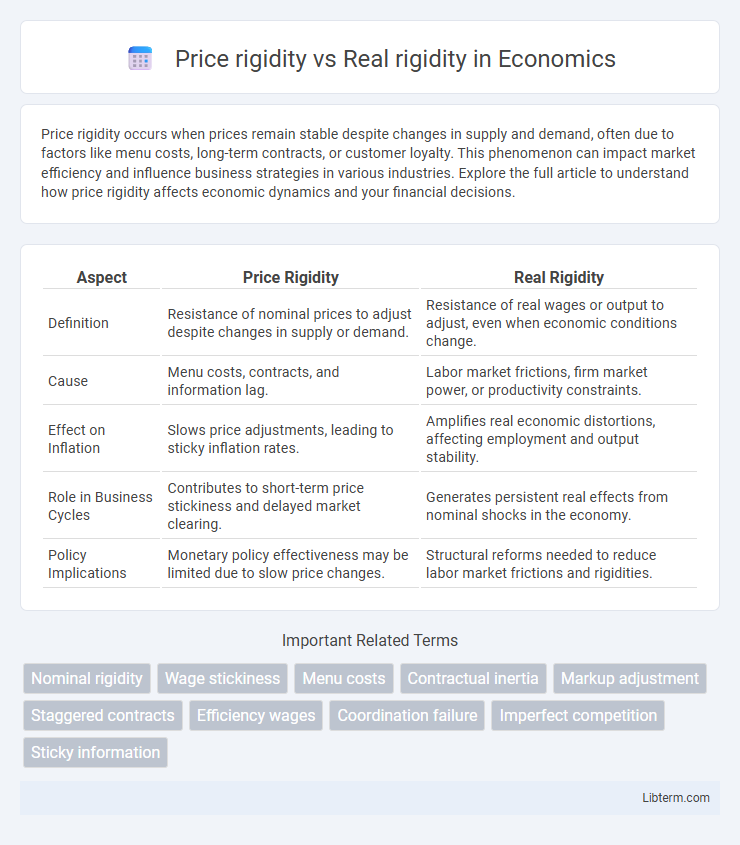

| Aspect | Price Rigidity | Real Rigidity |

|---|---|---|

| Definition | Resistance of nominal prices to adjust despite changes in supply or demand. | Resistance of real wages or output to adjust, even when economic conditions change. |

| Cause | Menu costs, contracts, and information lag. | Labor market frictions, firm market power, or productivity constraints. |

| Effect on Inflation | Slows price adjustments, leading to sticky inflation rates. | Amplifies real economic distortions, affecting employment and output stability. |

| Role in Business Cycles | Contributes to short-term price stickiness and delayed market clearing. | Generates persistent real effects from nominal shocks in the economy. |

| Policy Implications | Monetary policy effectiveness may be limited due to slow price changes. | Structural reforms needed to reduce labor market frictions and rigidities. |

Introduction to Price Rigidity and Real Rigidity

Price rigidity refers to the resistance of prices to adjust immediately to changes in supply and demand, often due to menu costs, contracts, or information lags, leading to short-term market imbalances. Real rigidity emphasizes the role of real economic factors such as labor market imperfections, firm-specific costs, and consumer preferences that reinforce nominal rigidities by limiting firms' ability to adjust output prices even when nominal prices change. Understanding both price rigidity and real rigidity is essential to analyze inflation persistence and the effectiveness of monetary policy in macroeconomic models.

Defining Price Rigidity: Meaning and Mechanisms

Price rigidity refers to the phenomenon where prices of goods and services remain stable despite changes in demand or supply conditions, often due to menu costs, contracts, or customer loyalty. Real rigidity extends beyond nominal price stickiness, emphasizing factors like wage rigidity, market structure, and imperfect competition that reinforce inflexible real prices and wages. Understanding price rigidity involves analyzing how these mechanisms prevent immediate price adjustments, impacting monetary policy effectiveness and economic fluctuations.

Understanding Real Rigidity: Concepts and Examples

Real rigidity occurs when factors beyond nominal price adjustments, such as long-term contracts, employee wage agreements, or customer loyalty, prevent prices from adjusting to market conditions. Unlike price rigidity, which stems from sticky nominal prices due to menu costs or adjustment costs, real rigidity involves structural factors that reduce firms' incentives to change output or employment despite economic shocks. Examples include unionized sectors where wages remain fixed despite demand fluctuations and industries with durable goods that face limited competitive pressure to alter pricing rapidly.

Key Differences Between Price and Real Rigidity

Price rigidity refers to the resistance of prices to adjust quickly in response to changes in supply and demand, often due to menu costs or contract constraints. Real rigidity, on the other hand, involves the limited responsiveness of relative real wages or quantities to economic fluctuations, caused by factors like labor market frictions or firm-specific productivity shocks. Key differences lie in their sources: price rigidity is primarily driven by nominal frictions, whereas real rigidity stems from real economic inefficiencies affecting labor and product markets.

Causes of Price Rigidity in Markets

Price rigidity in markets often stems from menu costs, where firms face expenses in changing prices frequently, discouraging adjustments even amid shifting demand or cost conditions. Real rigidity occurs when nominal price stickiness is amplified by factors such as product market competition and labor market frictions, causing firms to keep prices stable despite real economic fluctuations. Strategic complementarities among firms and consumer price expectations also contribute significantly to the persistence of price rigidity.

Factors Contributing to Real Rigidity

Real rigidity arises from factors that prevent wages and prices from adjusting to clear markets, such as long-term contracts, menu costs, and institutional regulations like minimum wage laws or labor union negotiations. Imperfect competition and consumer price perception also contribute by limiting firms' willingness to change prices in response to demand shifts. These elements create persistent deviations from equilibrium, intensifying economic fluctuations and complicating monetary policy effectiveness.

Impact of Rigidities on Macroeconomic Outcomes

Price rigidity causes slow adjustment of prices to shocks, leading to persistent output fluctuations and unemployment in macroeconomic models. Real rigidity, which includes factors like wage and price markups insensitive to economic conditions, amplifies the effects of nominal rigidities by reducing firms' incentive to adjust prices. Together, price and real rigidities contribute to prolonged business cycles and complicate monetary policy effectiveness by limiting the responsiveness of aggregate supply.

Price Rigidity vs Real Rigidity: Theoretical Perspectives

Price rigidity refers to the resistance of prices to change despite shifts in supply or demand, often explained by menu costs, contracts, or informational frictions in New Keynesian models. Real rigidity emphasizes factors that cause real wage or price stickiness beyond nominal rigidities, such as labor market frictions, firm market power, or adjustment costs, contributing to prolonged deviations from competitive outcomes. Theoretical perspectives highlight that while price rigidity alone may limit nominal adjustment, real rigidity mechanisms amplify the persistence of shocks by constraining real resource allocation and optimizing adjustments in the economy.

Policy Implications of Market Rigidities

Price rigidity limits a firm's ability to adjust prices in response to economic shocks, causing prolonged deviations from equilibrium and reducing monetary policy effectiveness in stimulating demand. Real rigidity, reflecting persistent variations in marginal costs or wages unaffected by price changes, amplifies this effect by reinforcing output and employment stickiness. Policymakers must design interventions acknowledging these rigidities, emphasizing structural reforms alongside monetary measures to enhance market flexibility and improve economic responsiveness.

Conclusion: Balancing Price and Real Rigidity in Economic Analysis

Balancing price rigidity and real rigidity is essential for accurate economic modeling, as price rigidity alone cannot fully explain persistent economic fluctuations. Real rigidity factors, such as labor market frictions and contract structures, amplify the effects of price stickiness by limiting firms' and workers' responsiveness to economic shocks. Integrating both rigidities in analysis improves predictions of inflation dynamics and output responses, leading to more effective monetary and fiscal policy design.

Price rigidity Infographic

libterm.com

libterm.com