The risk-free rate represents the return on an investment with zero risk, typically linked to government bonds like U.S. Treasury bills. It serves as a baseline for evaluating other investments, helping to measure risk premiums and make informed financial decisions. Explore the rest of the article to understand how the risk-free rate influences your investment strategy.

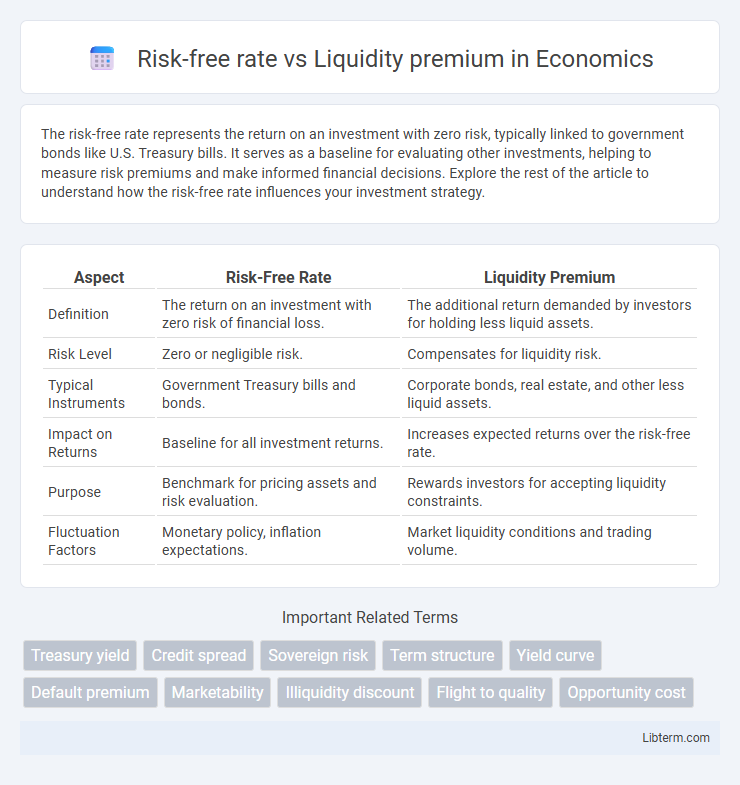

Table of Comparison

| Aspect | Risk-Free Rate | Liquidity Premium |

|---|---|---|

| Definition | The return on an investment with zero risk of financial loss. | The additional return demanded by investors for holding less liquid assets. |

| Risk Level | Zero or negligible risk. | Compensates for liquidity risk. |

| Typical Instruments | Government Treasury bills and bonds. | Corporate bonds, real estate, and other less liquid assets. |

| Impact on Returns | Baseline for all investment returns. | Increases expected returns over the risk-free rate. |

| Purpose | Benchmark for pricing assets and risk evaluation. | Rewards investors for accepting liquidity constraints. |

| Fluctuation Factors | Monetary policy, inflation expectations. | Market liquidity conditions and trading volume. |

Introduction to Risk-Free Rate and Liquidity Premium

The risk-free rate represents the theoretical return on an investment with zero risk, typically proxied by government Treasury securities such as U.S. 10-year Treasuries. The liquidity premium refers to the extra yield investors demand for holding assets that are not easily convertible to cash without a significant price discount, often seen in corporate bonds or less liquid securities. Understanding the distinction between the risk-free rate and liquidity premium is essential for accurately assessing expected returns and pricing financial instruments.

Defining the Risk-Free Rate

The risk-free rate represents the theoretical return on an investment with zero risk of financial loss, commonly based on government Treasury securities like the U.S. 10-year Treasury bond due to their minimal default risk. It serves as the foundational benchmark for pricing all other investments by reflecting the time value of money without uncertainty. The liquidity premium, contrastingly, accounts for the additional yield investors demand for holding assets that cannot be quickly sold without a price concession.

What is a Liquidity Premium?

A liquidity premium is the extra return investors demand for holding securities that are not easily tradable or convertible to cash without significant price discounts. It compensates for the risk associated with potential delays or losses when selling an asset in illiquid markets. Unlike the risk-free rate, which reflects the return on perfectly liquid and safe assets like government bonds, the liquidity premium varies depending on market conditions and asset characteristics.

Key Differences: Risk-Free Rate vs Liquidity Premium

The risk-free rate represents the return on an investment with zero default risk, typically associated with government securities like U.S. Treasury bonds. In contrast, the liquidity premium compensates investors for the additional risk and potential cost of converting an asset into cash quickly without significant price reduction. While the risk-free rate reflects time value of money, the liquidity premium varies based on market conditions and asset liquidity levels.

Factors Influencing the Risk-Free Rate

The risk-free rate is primarily influenced by factors such as central bank monetary policy, inflation expectations, and the supply and demand for government securities. Liquidity premium reflects the additional return required by investors for holding assets that are less liquid or harder to trade compared to risk-free instruments. Understanding these dynamics helps differentiate the baseline compensation for time value of money from extra yields demanded due to market liquidity constraints.

Determinants of Liquidity Premium

The liquidity premium is influenced by factors such as market depth, trading volume, and asset convertibility, which together determine how quickly an asset can be sold without impacting its price significantly. Assets with higher market demand and frequent trading tend to have lower liquidity premiums, reflecting reduced compensation for illiquidity risk. Conversely, less liquid assets require a higher liquidity premium to attract investors who face greater resale difficulty and potential price concessions.

Impact on Investment Decisions

The risk-free rate serves as the foundational benchmark for valuing investments by representing the return on assets with zero default risk, typically government securities. The liquidity premium reflects the additional yield demanded by investors for holding assets that are not easily tradable or convertible to cash without significant price concessions. Investment decisions are influenced by the liquidity premium as it adjusts the expected return, leading investors to favor assets with higher liquidity premiums only if the potential compensation outweighs the risks associated with reduced marketability.

Role in Asset Pricing Models

The risk-free rate serves as the foundational benchmark in asset pricing models, reflecting the return on an investment with zero default risk, typically represented by government treasury securities. The liquidity premium compensates investors for the additional risk of holding assets that cannot be quickly sold without a price concession, influencing prices by increasing required returns for less liquid securities. Incorporating both the risk-free rate and liquidity premium in models like the CAPM or APT allows for more accurate asset valuation by adjusting expected returns according to default risk and marketability constraints.

Real-World Examples and Applications

The risk-free rate, exemplified by yields on U.S. Treasury securities, serves as a baseline return reflecting time value without credit risk, while liquidity premiums arise in assets like corporate bonds or real estate, where marketability constraints demand higher expected returns. For instance, during financial crises, liquidity premiums on mortgage-backed securities surged as investors required compensation for difficulty in selling these assets quickly. In portfolio management, understanding the spread between the risk-free rate and liquidity premium guides asset allocation by balancing safety and yield within varying market liquidity conditions.

Conclusion: Integrating Insights for Better Financial Strategies

Integrating the risk-free rate and liquidity premium enhances the accuracy of asset pricing models, reflecting both time value of money and marketability risks. Financial strategies incorporating these components optimize portfolio returns by balancing expected yields against potential liquidity constraints. Recognizing their combined impact enables investors to make more informed decisions, improving risk management and capital allocation efficiency.

Risk-free rate Infographic

libterm.com

libterm.com