The average propensity to consume (APC) measures the fraction of total income that households spend on consumption rather than saving, providing insight into consumer behavior and economic health. APC varies depending on income levels, with lower-income individuals typically exhibiting a higher consumption ratio because they allocate more of their income to essential needs. Explore the rest of the article to understand how APC influences economic policy and forecasting.

Table of Comparison

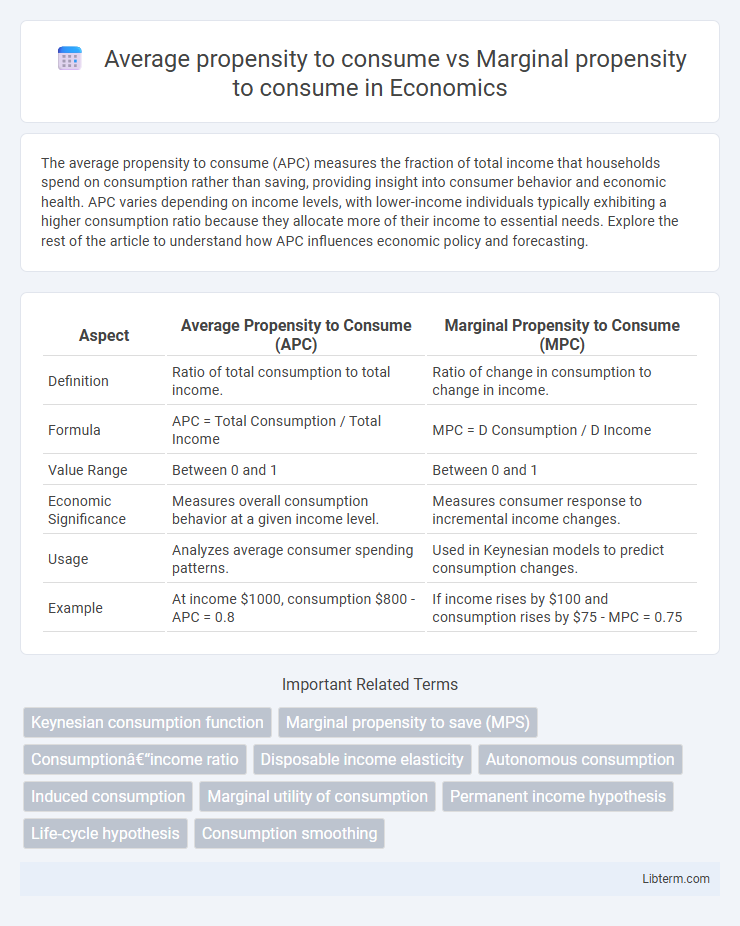

| Aspect | Average Propensity to Consume (APC) | Marginal Propensity to Consume (MPC) |

|---|---|---|

| Definition | Ratio of total consumption to total income. | Ratio of change in consumption to change in income. |

| Formula | APC = Total Consumption / Total Income | MPC = D Consumption / D Income |

| Value Range | Between 0 and 1 | Between 0 and 1 |

| Economic Significance | Measures overall consumption behavior at a given income level. | Measures consumer response to incremental income changes. |

| Usage | Analyzes average consumer spending patterns. | Used in Keynesian models to predict consumption changes. |

| Example | At income $1000, consumption $800 - APC = 0.8 | If income rises by $100 and consumption rises by $75 - MPC = 0.75 |

Introduction to Consumption Propensities

Average propensity to consume (APC) measures the proportion of total income spent on consumption, calculated as consumption divided by income, reflecting overall spending behavior. Marginal propensity to consume (MPC) indicates the change in consumption resulting from a change in income, representing the incremental tendency to spend additional income. Both propensities are crucial in Keynesian economics for understanding consumption patterns and their impact on aggregate demand and economic policy.

Defining Average Propensity to Consume (APC)

Average Propensity to Consume (APC) measures the proportion of total income spent on consumption, calculated by dividing total consumption by total income. APC provides insights into overall consumer spending behavior at a given income level. Unlike Marginal Propensity to Consume (MPC), which focuses on consumption changes from additional income, APC reflects the average consumption pattern across the entire income.

Understanding Marginal Propensity to Consume (MPC)

Marginal Propensity to Consume (MPC) measures the proportion of additional income that a household spends on consumption rather than saving, typically expressed as a value between 0 and 1. Unlike the Average Propensity to Consume (APC), which calculates total consumption divided by total income, MPC focuses on the incremental change in consumption resulting from a one-unit change in income. Understanding MPC is crucial for economists and policymakers when analyzing consumer behavior and predicting the impact of fiscal policies on aggregate demand.

Mathematical Formulas: APC vs MPC

The Average Propensity to Consume (APC) is calculated using the formula APC = C / Y, where C represents total consumption and Y denotes total income, measuring the proportion of income spent on consumption. The Marginal Propensity to Consume (MPC) is defined as MPC = DC / DY, indicating the change in consumption resulting from a change in income. While APC provides an overall consumption ratio relative to income, MPC focuses on the incremental change in consumption for each additional unit of income.

Key Differences Between APC and MPC

Average propensity to consume (APC) measures the ratio of total consumption to total income, reflecting the overall consumption behavior at a given income level. Marginal propensity to consume (MPC) captures the incremental change in consumption resulting from a one-unit change in income, highlighting how consumption responds to income fluctuations. The key difference lies in APC representing average consumption relative to income, while MPC focuses on the responsiveness of consumption to income changes, making APC a level measure and MPC a slope measure in consumption functions.

Factors Influencing Propensity to Consume

The average propensity to consume (APC) and marginal propensity to consume (MPC) are influenced by factors such as income levels, wealth, consumer confidence, and expectations about future earnings. Higher disposable income often reduces APC as savings increase, while MPC remains crucial in determining changes in consumption from additional income. Cultural norms, access to credit, and interest rates also shape consumption behavior by affecting households' willingness and ability to spend.

Real-World Examples of APC and MPC

Average propensity to consume (APC) measures the ratio of total consumption to total income, while marginal propensity to consume (MPC) assesses the change in consumption resulting from a change in income. For instance, during economic expansions, households may exhibit a high MPC by spending a large portion of additional income on goods like electronics and dining out, whereas the APC reflects overall consumption patterns relative to total earnings. In emerging economies, APC often remains stable as consumption habits are tied to steady cultural norms, but MPC can fluctuate significantly due to varying access to credit and income volatility.

Economic Implications of APC and MPC

Average propensity to consume (APC) measures the proportion of total income spent on consumption, while marginal propensity to consume (MPC) represents the fraction of additional income allocated to consumption. High APC indicates consumers are spending most of their income, affecting aggregate demand and economic growth, whereas a high MPC suggests increased sensitivity of consumption to income changes, influencing fiscal policy effectiveness. Understanding APC and MPC is crucial for predicting consumption patterns, designing tax policies, and managing economic stability through demand-side interventions.

APC and MPC in Fiscal Policy Analysis

Average Propensity to Consume (APC) measures the ratio of total consumption to total income, reflecting overall consumer spending behavior in an economy, while Marginal Propensity to Consume (MPC) indicates the proportion of additional income that is spent on consumption. In fiscal policy analysis, MPC is crucial for predicting the multiplier effect of government spending or tax cuts, as higher MPC values lead to greater increases in aggregate demand. APC helps assess long-term consumption trends relative to income, but MPC provides more precise insights for short-term stimulus impacts and policy effectiveness.

Conclusion: Importance for Economic Planning

Understanding the difference between average propensity to consume (APC) and marginal propensity to consume (MPC) is crucial for effective economic planning, as APC reveals the overall consumer spending behavior relative to income while MPC indicates the change in consumption from an additional unit of income. Accurate measurement of MPC helps policymakers design fiscal stimulus and taxation policies that maximize consumption and economic growth. Integrating both APC and MPC data enables targeted interventions that stabilize demand, encourage investment, and achieve sustainable economic development.

Average propensity to consume Infographic

libterm.com

libterm.com